So, how do you interpret or read forex quotes?? A Forex quote is the price of one currency in terms of another

From the previous lesson we learnt that currencies are priced and paired.

When currencies are priced and paired ,they are known as quotes on the forex market board. You must learn to read forex quotes because they are traded simultaneous with one another. One is bought or sold relative to the other.

Let’s take a look at some of quotes commonly traded on the forex market;

USD/CAD,EUR/USD,GBP/USD,EUR/JPY, USD/JPY, USD/CHF,AUD/USD, NZD/USD, GBP/JPY.

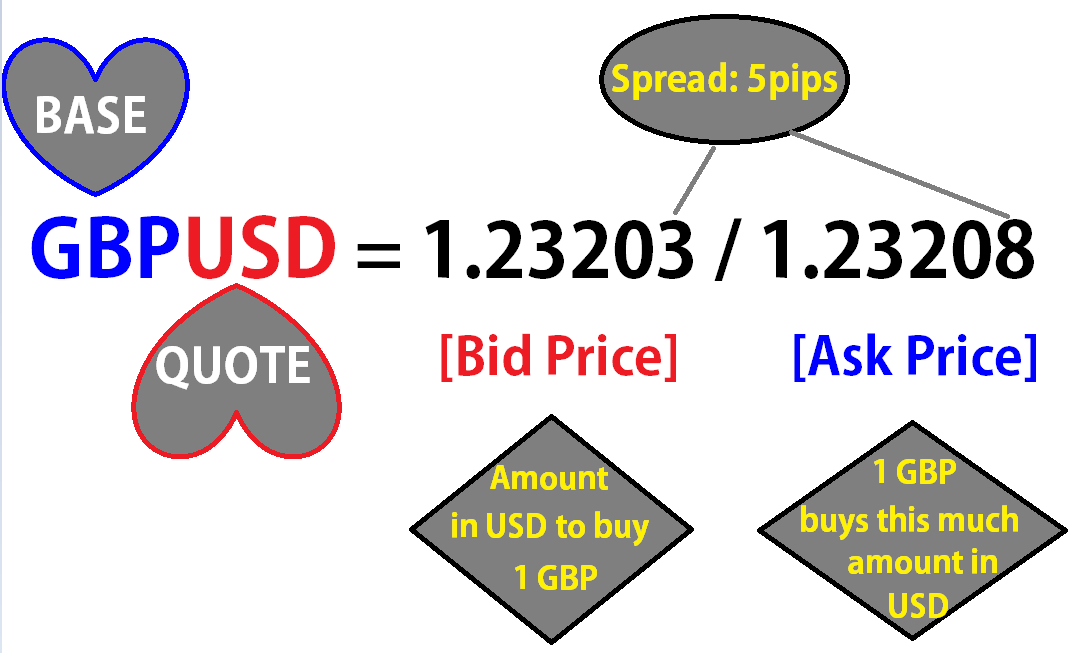

The first currency on the left is the base currency and the one on the right is the counter/quote currency.

The base currency is equivalent to 1 unit and the counter/quote currency is that amount 1 unit of the base currency can buy as stated on the exchange rate. That’s how you interpret or read forex quotes

When you buy a pair (go long), you predict that the market will go up. This means the base currency is appreciating in value.

Eg; if you buy a EUR/JPY pair, the EUR is adding value more than the JPY. So you buy EUR as you sell the JPY currency. Assuming the price is 124.034.

Likewise, while selling the pair, you tend to go short, so you sell 1 unit of the base currency, in this case which is EUR while buying the counter currency which is JPY at 124.036 of the quote currency.

Position taken by a trader.

To trade in the foreign exchange markets, there are 2 options; either buy or sell whichever works better for you.

Choose to buy, we say you are going long or taking a long position. Choose to sell then you are short on a trade; taking a short position.

A sell position/ short, means the market will go down ie the base currency will lose value in relation to the quote currency. If it goes as predicted, you make a profit. The reverse is true if we take the buy position/long position on the currency pair.

The sell position is always taken at a higher price. You sell the pair high at a price called the bid price and long position at a lower price, the ask price.

The ask and bid price – Read forex quotes

Choosing to sell/take the short postion, you use the bid price to sell the currency pair.

The bid price reflects how much the market is willing to pay to buy the quoted currency as you sell 1 unit of the base currency.

The bid price is the price at which the quote currency is bought in the market.

Likewise going high/ buying a currency pair, the price at which the market markers will sell the base currency is the ask price.

The bid price is always lower than the ask price. Very important to note as you read forex quotes.

Bid=buy, ask=sell.

Therefore, the bid price is the price at which the trader can sell to the market and ask price is the available price in the market at which a trader can buy from the market.

Let’s take a look at an illustration below

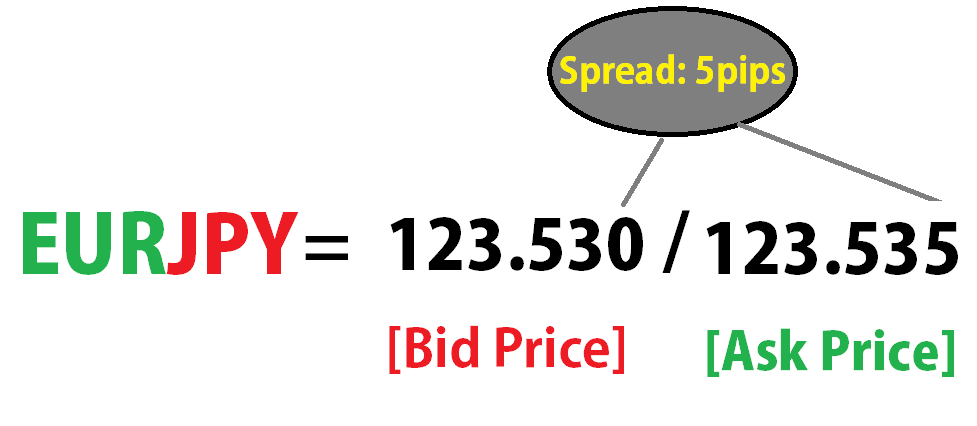

Taking a EUR/JPY as our example

EUR/JPY=123.530/35

Bid=123.530

Ask=123.535

The difference between the ask price and the bid price is the spread.

For EUR/JPY, the difference between 123.530 and 123.535 is 5 pips which is the spread.

spread, pips and lot

You might have been wondering about these small words the moment they appeared to you in our previous statements but not any more.

First time hearing of those words they are hard nuts to crack but with time you get used to them. We shall discuss details about these important terms in next lesson.

Let’s just look at the definitions real quick;

- Spread, this simply means the difference between the bid price and the ask price.The spread covers your transaction costs, brokerage costs and it is calculated using pips.

- A pip is the smallest change in value between two currencies.

- A lot is simply a trade size in forex trading.

Learn more about a pip& forex lot in the next lesson. Just click next.

How procrastination can affect your trading success?

Procrastination to trade is when your trading set up confirms and you hesitate to take trade. Or your trade show all failing signals and you hesitate to close trade to cut losses. Also, in cases, where you sometimes hesitate to take profit because you want to...

- Oh, bother! No topics were found here.