A Doji Candlestick pattern has very small body or none. It may appear with a small body and shadows or just in form of a cross.

Candlesticks appear in different shapes, sizes and numbers.

A doji forms when the open and the close are the same or almost the same. This shows that both the buyers and sellers have the same strength in the market and they are under indecision/war .

Prices move up and down the opening level during this session but closes at or near the opening point. Neither the buyers nor the seller control the market.

As a result, this may lead to a turning point of a trend once a decision is made.

Doji candlestick pattern appears in 4 different shapes. Namely;

- Long legged Doji,

- Dragonfly Doji,

- Gravestone Doji,

- Four price Doji

- Neutral Doji.

Long-legged Doji candlestick pattern

The long-legged Doji has a long upper and lower shadows almost of equal length.

After a long time of noise from both buyers and sellers in the market , it all makes no difference. Prices move up and downs during the session but close at almost the same level of opening.

The long legged doji shows a great level of indecision.

The dragonfly doji candlestick pattern

A dragonfly forms when the open, high and the close are at the same point and the low forms a very long shadow.

During the session, sellers get in possession of the market and drive prices lower but as the session ends buyers re-appear and drive prices back to the opening level.

It is in a T- shape.

For the dragonfly to have an impact on the market, it depends on either the previous price action or future confirmations.

A blue dragonfly following a long red candlestick, at the support level after a strong down trend, shows that sellers are likely to loose in favour of buyers in the market.

In order for the sellers to maintain the trend, more red candlesticks are needed after the formation of the doji candlestick pattern to increase their strength. Otherwise a bullish reversal may occur.

After a long uptrend, or at the resistance level, the appearance of a red dragonfly shakes buyers. It shows that the buyers are getting more weak and there is still existence of the sellers in the market.

Unless more of the blue candlesticks form in favour of the buyers, then the trend is likely to reverse direction favouring the sellers.

Gravestone Doji

The open, the low and the close of the session is at the same level and the high creates a long upper shadow.

This indicates that buyers are strong in the market at first from the beginning driving prices high.

They were shocked by the appearance of the sellers who came in towards the end of the session, pushed the prices back and closed as low as the opening and the low.

After a long downtrend or at the support as shown below, the appearance of a doji candlestick pattern shows the weakening of the trend. The selling presure is falling as the buying pressure increases.

This may cause a bullish reversal. If the sellers are unable to defend themselves then the buyers are likely to take over the market.

A gravestone doji candlestick pattern after a long up trend above, shows that the buyers are getting weak and the appearance of sellers is shaking the market.

The selling pressure is greater at the moment and if there is no more appearance of more blue candlesticks, sellers will just take over and push prices low.

Neutral doji

This is small in size just like a plus size. It forms when the buying and selling pressure is equal.

Four price doji candlestick pattern

This is just a simple horizontal line with no vertical lines below or above.

The open, high, low and close are equal.

Its occurrence is rare and only reflects one days trading

A four price doji shows complete and total uncertainty of the market direction.

It usually occurs when stocks or currencies are not liquid and have low volumes. Or, the data source reports only the closing price. It works better with the help of other candlesticks.

Like we said its rare in the forex market. This is simply because there is large volume and liquidity in the FX market.

Example of a Doji candlestick on market chart

Example of a Doji candlestick on market chart

We have mentioned this several times. When a Doji candlestick pattern appears on the market chart, it shows a sign of indecision between the buyers and the sellers.

This gives a signal to you as a buyer to prepare for a probable change in the market trend.

From the chart you can now see that when a doji appears especially on the levels of a support and resistance it gives a strong signal for reversal.

Doji 1 has the same color as the trend and so does not have a significant influence on the price action. Therefore the trend is likely to continue.

Looking at Doji star 2, it appeared on the support and the next candlestick gave a confirmation that the trend is actually changing.

Meanwhile, Doji 3 is a strong long legged doji following another Doji showing. This shows a strong battle between the buyers and the sellers at that moment. Next blue candlestick is not significant due to the strong rejection of higher prices indicated by the long upper shadow of the doji.

Therefore, the appearance of the blue candlestick means that there are still some of the buyers who have not given up yet. So the next candlestick gives you confirmation for your entry level. Sellers still stand higher chances as long as the next bullish candlestick does not close above the upper shadow.

let’s look at our second example below.

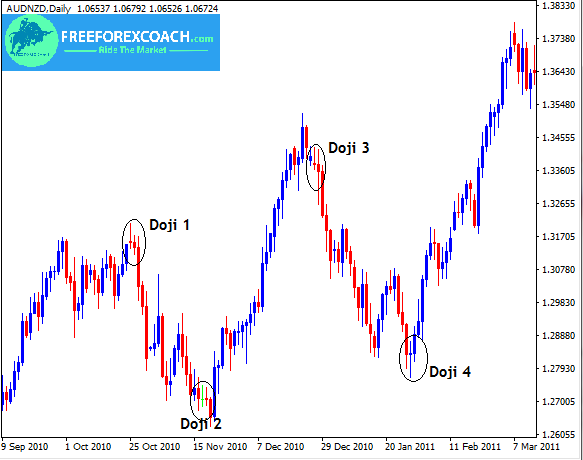

The below chart shows how Doji candlestick pattern can be relied on to identify trend retracements and reversal when a trend has been moving in one direction for a long time as marked on the chart as Doji 1-4.

When a Doji appears especially on levels of support or resistance, it is an indication for equal buying and selling pressure/ indecision.

Therefore, the next candlestick that forms gives a confirmation for the trend direction.

For example, a Doji in an uptrend followed by a big bearish candlestick is a good signal that the buyers are losing control of the market to the sellers.

So expect a change in trend to the downside. This is clearly identified on the chart above with Doji 1& 3.

If a doji forms in a downtrend and is followed by a large bullish candlestick, it signals weakness on the side of the sellers. It is a strong signal that a trend is likely to change direction to the upside. This is identified on the chart by a Doji 2 & 4.

A doji candlestick pattern is more meaningful when it appears on levels of support and resistance than when in the middle of a trend.

It is always worth looking at when a Doji appears on these identified levels in the market. This can increase on your chances of high probabilty of success of your trading set ups.

HOW TO SET RULES FOR PROFITABLE FOREX AND STOCK TRADING

I have always said and will say it again; Trading is about following your rules, everything else is amateur behavior. Following trading rules is very important if you want to profit from Forex trading and we shall look at reasons why you need to trade your rules. This...

- Oh, bother! No topics were found here.