There are main types of Moving averages in Forex. Moving averages are technical indicators that smooth out price action and helps to forecast future prices.

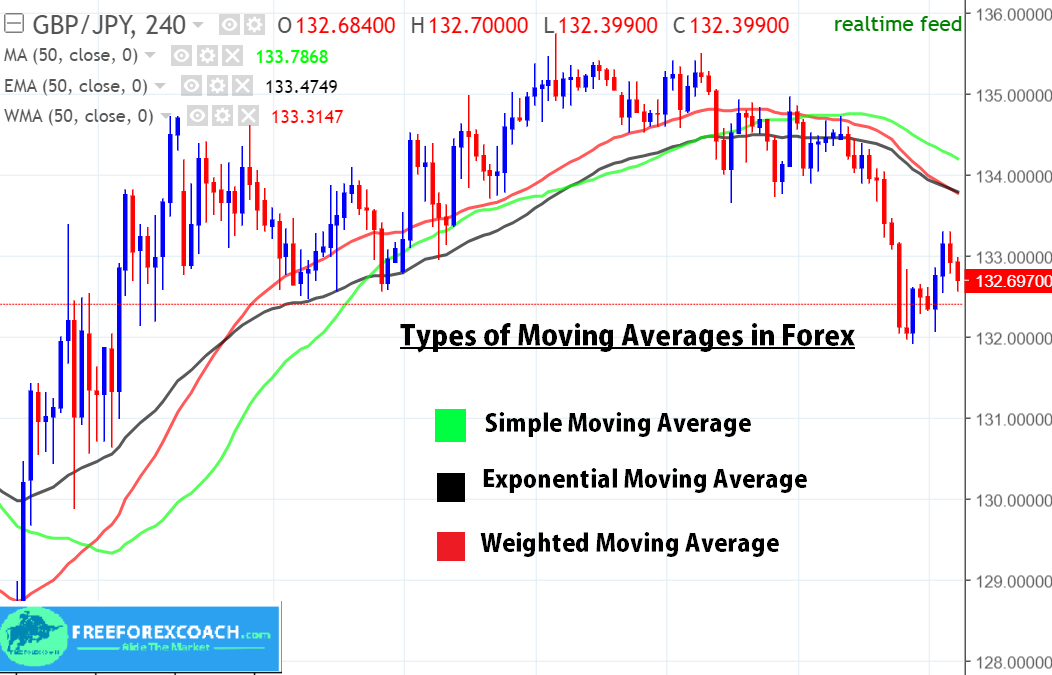

Chart with 3 Common Types of Moving averages in Forex Trading

Moving averages follow a price’s trend therefore are lagging indicators.

When you use a moving average on the charts, you can predict where price will go by looking at the slope of a moving average .

To calculate Moving Average, take the average closing prices of a currency for the last x number of periods.

The longer moving average is more smooth than the shorter moving average. This is because it averages out more prices which makes it less sensitive to new prices as they only make up a small part of the average.

In addition, smoother/longer moving averages are slower to react to price movements compared to the short moving averages.

You can also use Moving averages to identify a trend, support and resistance levels or to measure price momentum.

Let’s take a look at the 3 types of moving averages in forex.

- Simple/Arithmetic Moving Average(SMA)

- Exponential Moving Average(EMA)

- Weighted Moving Average (WMA)

Simple moving average(SMA) – types of moving averages in forex

This is just the average price of currency prices over a specific number of periods.

To calculate simple moving average, you add the last X period’s closing prices and then divide it by X period.

For example, suppose you want to calculate a 10 day simple moving average of a currency price.

You will add the last 10 closing prices of the currency for ten days and then divide it by 10. Keep doing the same when the next closing price is plotted while dropping the first closing price.

If you are plotting a 50 period simple moving average on an H1 chart, you would add up the closing prices for the last 50 hours and then divide it by 50 to get the moving average.

20 SMA and 50 SMA on Chart

But you don’t have to calculate any of the types of moving averages in forex, broker platforms have them installed already.

Simple moving average is itself a lagging indicator because it’s averaged by mostly past price data.

The longer the period you use for the SMA, the slower it reacts to the price movement.

Some of the Simple moving averages most traders use.

5 SMA for hyper traders, 10 SMA for short term traders/day traders, 20SMA also used by day traders, 50SMA mid term traders and 200SMA for long term traders.

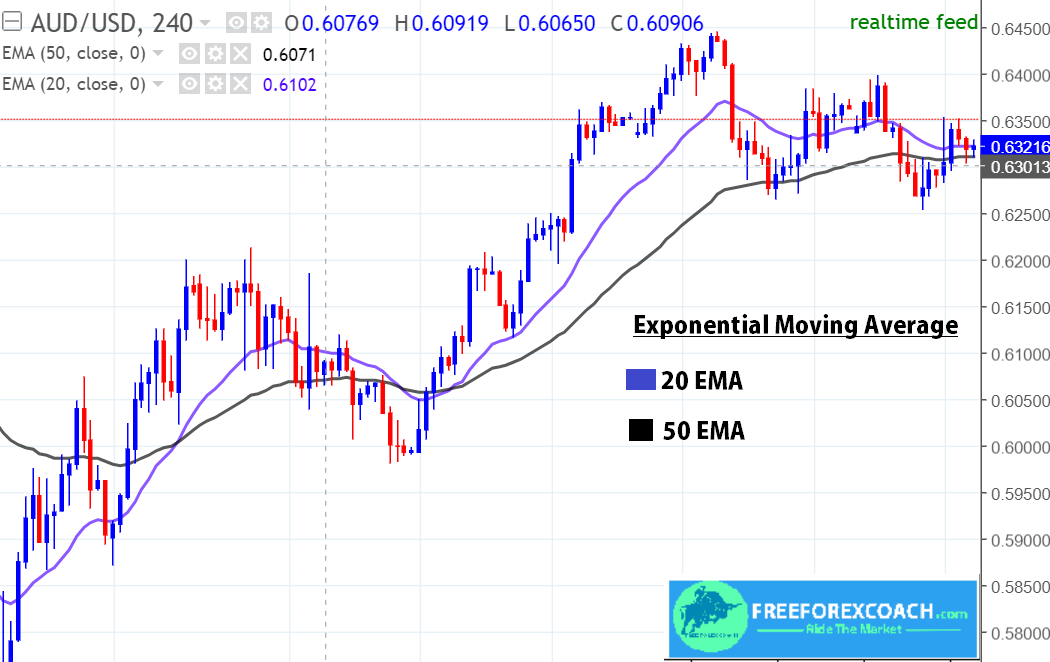

Exponential Moving Average

Exponential Moving Average reduces the lag by applying more weight to recent prices. This was developed to reduce the weaknesses of the SMA indicator by weighing more recent prices heavily.

The weight attached to the indicator helps it to respond more quickly to market changes.

Exponential moving average reacts more quicker to the most recent current price movements.

Formula for calculating EMA= [current price – EMA(previous) × multiplier] +EMA(previous)

20 EMA and 50 EMA on Forex Chart

Simple moving average Vs Exponential moving average

Exponential moving average shows what traders are doing recently. It relies on current happenings in the market unlike the Simple Moving Average that relies on past events.

Therefore, Exponential Moving Average responds to price action more quickly compared to SMA. This can help you to identify the trend direction quickly. However, it is less reliable because it is likely to give fake signals due to its quick actions.

It is always important to use EMA along with other indicators for strong and clear signals.

The SMA is slow but may save you from false signals.

Weighted Moving Average(WMA)

This puts more weight on the most recent data and less weight on the older data.

The weighted Moving Average is calculated by multiplying each of the previous day’s data by weight basing on the sum of the number of days in the Moving Average.

You just have to divide the number of each day by sum of the number of days. After that, multiply the result with the value of the security. Then finally sum up the total weight.

20 WMA and 50 WMA on Forex Chart

Alright, these calculations and formulas should not scare you. All this is done on the platform so you will not be required to do any calculations.

Like any other indicator, all types of Moving averages in forex have their fall backs. therefore they are not 100% perfect.

To avoid fake out signals, you should combine moving averages with other indicators like candlestick patterns, support and resistance and fibonacci retracement to give strong and clear signals.

What is important is to know how the moving averages work and when to use them on market charts.

Let’s take a more detailed look!

ATTRIBUTES OF A SUCCESSFUL TRADER

As i had promised to discuss the attributes of a successful forex trader. These are the most important of all. It's as simple as understanding the mechanisms of a predator. What hurts new traders is that they can not distinguish between facts and opinions and they end...

- Oh, bother! No topics were found here.