You can measure Volatility using Moving Averages in Forex by looking at how far Moving averages are from Price. The further they are, the higher the volatility.

First,

let’s have a small recap of what MAs are before we dig deep on how to measure Volatility using moving averages.

what are Moving Averages (MAs)

Moving Average is a trend following indicator that measures the direction of a trend.

In an uptrend, the moving average moves just below the price action and in a downtrend above.

When you look at moving averages movement with price, you can easily tell how much volatility is in the market.

The 3 common types of moving Averages include;

- Simple moving average (SMA)

- Exponential moving average (EMA) and

- Weighted Moving Average(WMA)

Moving averages are used to measure the average movement of the market for the estimated period of time.

For example, a 14-day Simple moving average is got by plotting the average price of every 14 days.

How to use moving averages to measure market Volatility

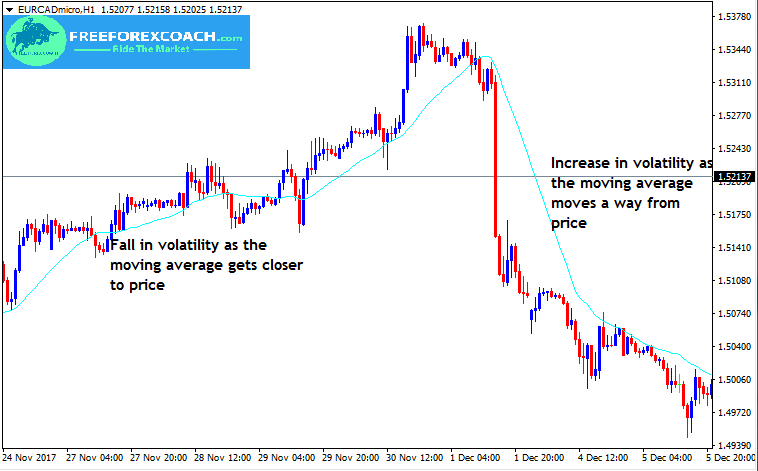

Take a look at the EURCAD, Hourly chart below;

The distance between the moving average and the price shows the volatility of the currency pair.

From the chart above, as the moving average moves a way from price, it indicates high volatility in the market.

On the other hand, if it gets close or passes through price, it shows low volatility in the market.

Periods of Low Volatility in the market

The moving averages gets closer to price or moves through price.

This low volatility is usually a congestion period on the forex market charts.

Take a look at the chart below,

Periods of high volatility in the market

The moving average moves further from price or expands.

This is phase of strong price momentum mostly from breakouts after congestion periods.

See chart below;

Therefore,

With the moving average on the chart, you can tell if the currency pair has low or high volatility depending on how close the moving average is to price.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post