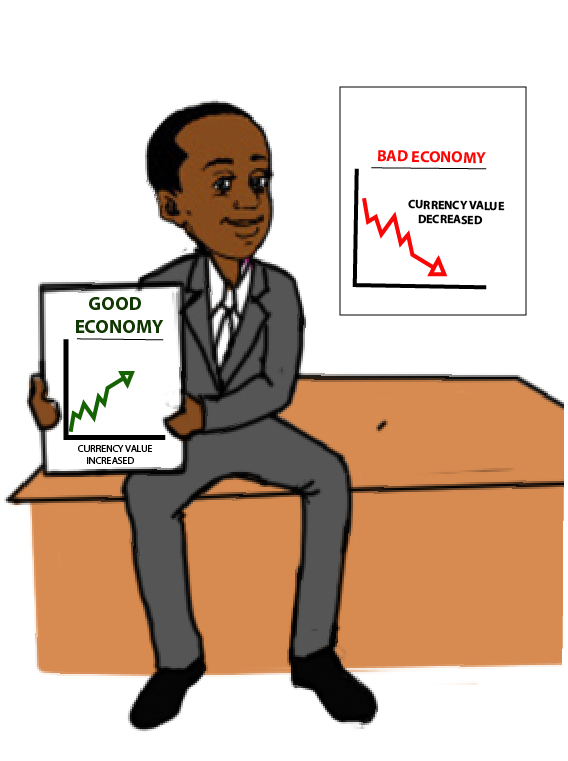

Fundamental Analysis in Forex is mainly about studying the country’s economy and it’s effect on the currency value.

Fundamental Analysis in Forex is mainly about studying the country’s economy and it’s effect on the currency value.

Forex trading analysis is categorized in 3 ways.

- Technical analysis

- Fundamental analysis

- Sentimental analysis

Previously, we looked at technical analysis that involves use of charts patterns, indicators and price action.

This is not the case for fundamental analysis in forex.

We shortly discussed fundamental analysis in our introduction part and so i suppose you have a clue already.

If It’s your first time, Just relax, we will go through everything together.

Let’s now dig in.

What is fundamental analysis

Fundamental analysis in Forex is the way to interpret Forex market behaviors while studying different countries economies.

In this case you focus on the overall state of the economy and the major factors that drive the economy to interpret the market behavior.

Major fundamentals factors to consider are the economical factors, political factors, social factors & environmental/natural factors.

In other words, you have to look at different factors to determine which economy is doing good or is at its worst moments and how that affects the currency value.

This helps you to know how a currency will react to fundamental data release from the currency’s nation of origin when compared to the other currency in a currency pair.

Whether you like it or not, you won’t get rid of fundamentals because they are the main reasons why things happen the way they do in the market.

For instance, when currency pair rises, it’s an indication that the country’s economy in question is doing well. When the currency falls, the reverse is true.

The major fundamental factors

The Major fundamental factors are,

Economical factors

- Interest rates

- Monetary Policy

- Inflation

- Consumer price index(CPI)

- Gross domestic product(GDP)

- Employment Rate

- Retail sales

- Purchasing manager surveys

- Producer Price Index or PPI data, and durable goods orders numbers.

Social Factors and environmental factors

Natural calamities such as floods, famine and drought,earthquakes, hurricanes and tsunami

Political Factors

- Wars and instabilities

- Change of government

- Elections

- Speeches and conferences

We shall look at each of them in details in our next lessons

Why you need fundamental analysis

You need the fundamental knowledge to help you make decisions in your trading life.

You may have shifted your focus only to technical analysis because you have already got a strategy to trade. Which is very fine.

However, you need fundamental analysis to back up your strategy.

You must be wondering what these have to do with you when all you need to trade Forex is a computer and internet.

Yes, that’s true but you must have some knowledge on what moves the market in order to get good signal setups to buy or sell.

Fundamental factors affect demand and supply of goods and services which is the major determinant of trade.

It helps you to relate the country’s economy and its financial performance in relation to the value and future performance of its currency.

The country’s economy and financial performance is backed up by different factors such as monetary policies, macroeconomic activities, political events and natural factors.

When all these factors are rounded up they lead us to only one thing, an economy.

An economy also depends on foreign exchange trade which now brings us to the exchange rate.

Fundamental data reports.

To trade fundamentals, you need to know what the market is expecting in relation to the actual news released.

Whether it’s positive or negative from the expectations. The more it deviates from expectations the greater impact it has on the exchange rates.

Markets react to data release within half an hour from the time it is announced and then settles giving you a chance to analyze the behavior of the affected currency in relation to other paired currencies.

However, not every data released brings an impact on the market. Sometimes you will realize changes just for a few minute or no change at all.

Next we are going to look at some of the major indicators that normally cause pollution in the market.

How procrastination can affect your trading success?

Procrastination to trade is when your trading set up confirms and you hesitate to take trade. Or your trade show all failing signals and you hesitate to close trade to cut losses. Also, in cases, where you sometimes hesitate to take profit because you want to...

- Oh, bother! No topics were found here.