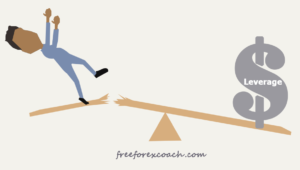

Yes, Leverage is a double edged Sword. Most traders fail because they want to use leverage and they don’t understand how leverage works in real sense.

So, it is not that they have no skill of trading or they are unfortunate. Largely it is because of high leverage.

It doesn’t matter whether your broker gives you a leverage of 1:100 or 1:400. Or he tells you that you can actually trade 10,000 units with an account as small as $100 dollars.

What matters is, Do you know how leverage works?

Leverage is a double-edged sword

All you need is to take precautions on all that brokers tell you.

It’s not that you don’t succeed when you use leverage. But you have to consider different factors before you take in that choice. Among them, the size of your trading account matters a lot.

Leverage as a double edged sword means, the same way you can make money trading with leverage is the same way you will lose it.

You can easily make a lot when the trade goes as expected.

Similarly, you can easily lose your whole capital when you trade with leverage.

No Leverage

But suppose you were risking 1% of your actual $100 account (no leverage) on each trade which is (1%×100). When the trade goes against you , you would only lose $1. That’s safe but boring.

No matter how badly you want to double your account or achieve your million dollar dream, don’t use a standard account or mini with such a small account. Do it as a micro!

With Leverage.

Thanks to the Forex brokers you can trade a big size with your small capital account and compete with those having large accounts.

In this case you can control a mini account using just $100 that means your broker will allow you to trade 10,000 units or use a size of 0.1 with a leverage of 1:100.

Isn’t that fair enough?

Of course it is!!. Actually it’s very exciting thinking about the whole calculation.

Let’s look at an example.

Example on trading Forex with Leverage

If your account balance is $100 and your broker allows you to hold a position as big as 10,000 units.

This means if you win 1% on each trade, you earn 100% of your actual deposited money. Ok, let’s do some little math;

Your deposit is $100, with leverage your account became $10000. In case of a winning trade, you earn (1%×10000) =$100 as profit.

In actual sense your account gets doubled in just one single trade to $200.

Who doesn’t want to double his or her account in a single trade? That would be the very best news to a Forex trader.

However, since Forex trading is a probability based investment, we must always consider 2 scenarios. A loss and a win.

In this case, if our first trade came out as a loss. This would make a loss of $100.

Moreover, the $9900 is borrowed money from the broker. So What now?

The whole account is wiped out.

And before you could finish running your first trade you are receiving a margin call that you have got insufficient balance and the broker closes your trade.

Ooh No! What a stub in the back. All because of Leverage

This is one of the dangers of using a high leverage on a small account. You expose your account to 100% risk in your ignorance and your account suffers the consequences.

How much do you need to trade forex with leverage

You find a trader opening a standard account with just $100, NO! That’s Suicide!

Come to think of it. If it gives hard time trading such a small amount on a micro account with proper stops, what do you expect on a standard account?

Let’s see, on a standard account, the smallest movement is equal to $10 which is equal to 1 pip. This means if a trade goes against you, just 10 pips are enough to blow you off completely.

Start trading with a micro and first develop your account till it is big enough to trade any position of your choice.

Alternatively,If you badly want to trade the standard account, save your $100. Open a demo account and stick with it until you come up with more money enough.

The best way to profit from leverage is to have at least have $100,000 of trading capital before opening a standard account, $10,000 for a mini account, or $1,000 for a micro account.

Leverage is good but only when used in a proper way!!

In our next lesson we shall take you through what leverage is and how you can avoid big drawdowns when using leverage

Common mistakes most traders make and how to avoid them?

Fear and greed are the number one causes for the common mistakes most traders make when trading. Fear and greed normally come before trading, during and after trading. When you are under fear or greed, you are likely to commit these mistakes most traders make; Get...

- Oh, bother! No topics were found here.