How long you can hold an open position in forex, is a personal thing for all traders. The decision is all yours.

You know what your goals are as a trader, the kind of strategy you use to trade. All this starts from what you are? and What you want?

If I am to answer, this question!

I would of course first ask myself, what kind of trader am I? A scalper! Day trader, swing trader, trend trader or position trader.

As long as you can answer that, then you can surely determine how long you should hold an open position in the market.

For instance,

If you are a scalper, I would advise you to hold a position from seconds to 30 Minutes.

For a day trader, hold the position from atleast 30 Minutes an hour to a whole day.

Swing trader, from four hours to a few days.

Trend trader, from one day to several days.

Position trader, from one week to several weeks.

Long-term trader, from one month to several months.

Your goals determine how long you should hold an open position in forex

True, what you want as a trader determines how long you should hold on an open position in forex.

Your goals define the kind of trader you are, your trading strategy and how long you have to hold on a position in the market.

If your goal/ target is to achieve 600 pips on a single trade, you will have to hold longer till you achieve your target.

When your goal is to achieve 30 pips and realise your profits within 4-12 hours, then you will not have to an open position for more than one day.

But if your aim is to have as many trades as possible in a single day, you should opt for scalping or holding a position for a very short time.

Other wise, if you are the kind who doesn’t sleep as long as you have an open position at night, you should focus on trading lower time frames probably from 15-Minutes to H4-hour time frame and close them as the day collapses.

Newbie Trader in the Forex Market

Determining how long you should hold an open position in forex is one of the most challenging thing especially to the newbie traders.

You open a position on a 15 minutes time frame and hold it for more than a week. Its not OK.

This happens because sometimes you don’t set targets for your trades, or you just trade with no reason.

All you care about is profit, so you just take a trade.

Often times we trade with no stop loss levels, and when a trade goes against your direction, you tend to hold on waiting on its return to your preferred direction.

I can’t guarantee you that the belief you are holding on to is true. But what’s for sure is the longer you cling on a losing trade the sooner your account is wiped to zero.

How to successfully hold on a winning open position.

To become a successful Forex trader, you will need a trading strategy that you can absolutely trust. Most traders have entry strategy but no exit strategy nor risk limit (stop-loss).

A complete trading process must include the entry and the exit point levels.

As the entry tells you it’s time to take position, your exit strategy should tell you when to exit the market.This includes stop-loss and the profit target.

The stop-loss level will close the open position with a minimal loss just in case you are wrong about the market direction.

Your target profit will close the open position with a profit when the trade moves to your favour and reaches the target level.

This gives your more chances to look at other opportunities in the market and sets your mind at peace.

However, if you are a trader who prefers yielding more pips on a single trade, such as 700 pips and more, you have to hold longer on your positions.

In order to achieve that, there are a few things you must consider if you are trade successfully.

Once you have this at your disposal, you can hold your position for as long as your strategy allow you to.

Let’s take a look.

1. Forex swap

In Forex, transactions are settled at the end of the trading day. Most traders hold on to their positions for more than one day seeking to get better trading results.

Holding trading positions active for overnight, your broker might charge or pay you some fee.

The fee paid or charged depends on the underlying interest rates of the two currencies in the pair.

And if you hold it on Wed (EST) after rollover, then this fee is tripled to take into account the weekend.

These fees can influence how long you should hold an open position in forex incase you find the fee costly.

What is swap in Forex?

Swap is an interest fee that is either paid or charged to you at the end of each trading day for holding an overnight position with your broker.

It can be negative or positive.

When negative, you will lose some money for holding an overnight positions. While the positive swap will add you some money to your account.

In Forex, when you keep a position open through the end of the trading day, you will either be paid or charged interest on that position, depending on the underlying interest rates of the two currencies in the pair.

Therefore, as a trader, it is very important to know currency pairs that are good for an overnight trade to avoid being cut some fee.

Like I said before, this depends on the underlying interest rates of the two currencies in the pair.

For example if you hold a sell position overnight on a currency with higher interest rate in the pair, you are likely to pay some fee.

But if it is a buy position, then you are likely to receive some fee.

We shall get more into details about swaps and overnight charge on Forex trading positions in our next article.

For now let’s look more into things that can influence how long you should hold an open position in Forex

Next, we shall look at,

2. The Currency Pair to trade.

The Forex Market provides a variety of Currency Pairs.

All pairs are profitable as long as they are traded in the right way with a right strategies.

Some Currency Pairs are majors. This is because they are mainly from big economies and are commonly traded in the market.

The Minor/cross currency pairs, are next to the Majors. They are Minors because, are not paired with the U.S.dollar. Then we have the exotic pairs. These are from developing merging economies.

The Forex currency pairs are also differentiated by their level of liquidity, volatility and spreads.

To hold an open position for long, you need to first understand the kind of currency pair you are going to trade.

Highly liquid pairs are less volatile and have low spreads hence suitable for long-term trades. The highly volatile pairs have large spreads and make large price movement.

These pairs may work better for short-term traders but not long-term trading.

So, what I am trying to say is, if you are to hold an open position for long, choose a currency pair that is less volatile and highly liquid. In this case, Major Currency Pairs would work better.

Currency pairs also behave differently in the market.

Some currency pairs tend to respect key levels of support and resistance and others don’t

.You can also rely on this to determine how long you can hold an open position by observing market levels of support and resistance.

Knowing the right currency pair to trade helps you to plan ahead for the expected volatility, spread and psychological levels such as support and resistance and price rejection levels.

3. Your Account size

You also need to put your account size in consideration.

Before making any decisions to trade, you need to consider if you have enough capital to finance your trade positions.

You should not be a trader who takes trades and before the trades close you’ve already received a marginal call from your broker.

When you take a position, it doesn’t guarantee that it will immediately move to your preferred direction. So you must have enough capital to run your trades long enough before they close out.

In addition, you must also take precaution of how much you are willing to risk on each trade you take. If you want to hold winning trades for longer, you need to lower your risk.

You also should consider the kind of size you plan to use on each trade.

Depending on your account size, if you plan to hold an open position for long, you should always use a small position sizes.

Bearing this in mind as a trader, you have no control over the market and you can’t tell what may happen in the next minute. Anything can happen at any time.

So using a smaller size keeps you at an advantage, in situations when the market goes more volatile. You will be able to set stop-loss levels depending on the expected volatility.

This gives your trades enough room for adjustments and in case of a stop out, you don’t incur a big loss.

This is the only way to have peace of mind while holding a position for weeks.

4. The Major Fundamental News

The Forex Market is highly influenced by the four major fundamental factors in the economy. They include economic, political, social and environmental factors.

Fundamental data news is released every trading day by all major economies in the Forex Market. You can follow this up on the economic calendar.

As a trader, this should not miss on your trading kit of your daily trading routine otherwise you will be overwhelmed by the results.

It is always important to look a head of the market news depending on how long you plan to hold on an open position. Know what is expected and plan along with it to avoid surprises.

Major fundamental news can by the way change the direction of the entire trend direction.

Therefore, however much you tell yourself you don’t want to trade noise, I should tell you that your technical may not be able to save you at the release of some news events.

Always be sure to check the economic calendar before placing a trade. If your expected holding period is several days or weeks, you should check the calendar for that period.

This will give you a good idea of how much volatility to expect over that period as well as when to expect it.

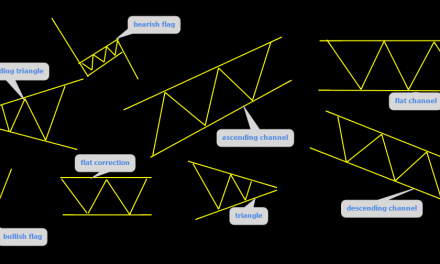

5. Time Frame.

Lastly you need to know the kind of time frame you should trade on.

You cannot trade on a 15 Minutes chart time frame when you plan to hold a trade for 3 Weeks, or H1 when you plan to hold a trade for months.

For a daily trader, you can choose to hold your trades from 15 Minutes- daily. What matters is, at the end of your trading day, all your positions are closed.

For swing traders, you can trade on H4 and Daily, you can hold your position for one to a few days.

Trend trader, on Daily and weekly. You can hold open positions for a few days to a few weeks and a long-term trader for a few weeks to months.

Trading on the right time frame makes your analysis easy and you are able to plan for volatility expectations.

Conclusion on how long you should hold an open position

It’s every traders’ dream to catch a big move in the market. But you need to set a realistic holding period.

This is not because currency pairs don’t move that far very often, but because it’s mentally and emotionally challenging to wait.

Markets don’t move in a straight line. Sure, there periods where it seems true, but precaution needs to be put in place.

Be alert always, plan for expected volatility on your trades.

Make use of the economic calendar and know the currency pair you want to trade.

As long as you anticipate those type of moves against your position, there’s nothing to worry about when it actually happens.

You should also not forget to lower your risks,

if you want to hold longer to winning trades. Determine how much you can risk on each position and how much size you should trade with.

Small size will enable you to set large stop-loss level and your trade will have enough space for volatility adjustments.

Last but not least, the kind of time frame you trade on also matter a lot.

For short-term traders, smaller time frames of 15 Minutes, 30 Minutes, H1 are suitable. For swing and trend traders, H4-time frame, Daily and weekly time frame are suitable for trades.

Trading is both emotionally and physically challenging especially watching a position you have held for a few days turn around consuming your profits.

As long as you have put the listed above in consideration, all you need is to stick to it and let your trades run.

It is not that you will always have every trade right but once it happens the profits will be enough to cover-up the loss and you still stay in profit.