Japanese Candlesticks in Forex trading are the most popular ways to formulate Forex Strategies. Now we shall look at how they came about and how to use and interpret candlesticks .

Let’s calm down. Go step by step so that we don’t miss any bit.

Candlesticks are really important and they play a big role on the forex market charts. To begin with we need to know what really a candlestick is and its origin. Are we ready? Thumb ups !

Japanese Candlesticks in forex are a technical analysis tool that traders use to chart and analyze the price movement of securities.

Origin of japanese Candlesticks?

The Japanese candlestick is an ancient method of analyzing markets which was used by Japanese to trade rice contracts. Candlestick charts were developed by a Japanese legendary rice trader named Homma Munehisa.

Homma Munehisa from the town of Sakata, analysed the markets basing on human emotions. It all started in early 1868 from the town of Meiji where Homma made great profits using candlesticks.

The Japanese Candlesticks

The black and white real bodies of the candles were used to analyse the behavior of supply and demand of rice in the market. This further became familiar and people started developing trading strategies and patterns.

As a result market predictions became important. Homma Munehisa was so deep in love that he spent almost half of his life trying to study, research and discover the behavior of the great candlesticks.

Finally” the cat was let out of the bag.” He then revealed the great secret that was behind the candlestick charts.

It was later discovered by Steve Nison from the office of the Japanese trader and he immediately introduced it to the Western region. Nison understood the power of the Japanese candlesticks and not only did he fall in love with it but also took it as his companion of life.

The Japanese candlestick later became popular to most traders due to its level of ease in reading and interpreting charts. Thanks to Nison, he was able to transform many lives of people by sharing this great idea to the other side of the world.

Now we know the real origin of candlesticks, Let’s now take a brief look at the true nature of a candlestick

Formation of the Japanese candlesticks

The shape and a body of the Japanese candlestick is not very different from the ordinary candles we use to light especially in our churches. For those who have not seen that in churches at least you have seen/used one at home.

Anyways where you saw it is not important , you can run to next shop and ask for one to take a clear look at it.

You will love it more after this section. Let’s look at the illustration below.

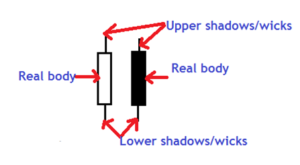

A candlestick has a hollow or filled part known as the real body and long thin lines up and down.

The line below and above the body of the candlestick is the shadow or the wick.

The real body shows the range between the open price and the closing price while the shadows show the highest and lowest price can moved in a specified time.

If the close is lower than the open of the real body, a black color is a bearish candlestick. On the other hand, if the close is above the open of the real body, a white color, it is a bullish candlestick.

Point to note,

The color of the candlesticks represent the market participants. Therefore, from the above candlesticks, the black color represents sellers/ bears while the white color represents buyers/bulls.

japanese Candlesticks forex – colors on the chart

Black and white are not a permanent colors for the candlesticks.

You can choose to use any colors of your choice to differentiate the candlesticks instead of black and white.

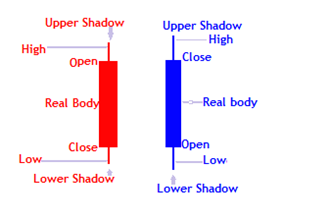

In this case, we chose red and blue for our candlestick. Blue represents the bulls/buyers and red represents the bears/sellers.

We shall mostly use these throughout the next free coaching sessions/lessons.

Candlestick interpretation

Like bar graph and line graph, candlesticks also represent buyers and sellers on the forex market chart.

Candlesticks are charted on different market time frames; that is, 1 minute chart, 5 minute, 15 minute, 30 minute, 1 hour, 4 hour, daily,weekly and monthly chart.

If you have the chart on a daily setting each candle represents one day. The same applies for the other time frames.

A Japanese candlesticks in forex are composed of the open, high, low and close in a specified time frame.

The length of the of real body of a candlestick shows the strength of the sellers/bears or buyers/bulls in the market.

The low show the lowest price in the market in a period of time. On contrary, the high, shows the higher high price has moved up in the market in a period of time.

japanese Candlesticks Highs and Lows

Highs and lows make up the upper and lower shadows and traders always look at them as price rejections.

What’s the real hidden meaning behind lows and highs?

First;

A low is the lowest level price can move. Or lowest price sellers are willing to sell in the market.

For instance, on a bearish candlestick, we see price opens , moves up, which means there are still some buyers in the market. But because there are more sellers compared to buyers, they push prices back down to the open hence forming a high.

Below the open, the real body shows the domination of sellers through out that period of time. Then the lower low on a bearish candlestick shows the lowest price sellers are will to sell in the market.

At this moment, prices are very low, so some of the buyers will want to take advantage of the situation by buying at very low price. As more buyers buy, price is pushed back up until the period expires and candlestick closes hence forming a low.

Secondly,

For a bullish candlestick; price fall below the open. When it forms a low below the open, it means there are still some of the sellers in the market at the moment. But because more buyers are getting to the market, price is then pushed back up hence forming a low.

Above the open, a real body shows dominance of the buyers. When price hits its highest high, it becomes expensive for traders to buy more.

Some traders start selling off closing their positions. The presence of sellers will push prices down. At the expiration of the period price closes with a small fall in price hence forming a high.

In conclusion

Japanese candlesticks in forex are very important on a trader. They are the easiest to interpret compared to both line graph and bar graph.

Candlesticks appear in different forms and sizes and every candlestick has a different meaning on the market.

As we go further, we shall go deep into different forms of candlesticks, their significances and how to trade using candlesticks.

How long should you hold an Open Position ?

How long you can hold an open position in forex, is a personal thing for all traders. The decision is all yours. You know what your goals are as a trader, the kind of strategy you use to trade. All this starts from what you are? and What you want? If I am to answer,...

- Oh, bother! No topics were found here.