Ichimoku Kinko Hyo in forex is a technical chart indicator that defines future areas of support and resistance.

It also identifies a true trend direction, gauges momentum and provides trading signals.

This indicator gives all you ever need as a trader to trade successfully.

Just a one look on the market chart and you identify the trend and the potential signals with in that trend.

“Ichimoku kinko hyo means a glance at a chart in equilibrium”.

It was developed by a great journalist Goichi Hosoda in 1936 and later published in 1969 in his book .

The Ichimoku kinko hyo is one of the easiest indicators you can come across with best results.

Ichimoku kinko hyo on a forex chart

From the chart above, Ichimoku Kinko Hyo comprises of five lines which appear in different colors. Each line represents a different role on the chart.

Tenkan Sen (conversion line): This is the blue line. It is derived from the highest high and lowest low for the past 9 days. Tenkan Sen is the fastest and most sensitive line that follows price the closest.

Kijun Sen (base line) : This is the red line. To calculate the Kijun Sen, you take the average of the highest high and lowest low for the past 26 periods. It follows price after the blue line.

Chikou Span (green line): It is a lagging line. It is plotted 26 days in the past/ behind.

Senkou Span A (green line): This is the first Senkou Span line. You calculate it by averaging the Tenkan sen (blue line) and Kijun sen(red line).

The Senkou Span A, moves faster than the Senkou span B because it has a shorter moving average. Therefore, this makes it more sensitive to price change and faster.

Senkou span B (orange line); With this, you average the highest high and lowest low for the past 52 days. It is therefore plotted 26 days ahead.

Cloud: The cloud is the zone between Senkou Spans A and B. The crossing between them determines the cloud colour (type of trend).

How to use Ichimoku Kinko Hyo in forex

Using Ichimoku Kinko Hyo in forex is so simple with some basic procedures.

Guidelnes to use Ichimoku Kinko Hyo in Forex.

- Add indicator on your chart.

- Identify the the trend (Cloud color).

- Identify position of Kinjun Sen in relation to the Tenken Sen.

- Take a note of the Chikou Span position in relation to price.

- Take the trade position

How to identify a price trend using Ichimoku Kinko Hyo

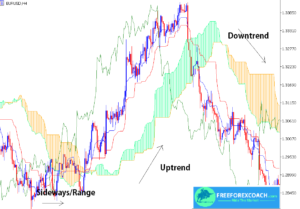

Take a look at the chart below;

When prices is moving above the green cloud, it is an uptrend. The uptrend is strong when the leading span A green Senkou cloud line is rising above the leading Span B orange Senkou (cloud line). Hence forming a green cloud.

On contrary, it becomes a downtrend when price is moving below the orange cloud. The trend is strong when a green Senkou is falling or below the orange Senkou(cloud line), hence cloud orange.

In addition,the trend is flat or in consolidation when the prices are in the clouds.

Therefore, the Ichimoku Kinko Hyo, shows you how price is trending in the market. You can rely on it to generate both entry and exit points.

Ichimoku Kinko Hyo in forex also helps traders to determine the strength/ momentum of a trend and possible signals to trade.

How to generate trade signals

Take a look at the chart below;

For the Bullish Signals

- Price should move above the cloud, indicating an uptrend

- The cloud colour turns from orange to green

- The Tenkan Sen crosses above the Kinjun Sen

- Chikou span above the price on the upper side

From chart above, the Buy signal B qualifies to the above conditions. Note that we didn’t take the buy trade after immediate cross over at A of Tenkan Sen and Kinjun Sen.

This is because the cloud had not turned from orange to green. You should always wait for the cloud to change color to make your entry or exit decisions.

Bearish Signals

- Price should move below the cloud – show downtrend

- The cloud colour changes from green to orange

- The Tenkan Sen crosses below the Kinjun Sen

- Chikou span below the price on the down side

You can see from the chart above, the Sell signal at D, qualifies.

Note that, at C we didn’t sell at the immediate crossover of Kinjun Sen and Tenkan Sen, because price was still in the cloud.

Take profit/Exit levels

Buy Take profit when,

- The Tenkan Sen crosses below the Kinjun Sen

- Chikou span below the price on the down side

The target/exit for our buy trade on the chart above at T qualifies.

Sell Take profit when,

- The Tenkan Sen crosses above the Kinjun Sen

- Chikou span above the price on the upper side

Target for the sell trade on our chart is not shown because, the trade is still running since the target/exit conditions haven’t been met just yet.

You must be wondering why the cloud isn’t in the exit criteria. This is because the Tenkan Sen, Chikou Span and kinjun Sen react to changes in the trend quite fast before the cloud color changes.

Waiting for the cloud to exit may lead you to give away some of profits back to the market.

Always watch the the Tenkan Sen, Chikou Span and kinjun Sen behavior to determine your exit.

Avaricious Life of a Newbie Trader.

Life of a Newbie Trader in Forex is super Interesting. With a lot of eager to make money, you never want to miss out on any chance. When you read about Forex trading, everything is simple. You may even start to think that your friends may not recognize you after...

- Oh, bother! No topics were found here.