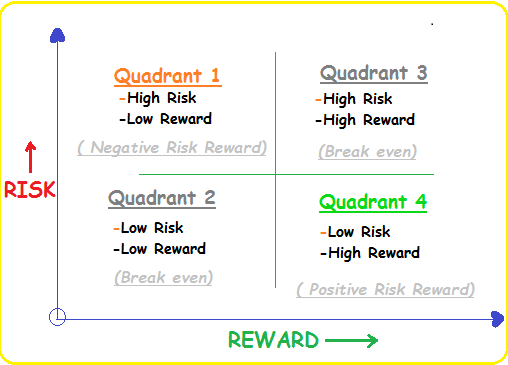

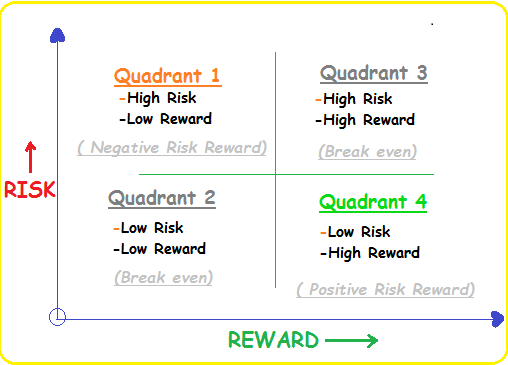

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business.

RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming profitable.

In simple terms, the risk reward ratio is a measure of how much you are risking in a trade for what amount of profit.

So, how do risk reward ratio quadrants distinguish professional traders from beginning or struggling traders?

Take a look at the illustration below;

Risk Reward ratio Quadrants 1

High Risk+ Low Reward = Negative Risk reward ratio.

This is where starters and all amateurs belong.

Their goal is just to make money instead proper trading. So what usually happens is that they close out profits very fast with fear of then turning to losses.

They let losers run hoping to turn back to profit. At this level, they don’t have any idea about the risk involved.

A negative risk reward ratio means you are risking more and making too little.

This is the worst way to make money in any business.

Here generally, they have no trading plan, no money or risk management. They know nothing of position sizing!

Trading is just a gamble, all profits are out of luck.

The inevitable result in this case is margin call and ultimately loss of all the funds. In short, ‘account blown’.

Risk Reward ratio Quadrant 2

Low Risk+ Low Reward = Break even.

Struggling traders lie here! They have lost their first accounts therefore are scared of the market.

But they also still believe they can possibly make money from the market. The emotion of fear is now at play here.

They are scared of what the markets could do to them, so they cut their losses and cut the profits too.

At this stage, they know there is risk but have not accepted losses. Only fear is at play. Their accounts stay stagnant almost at break even with little or no profit

Risk Reward ratio Quadrant 3

High Risk+ High Reward = Break even.

This is the over confidence phase. The fear is not at play at all.

All this is because they are not losing money but they aren’t making it either. The account is still breathing but stagnant with no growth.

Immediate reasonable solution is to risk more to make more, right? Of course, it’s what they implement, they get frustrated once more after getting same results.

The account stays stagnant almost at break even with little or no profit.

Risk Reward ratio Quadrant 4

Low Risk+ High Reward = Positive Risk reward ratio.

Successful/professional traders belong here. They have mastered the risk reward ratio concept.

These are guys who turn small amounts into large amounts CONSISTENTLY. This is the right zone of trading. Small risks that turn into large rewards.

That’s a positive risk reward.

Positive risk reward simply means more return on your investment. The advantage here is that you can afford to take stop loss hits more than you think.

In fact, it’s possible to lose more than ½ your trades and still turn over a profit if you have the correct risk reward.

This is because your winning trades make up for any losing trades you may have accumulated, plus the leftover profit on top.

So even with losing trades you can still build up your equity curve.

The main ingredient here is patience and consistency. Professional traders understand that trading is a game of probabilities.

The edge is to manage the losses and increase your reward.

Successful traders have mastered the art of Patience; they patiently wait for setups that have a positive risk reward ratio.

Those are the only ones worth the risk. They don’t collect any stones, they calmly wait for the diamonds to show up!

Conclusion

You might think that there are huge differences between professional traders and struggling traders, but the truth is, they aren’t.

Trading success does not take some holy grail trading system or an advanced degree in finance.

The main ingredient is the willingness to do what you need to in order to develop positive trading habits

Risk reward ratio is not only a way of money management but the main way to realize profits in trading.

Many traders put way too much emphasis on the win rate and do not understand that a win rate does not tell you anything about the quality of a system or a trader.

All you need to get on the track to trading success is probably a slight adjustment in how you think about trading and a willingness to begin changing your trading habits.

This will transform you from a struggling to a professional profitable trader.