To trade forex using ADX Indicator, you must always remember that ADX is a technical indicator that measures the strength of a trend not direction. It’s the directional movement lines (-D and +D) that show trend direction.

It was developed by Welles Wilder. He also developed the Average True Range (ATR) and Parabolic SAR and other indicators. We shall discuss these in later lessons. OK.

If the price is going UP, and the ADX indicator is also going UP, then it indicates a strong bullish trend.

The same is true if the price is going DOWN and the ADX indicator is going UP. Then the bearish trend is strong.

The Average Directional Index(ADX) indicator fluctuates from 0 to 100%.

Readings below 20 indicate a weak trend and above 50 indicate a strong trend.

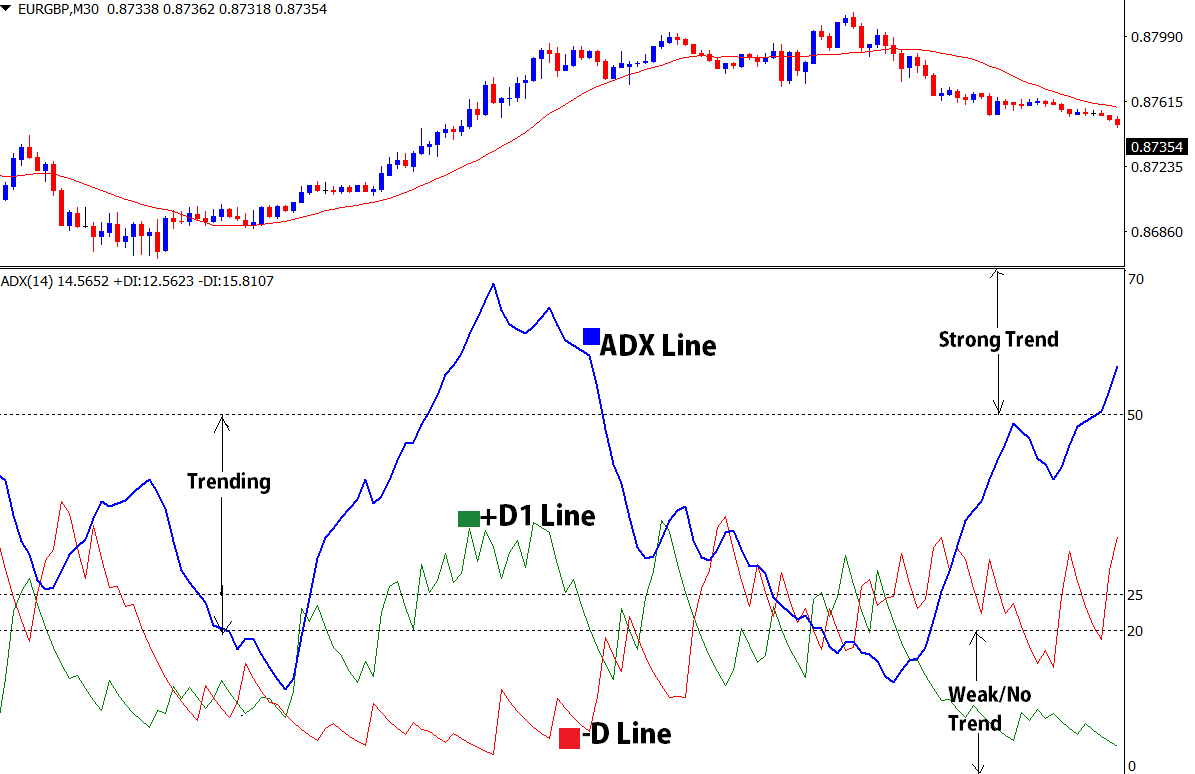

The structure of ADX indicator with Directional Movement lines

Some platforms provide ADX indicator with additional -DI and +DI indicators while others may not.

The Average Directional Index (ADX) comprises of three lines indicator that includes;

- The ADX line.

- The Minus Directional Indicator (-DI)

- And the Plus Directional Indicator (+DI)

The three indicators in one are used to tell both the trend direction and the trend strength.

- The ADX line, measures the strength of the trend.

- The +DI, the positive directional movement indicator shows price in an uptrend.

- The -DI, the negative directional movement indicator shows a downtrend.

How do you read the ADX indicator along with directional movement indicator

Points to Note:

- The ADX fluctuates from 0 and 100.

- When the reading is below 20, it indicates very week or no trend.

- ADX Values between 25 and 50 signal a trending market.

- Values between 50 and 75 very strong trends

- When the +DI is above the -DI, buying is stronger than selling hence strong uptrend.

- On the other hand, when -DI is above the +DI, selling is stronger than buying, strong downtrend.

The Crossovers of -DI and +DI lines can be used to generate trade signals.

how to trade forex using ADX indicator in an uptrend

For a Buy Signal

- +D line crosses above the –D line gives a buy signal.

- When ADX line is above 25 confirms buy trade signal

- Stop loss about some pips below the confirmation candle better below some previous congestion

- Common take profit /exit is when -D crosses above +D

- Target profit level can also be when ADX is above 75 or if it comes back to 50 before 75. (ie first time hits 50, goes may be to around 69 and returns to 50, you exit)

Explanation for Profit Target zone

When the ADX line is above 50, this means the buyers have been in possession of the market for long. As the ADX goes beyond 75, it indicates over bought conditions which may be a sign of a trend coming to an end.

This signals a probable change in the direction of the trend giving you a warning to exit the buy trade or to prepare for a sell position .

As ADX falls below 50, it’s an indication of a falling momentum in the uptrend.

how to trade forex using ADX indicator in a downtrend

For a Sell/Short Signal

- When -D line crosses above the +D line gives a sell signal.

- When ADX line is above 25 confirms sell signal

- Stop loss about some pips above the confirmation candle better above some previous congestion

- Common take profit /exit is when +D crosses above -D

- Target profit level can also be when ADX is above 75 or if it comes back to 50 before 75. (ie first time hits 50, goes may be to around 69 and returns to 50, you exit)

Explanation for Profit Target Zone

When ADX goes above 50 and -D is above +D, it is an indication that the sellers are stronger than buyers. Above 75, the trend may be nearing an end. This signals a probable change in the direction warning you to exit.

As it falls below 50, it indicates a fall in the momentum of the down trend.

Major important notes:

Take a look at the chart below

- The ADX line(blue line), measures the strength of the trend but does not tell the direction.

- The +DI(green line), the positive directional movement indicator measures how strongly prices move upwards (strength of buyers).

- The -DI(red line), the negative directional movement indicator measures the strength of sellers in a downtrend.

From the chart above, you realize that every time the ADX line, goes beyond 50 and fall back below, a trend changes shortly.

This is an indication for end of one trend and beginning of a new trend. Therefore you can rely on that to determine your trade entry and exit points.

Lastly,when the ADX line is ranging between 20 and 25, it is an indicates a ranging market environment. As ADX line falls below 20, this indicates a very weak trend and it may lead to a change in the direction of the price trend.

So when trading ADX indicator you need the help of the two indicators +D and –D which give the direction of the trend.

Like any other indicator, to trade forex using ADX indicator has got its shortcomings like making fake signals especially when used on small time frames. To get best results, use the indicator on large time frames.

The ADX indicator works best when used in combination with other indicators. We shall learn combining indicators for better signals in the next later lessons.

Why is it hard for most traders to maintain consistent profits in trading?

You would be suprised at reasons why most Forex Traders fail to Make Money from Trading. They are simple reasons mostly emotional. Out of 100, only 5% of the traders have managed to make CONSISTENT profits and the 95% have failed. Out of 95%, 99% are the new traders....

- Oh, bother! No topics were found here.