Three Drives harmonic Pattern in Forex is one of the strongest reversal patterns and it is traded against the trend after it completes.

It is almost the same as the A – B – C – D only that, a Three drives pattern is made of 5 legs, while an A – B – C -D pattern has only 4.

Besides the three legs, it also has two retracements/corrections instead of just one.

It consists of a series of higher highs or lower lows that complete at a 1.272 Fibonacci extension.

The three drives harmonic pattern in forex gets its name for the 3 peaks marking the attempts of the exhausted market to continue trend.

Because it signals trend reversal, it always forms at the end of a trend.

In a downtrend, it appears as a bullish three drives while in an uptrend, it is a bearish three drive pattern.

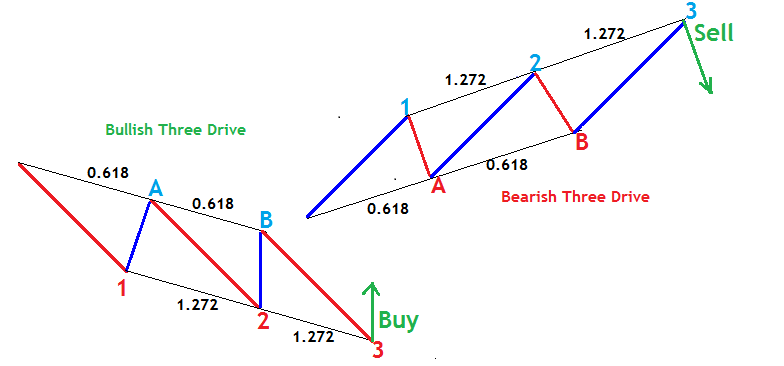

Take a look at the illustration below;

Characteristics of the three drives pattern in forex.

It has three drives marked 1,2,3 and two corrections A and B.

- Point A should be no more than 0.618 Fibonacci retracement of Drive 1(peak 1)

- Drive 2 should be 1.272 extension of retracement A of the Drive 1.

- Point B should be 0.618 retracement of Drive 2

- Drive 3 should be 1.272 extension of retracement B of Drive 2.

The bullish three drives harmonic pattern, appears towards the end of a downtrend and signals bullish reversal. Possible time to buy.

On the other hand, the bearish three drives pattern in forex forms in an uptrend and signals bearish reversal. Good opportunity to sell.

How to trade three Drives harmonic pattern

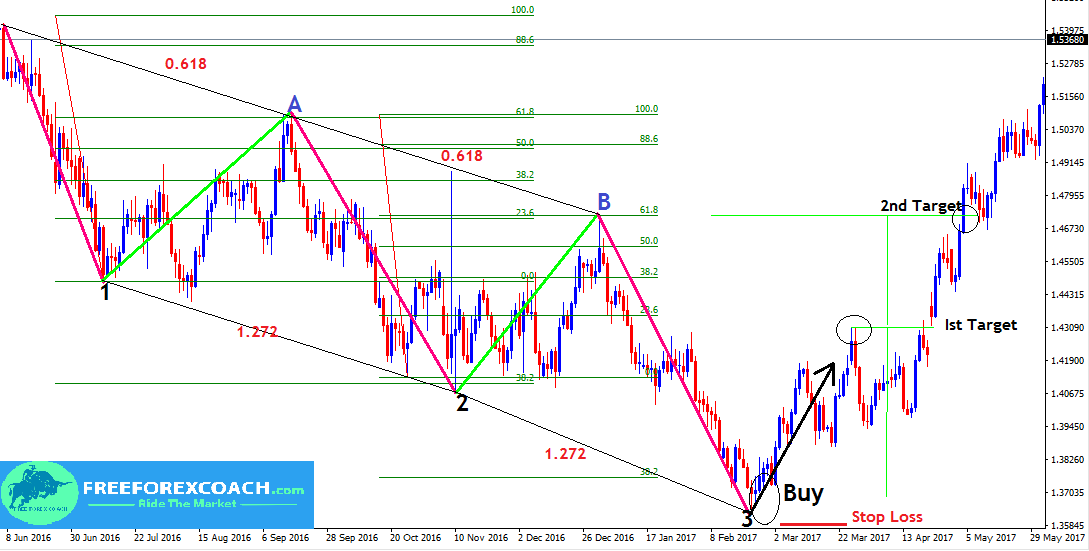

Below is a price chart with a Bullish 3 Drive pattern

We already know that a bullish three drive is a bullish reversal pattern. Therefore when it forms after a long downtrend, we should get ready for buy opportunities.

The pattern is complete after drive 3 cover 1.272 extension of correction B.

For instance,

From the above chart, the Buy entry signal is at 3. This after the price hits the extension level 1.272 on the third drive down which is where we placed our entry for the buy trade.

The stop loss is placed few ticks below point 3 to the next level.

Whereas our target profit lies within A and B retracements.

You can also set targets following the next Fibonacci retracement levels after the entry point. Or swing lows and highs. For example,1,2,A and B

However, some books require you to draw a Fibonacci retracement from the start of the pattern to the completion of the pattern. Then set your target at level 1.618 of the retracement of the entire move.

Therefore, choose any that makes you comfortable and use that.

Note that,

The most important point to ensure here is to have a favorable risk reward ratio. Entries with low risk/reward has to be taken cautiously or discarded altogether.

Follow the same procedure when trading the bearish three drive pattern.

Why you make small profits and take big losses?

Major Reason why You make Small profits and take Big Losses in Forex is because you have lost market objectivity. This is due the influence of greed, fear, regret and revenge. You trade what you are thinking instead of what you see! The problem is that traders want to...

- Oh, bother! No topics were found here.