Interest rates Affect Inflation levels. The Central bank will raise interest rates to reduce inflation and decrease rates to maintain balance in economic growth.

Like we have seen in our previous lesson

, inflation is the persistent increase in the general prices of goods and services in an economy for a period of time.

Interest rate is the rate at which banks lend money to consumers or individual people.

Inflation and interest rate are highly related to each other in that one never lags behind the other.

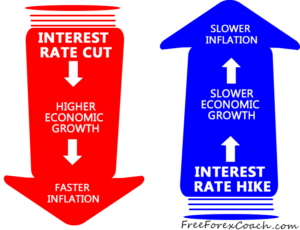

Let’s see how interest rates affect inflation. Take a look at the illustration below

At low interest rate:

When the interest rates are low,

it is easy for people to borrow from banks making a lot of money available for them to spend.

This leads to increase in economic growth and improved social standards of living.

As a result more demand for commodities hit the economy while there is no growth in supply or change in production.

Excessive demand over supply leads to hike of prices hence inflation.

Alternatively,

the low interest rates discourage saving leading to increase on people’s disposable income and increase on spending.

When this happens demand may rise over supply hence price increase.

When nothing is done about it, further increase in demand may lead to higher prices hence high inflation.

At high interest rate:,

So, when interest rates are high,

Borrowing is restricted leading to reduction of money in circulation available to spend.

This makes it expensive for the consumers to buy goods and services.

When the demand is less than supply, the high prices stabilize or sometimes fall. Since inflation follows price changes it will also fall.

In addition to that,

Increase in interest rates also encourage savings due to high interest earned on saving.

This reduces on the amount of disposable income available to spend. As a result, demand for commodities fall thus a fall in inflation.

The demand is less than the supply, the hike in prices stabilise, and inflation falls.

From the above explanation, you can see how interest rates affect inflation. It is the major tool used to curb inflation

The Reaction of the Central Bank on inflation

The Central banks Use economic indicators such as the Consumer Price Index(CPI) and the Producer Price Index (PPI) to establish interest rate targets to keep the economy in balance.

This comes with an aim to achieve target employment rates, stable prices, and stable economic growth.

The Central bank will raise interest rates to reduce inflation and decrease rates to maintain balance in economic growth.

We shall learn about CPI and PPI in our next lessons ahead

How procrastination can affect your trading success?

Procrastination to trade is when your trading set up confirms and you hesitate to take trade. Or your trade show all failing signals and you hesitate to close trade to cut losses. Also, in cases, where you sometimes hesitate to take profit because you want to...

- Oh, bother! No topics were found here.