Your favorite currency pairs in Forex Market are those you think about always every time you open the market to trade.

Traders base on different reasons to choose their favorite currency pairs in Forex to trade.

For example price volatility, spreads or pip value or interest rate differentiation.

Currencies in the Forex Market are traded in pairs over the counter.

You sell one currency simultaneously buying the other. The 2 currencies form a currency pair.

The Forex Market is the world’s largest and most liquid market, with trillions of dollars traded each day in the market.

If you are new in the Forex Market, the first step to take is to gain familiarity with some of the more commonly traded currencies.

Secondly their regions and popular uses not only in the Forex Market but in general, as well. This helps you to choose your favorite currency pairs in Forex to look up to every time you choose to trade.

We shall purposely a look at 8 popular currencies Forex traders should get familiar with, what moves them and their interest rates.

This will help you to know more of your favorite currency pairs in forex as you trade.

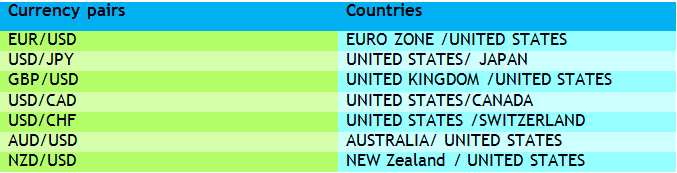

The Most Traded Currencies in the Forex Market.

The most actively traded currencies in the forex market consist of the U.S. Dollar, the European Union’s Euro, the Japanese Yen, the British Pound Sterling, the Swiss Franc, the Australian Dollar, the Canadian Dollar and the New Zealand Dollar.

Among the above listed currencies, the U.S. Dollar is the most dominant in the Forex market.

Lets take a marathon and try to study each currency.

1. The U.S. Dollar

The U.S. dollar is the most and easily traded currency on the Forex Market.

It is paired with all the other seven currencies hence making Major Currency Pairs. They are; USD/CAD, USD/JPY, USD/CHF, AUD/USD, NZD/USD, EUR/USD, GBP/USD.

It is the leading currency traded in the foreign exchange market.

Its nickname is the Buck, named after buckskin (leather made from a skin of a buck or male deer).

Since USA is the largest economy, the dollar is used as the standard currency for most commodities, such as crude oil and precious metals (gold, silver).

This means, these commodities not only fluctuate in value due to the basic economic principals of supply and demand but also to the relative change in value of the U.S. dollar.

This makes sense to say, the USD dollar cannot avoid making every day’s transaction since every time a commodity is transacted a dollar is exchanged.

In addition, some countries use the U.S. dollar as an official currency in lieu of their local currencies (dollarization).

The U.S. dollar also acts as an informal alternative form of payment in some countries but those nations maintain their official local currency.

Some currencies of the merging countries rely on the U.S. dollar to determine their value e.g. the Canadian dollar and the Australian dollar.

What Actually moves the Dollar

When trading the dollar, there are several facts that should not skip your eyes.

To mention but a few; demand for commodity goods and precious metals such as crude oil and gold, FED, the US economy and the global economy.

- An expansion in the US economy attracts more investors which a sign of economic development, hence increases in demand for the dollar. This leads to value appreciation for the dollar.

- Most of the transactions around the world are carried out using the dollar as a means of exchange.

- This simply means that economic development in any of the countries contribute to the strength of the dollar through the demand and supply for the dollar to purchase and sell commodities.

- Lastly, the FED. The Fed regulates the economic development of the US economy through interventions in the interest rate.

Its current interest rate was officially hiked from 2.00% to 2.25%, following the inflation hike and fall in unemployment rate.

A rise in interest rate appreciates the value of the U.S. dollar. The reverse is true.

2. The Euro

The euro, ( fiber ) is the second traded currency in the Forex Market after the U.S. dollar.

It is the official currency of the Euro zone representing the 19-member states in Europe. The major economies in the Euro Zone are France, Italy, Germany and Spain.

Unlike gold and crude oil, the Euro is also an anti-dollar among the common traded currencies in the financial market.

The EUR is highly traded in the Forex Market because it is highly liquid, has a large economy and moderate volatile when paired to any currency.

The EUR/USD is one of the traders’ favourite currency pairs traded in the market.

It is the most liquid currency pair and from the most active financial economies in the whole world; USA and the Euro zone.

What moves the EUR

When trading the Euro, these are the most important things to look at; The European economy, the U.S. dollar index (USDX) and the European central bank.

- The European economy is highly influenced by the major fundamental factors (economical, political and social).

A small change in the economic growth leads to fluctuation in the value of the Euro. To mention but a few; Employment Change, Inflation, GDP and Consumer Confidence.

- The U.S. dollar index (USDX). This measures the value of USD relative to a basket of foreign currencies (US trading partners’ currencies).

The Euro carries the largest percentage compared to other countries. That is; Euro 57.6%, JPY 13.6%, GBP 11.9%, CAD 9.1%, SEK 4.2%, CHF 3.6%.

This is worth considering especially when trading the EUR/USD. When the dollar index is rising, it signifies a strengthening dollar and so the EUR/USD falls. And the reverse is true for this case.

- The European central bank manages the monetary policy for the Euro member states.

Like any other central bank, it aims at regulating inflation through lowering and hiking the interest rate for the region. Its interest rate remains 0.00% since Mar 10,2016.

3. The Japanese Yen

The Japanese yen is the easily most traded currency in Asia and the 3rd most traded currency after USD and EUR in the forex market.

The Yen pairs are known to be the traders’ favourite currency pairs for carry trade. Traders profit from the difference in interest rates between two currencies.

Due to its low and stable interest rate, most investors borrow more of the Yen to invest in high yield securities in other parts of the world.

What Moves the JPY

- Japan’s low interest rate as low as zero makes consumption of its exports very cheap hence attracting more foreign consumers for its products resulting to high demand for the Yen.

- Most investors run to it in times of financial crisis as a safe haven investment.

- The Bank of Japan, as a central bank, has maintained low rates since the Japan’s property bubble collapse and is involved in currency interventions like Selling the Yen to help keep Japan’s exports more competitive.

This is because the Japan’s economy depends more on exports. The current interest rate is -0.10% since Jan 29, 2016

4.The Great British Pound

The Great British pound, also known as the pound sterling, the official currency of United Kingdom.

It is the fourth most traded currency in the Forex Market.

It also acts as a large reserve currency due to its relative value compared to other global currencies. GBP is one of the oldest currency in the world.

United Kingdom is the third largest economy in Europe after Germany and France.

Although the U.K. was an official member of the European Union, it had chose not to adopt the euro as its official currency for many years.

This reminds us of the Brexit policy on 23 June 2017 (UK voted out to exit from the European Union). For so many reasons, the GBP became more volatile since the vote out of the UK to exit the European union.

What Moves the GBP

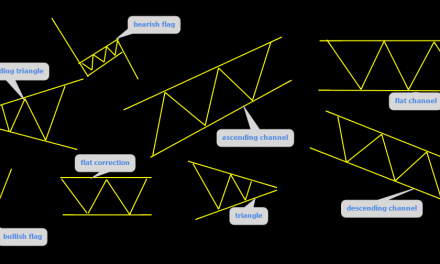

- The GBP has the most Forex traders’ favourite currency pairs because it makes nice curves and clear patterns. This makes it easy to analyse and trade. Its pairs are the most volatile in the Forex market and have big pip value.

- It is very important to be alert when the most important news events from U.K economy are on release because the GBP is highly sensitive to news release.

- The Bank of England is in control of price stability and inflation through regulating the interest rates. Its interest rate is now at 0.75%.

5. The Canadian Dollar

The Canadian dollar(loonie) is also among the most traded currencies in the forex market.

It is known for causing very large movements in the market due to the fact that it is a commodity currency.

This means it is highly sensitive to fluctuations in commodity prices in the market; notably crude oil, precious metals and minerals.

What Moves the CAD

- Canada is among the largest producers and exporters of commodity products esp. crude oil. The loonie gets more vulnerable as crude oil prices fluctuate.

- Apart from the USA being its closest and the only neigh bordering country by land, it is the major trading partner with Canada. Therefore the US economic dynamics greatly affect the Canadian dollar .

- Additionally, Canada is the world’s largest exporter of oil to the United States. The Canadian economy, as well as the Canadian dollar are highly correlated to the strength of the U.S. economy and movements in the U.S. dollar.

This can also be gauged by looking at the US crude oil inventories. A hike in oil prices directly affect USD since most of its economic activities depend on oil and so does to the value of the CAD. An increase in oil prices strengthens the CAD as it weakens the USD.

- The Bank of Canada is behind the hiking and lowering interest rates to monitor inflation and price stability. Its interest rate is 1.75%.

6. The Swiss Franc

The Swiss Franc (confoederatio Helvetica franc, swissy), is viewed by many as a “neutral” currency.

The Swissy is the 6th most traded currency on the Forex Exchange Market in the world.

It is the main safe haven currency for investors during financial uncertain times due to its high degree of stability, neutrality and reliability.

Investors find it safe purchasing lots of CHF during periods of financial uncertainty due to Switzerland’s peaceful modern economy and it’s strong bank secrecy laws.

In addition, 25% of Switzerland’s money is backed/kept as gold in the bank as reserves.

You can also rely on this fact to determine the value of CHF by looking at gold price movements. This reminds us that since most of Switzerland’s money(reserves) is backed up as Gold, the two are highly positively correlated.

Switzerland’s economy as well as CHF is highly affected by its proximity to the European economy. This is because most of the Switzerland’s exports go to the Euro zone.

Therefore, a change in the European economy highly influence the value of the CHF.

The Swiss National Bank ensures that the Franc trades within a relatively tight range, to reduce volatility and keeps interest rates in line. Its interest rate is as low as -0.75% since Jan 15,2015.

7. The New Zealand Dollar

The NZD, commonly known as the Kiwi on the Forex market. It is among the popular currencies commonly traded on the Forex Market.

It is well known for its relatively high interest rates therefore good for Carry Trading.

Initially, the currency was New Zealand pound, but was later changed to New Zealand dollar as the official currency of New Zealand in 1967.

The system changed to decimal currency. One-pound equalling to two dollars.

The NZD is highly affected by commodity price fluctuations since the economy is highly dependant on exporting commodity products.

The Reserved Bank of NZD interest rate is at 1.75% making it the second in position with the highest interest rate among the major traded currencies in the Forex Market.

8. The Australian dollar

The Australian dollar is the official currency in Australia. It was introduced in 1966 as a national currency under a decimalized system replacing the pound, the shilling and the pence.

Its common nickname is Aussie.

Aussie is also among the commonly top eight traded currency in the Forex Market.

Due to its high interest rates, Aussie is one of the best candidates in carry trade best paired with the Japanese Yen.

It is also a commodity currency since its value is largely dependant on commodity and natural resource prices; notably Gold, Oil, Iron Ore, Wheat and Wool.

Australia is the one of the biggest producers of Gold in the world therefore gold prices highly affect the Aussie currency during the times of price fluctuations.

The Aussie and Gold are positively correlated. They tend to move in the same direction most of the time.

Therefore, as a trader you can rely on their relationship to determine the future value of the other.

For instance, when prices of Gold rise, AUD value appreciates following the increase in prices of Gold. When Gold prices fall, AUD value also shrinks.

The Reserved Bank of Australia interest rate is at 1.50% since Aug 02,2016

Which currency has the highest interest rate.

Most traders favorite currency pairs in forex.

The (U.S. dollar) remains the primary currency in the most traded currency pairs with 88% of all Forex transactions.

The JPY the second, then the EUR, GBP and the rest.

EUR/USD, USD/JPY, GBP/USD, USD/CAD, AUD/USD, NZD/USD, USD/CHF, EUR/JPY, GBP/JPY, EUR/CAD, GBP/CAD, GBP/JPY, GBP/AUD, GBP/CHF, CAD/JPY, EUR/AUD, NZD/CAD, NZD/JPY, AUD/CAD, AUD/JPY, AUD/CHF, NZD/CHF, EUR/GBP,EUR/CHF, CAD/CHF.

Currencies paired with the USD are Major Currency Pairs and the rest are Minors or Cross Currency Pairs.

The major currency pairs are the traders’ favorite currency pairs in forex because they are highly liquid, have low spreads and easy to analyse.

Conclusion on favorite currency pairs in forex.

As we have seen, every currency has specific features that affect its underlying value and price movements relative to other currencies in the Forex Market.

Understanding what moves a currency helps you to know when to trade and why you should trade.