Wedge Pattern in Forex is both continuation pattern and reversal pattern. They are similar to symmetrical triangles but take long to form compared to symmetrical triangles.

Wedge pattern in forex take about 3-6 months to complete on a daily chart therefore they are long-term patterns. The patterns form after a strong rise or a decline in price.

What are Wedge patterns

Wedges have converging trend lines that slant in either upward or down ward direction. They form both in uptrend and downtrend after a strong rise or fall of prices.

There are 2 types of wedge pattern in forex;

- A rising wedge

- A falling wedge.

Rising wedge

A rising wedge is a bearish pattern. It makes higher lows faster than it makes higher highs.

This makes the lower support trend line steeper than the resistance trend line indicating a fall in momentum.

When this happens, we expect a price break on either sides of the pattern as price approaches the apex.

When a rising wedge forms in uptrend, it may lead to a reversal of the trend. On the other hand, if it forms in a downtrend, it signals a continuation of the initial trend.

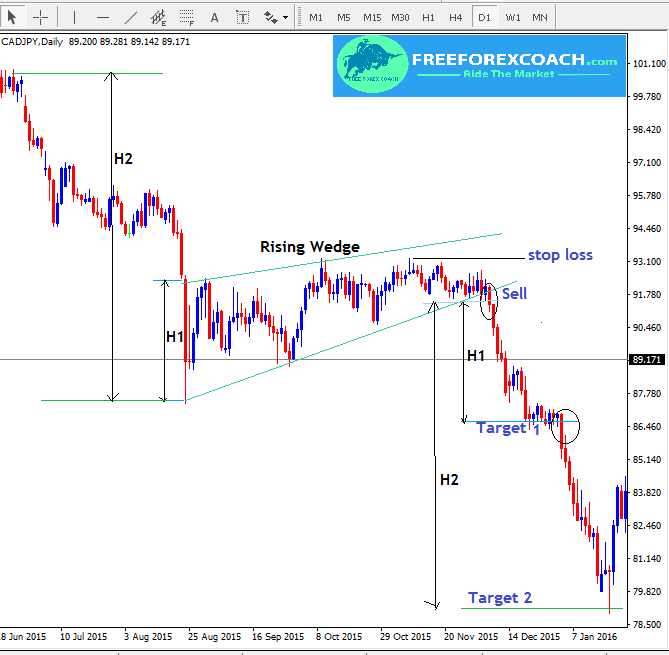

A rising wedge in a downtrend

From the above chart,

You can see how price action is forming new highs, but at a much slower pace than when price makes higher lows.

A price break at the lower trend lines confirms the completion of the pattern and sighals short/sell entry.

How to trade a rising wedge pattern in forex

In an Uptrend

- First you have to identify the main trend direction of the price action.

- Spot the wedge. You can clearly see how price formed higher lows faster than higher highs forming a rising wedge pattern.

- Your Entry point is after the close of the confirmation candle below the lower trend line

The confirmation candle must close below the lower trend line of the wedge .

Stop loss & Profit Target wedge pattern in forex

From the above,

Take profit target 1 is equal to the size of the wedge (H1) and Profit target 2 is equal to the distance moved by price before formation (H2) of the pattern.

Stop loss should is set slightly above your entry point.

Your minimum take profit target is equal to the size of the wedge.

Maximum profit target is equal to the distance moved by price before formation of the pattern. Here you should put the level of market volatility in consideration.

Stop loss is set slightly above your entry point above the next high.

Let us take a look at another example;

Rising wedge in a downtrend

From the above chart ,

- The confirmation for the Sell entry is the candle close below the support line.

- Take profit target 1 is equal to the size of the wedge (H1).

- Profit target 2 is equal to the distance moved by price before formation (H2) of the pattern. Stop loss is set slightly above your entry point.

How to trade a falling wedge

A falling wedge is a bullish chart pattern. It is a reversal and also a continuation pattern depending on its position/ trend.

A falling wedge forms steeper resistance trend lines. This is as a result of forming higher highs faster than higher lows.

It is the opposite of a rising wedge. When it forms in a downtrend price is likely to reverse. However, when in an uptrend, price is likely to continue at the completion of the pattern.

In a downtrend

A falling wedge pattern in a forex is traded in the same way as a rising wedge only that a falling wedge breakouts to the upside hence gives a buy signal.

The breaking candlestick on the upper side of the wedge confirms the completion of the pattern.

Entry point is at the close of the confirmation candle above the resistance/trend line.

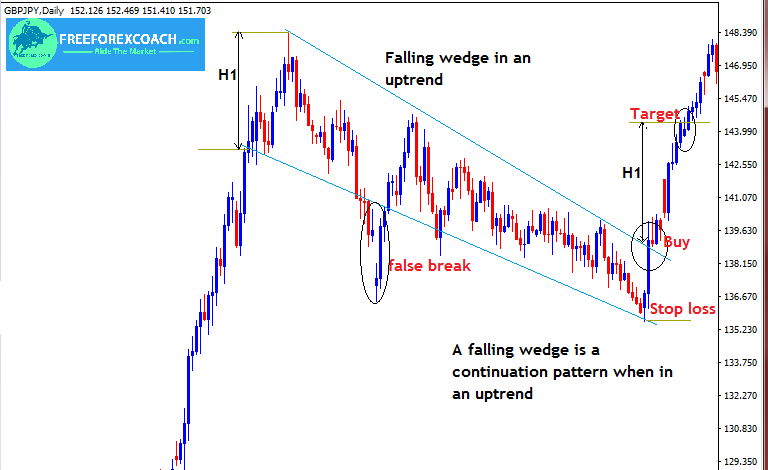

A falling wedge in an uptrend

Following the breakout on the upper trend line, take buy position after the close of the confirmation candlestick.

Like we said,

Your first target should be equal to the height/size of the wedge,in this case – (H1).

Stop loss is set slightly below the entry point.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post