Bullish / bearish engulfings in forex are both reversal patterns. They can indicate that the market is about to change direction after a previous trend.

Bullish/Bearish engulfings in forex are composed of two different candlesticks. One with a big body engulfing the other with a small body. The second real body should be of the opposite color of the first real body.

In addition, the second candlestick is much larger than the first, so that it completely covers or ‘engulfs’ the length of the first candlestick.

For a perfect engulfing candle, no part of the first candle should exceed the shadow of the second candle. This simply means that the high and low of the second candle wholly covers the entire first candlestick.

However, even if it covers just the real body of the first candle, it is still relevant.

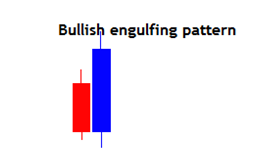

The bullish engulfing candlesticks pattern in forex.

Bullish Engulfing candlestick pattern has a small bearish candlestick followed by a large bullish candlestick which engulfs the bearish candlestick.

So as the bearish candle closes, the bullish candle opens and forms a large candlestick which closes high above the open of the bearish candlestick.

This means bulls come in the market with great buying pressure and push prices high.

A bullish engulfing pattern appears in a downtrend. The first candlestick shows that the bears were in charge of the market whereas the second candlestick shows a strong bullish pressure pushing prices further than the open of the sellers.

This completely shows that buyers are in full control of the market.

In other words, a bullish engulfing pattern at the bottom of a downtrend gives a strong signal that trend is likely to reverse.

To trade bullish / bearish engulfings in forex, there must be a confirmation candlestick. E,g

When another bullish candlestick forms above the close of the bullish engulfing, it gives a confirmation that buyers have full control of the market. Therefore this would be a good time for you to buy.

The bullish pattern is however also a sign for those in a short position to consider closing their trade.

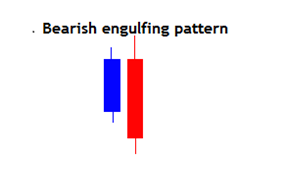

Bearish Engulfing Candlesticks Pattern

Bearish engulfing is the opposite of a bullish engulfing pattern. These are two candlestick pattern that forms at the end of uptrend. It is a bearish reversal pattern.

A bearish engulfing pattern is a small bullish candlestick followed by a large bearish candlestick which fully engulfing the first one.

The first candlestick shows that the bulls were in charge of the market, while the second shows that bears are stronger hence pushing the market price lower.

The formation of another bearish candlestick gives confirmation that the previous trend is likely to reverse. It signals a possible downtrend.

In case you are ready to take position, this is a good time to sell. However if you had a long position, this is the time to think about closing your position.

The bearish engulfing is more significant when it appears at resistance.

Example of bullish / bearish Engulfings in forex

Looking at the GOLD weekly chart above, the appearance of the engulfing patterns after an extended trend, usually marks a trend reversal. Mark extended and usually(not always).

Conclusion on bullish / bearish engulfings in forex

- Bullish / Bearish Engulfings in forex are comprised of two candlesticks

- They are both reversal candlestick patterns.

- The second candlestick is larger than the first one, so that it fully engulfs the entire body of the first one.

- A bullish engulfing pattern appears with a small red(bearish) candlestick engulfed by a longer blue candlestick(bullish). This indicates a bearish trend is likely to reverse,

- A bearish engulfing pattern is made of a smaller green candlestick engulfed by a larger red candlestick. This signals a bullish trend is coming to an end.

CONFIRMATIONS

- A bullish engulfing is more significant when it appears at the support. while a bearish engulfing is more significant at the resistance.

- Buy after confirmation with another bullish candle closing above the bullish engulfing pattern. This would also be good time to exit a shot position especially when approaching support.

- Sell after confirmation with another bearish candle closing below the bearish engulfing pattern. It is also agood signal to close a long position especially when on resistance.

These engulfing patterns when clearly studied and followed, they can yield good profits in the trading.

Common mistakes most traders make and how to avoid them?

Fear and greed are the number one causes for the common mistakes most traders make when trading. Fear and greed normally come before trading, during and after trading. When you are under fear or greed, you are likely to commit these mistakes most traders make; Get...

- Oh, bother! No topics were found here.