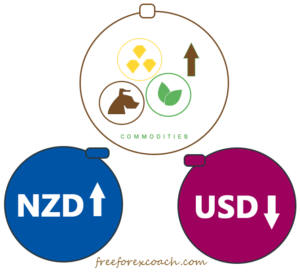

Commodity Prices affect NZD directly.

This simply means, a fall in prices of the commodities lead to a fall in value of the commodity currency.

Conversely, a rise in the prices of the commodities leads to appreciation of the commodity currency.

Commodity Prices and NZD.

New Zealand has many natural resources and is a major global exporter of agricultural produce.

As a result, the New Zealand dollar is seen as a commodity currency.

Commodity prices affect NZD since The New Zealand economy is highly dependent on its great export of commodities.

When the commodity prices rise, its exports increase hence boosting the economy. This also results to appreciation of the value of NZD.

In addition,

New Zealand economy and the Australia’s economy depend on each other for trade.

This means, the New Zealand economy is also affected by gold price fluctuations in Australia.

When gold prices rise, Australian economy expands and so does the New Zealand economy. On the other hand, if gold prices fall, Australia’s economy collapses and also New Zealand.

Commodity prices have a strong positive correlation with the NZD and AUD, and negative with the USD.

The NZD and US. dollar

Apart from the US. economy depending on New Zealand’s imports, the US dollar is pegged to commodity prices.

Every time you purchase or sell a commodity on the global market, you spend or receive a dollar.

As demand for commodities from New Zealand increases, prices rise hence more supply of the dollar and more demand for the NZD.

As a result the Dollar value falls and the NZD value appreciates.

When Commodity prices rise, the New Zealand dollar rises, the US. dollar falls and the NZD/USD rises.

The most prominent commodity news that move NZD/USD is specifically dairy products.

New Zealand is a top 5 global exporter of dairy, milk powder, butter and cheese taking 21.2% of New Zealand’s total exports.

The diary exports mainly go to China, Australia and United States.

How long should you hold an Open Position ?

How long you can hold an open position in forex, is a personal thing for all traders. The decision is all yours. You know what your goals are as a trader, the kind of strategy you use to trade. All this starts from what you are? and What you want? If I am to answer,...

- Oh, bother! No topics were found here.