In this article, we will discuss the major EURUSD price action for this new week and what major levels to observe going forward. Small time frame Forex trading strategies must kept within the daily channel. Let us discuss the details below;

MULTI-TIME FRAME EURUSD PRICE ACTION ANALYSIS

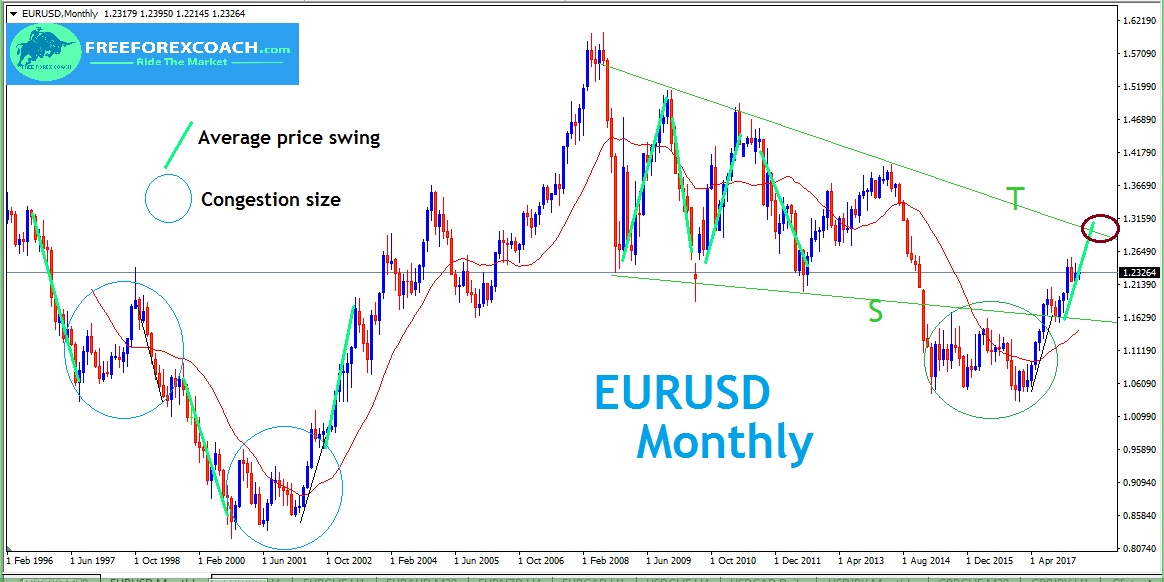

Monthly EURUSD chart.

When you look at the monthly chart below, the average swing movement on this pair is almost complete. The lime green lines indicate the average swings.

Price is now onto major resistance zone but no major signs of reversal just yet.

Also, if you clearly look at EURUSD price action on this chart, the size of the previous congestion circled green, is almost same as other previous congestions circled blue. In other wards, we still have room for more upside. This is likely because price makes a larger move than average after such congestions. In this case, the immediate resistance zone is the green trendline marked T

Therefore, the levels to watch critically on the monthly chart are; Trendline T and S.

Next, let’s look at the daily time frame to see what exactly is happening.

Daily EURUSD chart

As mentioned previously, the price is in a major monthly resistance zone. This means that a congestion is likely to occur. These congestions are mainly clear on the lower time frames, for instance the daily time frame before a new swing.

Let us now take a look at the daily chart below and see what’s happening in the price action

From the chart above, we see EURUSD price action as a channel congestion held by trendlines A and B. The green trendline is the monthly S trendline.

A break and close of candle below A may land price into immediate support around 1.20915 marked with a black line.

While the Break and close of candle above resistance trendline B, preferably weekly candle close may lead price into the monthly T trendline resistance target.

Since price on the daily time frame is in a channel congestion, trading on the small timeframes like 4-Hour and Hourly must be kept within the channel. This means, you should not set your targets beyond trendline A and B until we have a daily/ weekly candle break beyond the trendlines

Let us now take a look and discuss the EURUSD price action on the hourly chart.

Hourly EURUSD chart

The EURUSD price action now on the hourly timeframe shows a small price congestion between the Red trendlines marked r & h. Take a look at the chart below.

Close above r, may lead price into immediate support marked with blue horizontal line Y around 1.23719 resistance zone.

On the other hand, a close below h could lead price into immediate support around 1.22790 zone marked with blue horizontal line X.

The most important thing now is to keep the trading on the small timeframes like 4-Hour within the daily channel.

However, you should not set your targets beyond trendline A and B until you get a daily/ weekly candle break beyond the trendlines

NB. That channel/trendline break to the upside highlighted with pink was shared on the twitter page here. You can follow the twitter page for short term analysis on all forex currency pairs