‘Moving Averages Summary is a recap on what we initially discussed in the previous lessons on moving average and some of the most questions traders ask.

Mostly we shall concentrate on the common questions traders ask about moving averages.

Mostly we shall concentrate on the common questions traders ask about moving averages.

common questions – Moving averages summary

What is a moving average?

Why should you use moving averages?

What is the best moving average to use to trade?

How to use moving average on the trading charts?

How do you analyse moving average to trade?

What is a moving average?

Moving Average is a technical indicator that helps to smooth out price action.

It can be used to predict future price direction by looking at its direction movement.

The longer the moving average the smother it becomes and the slower it gets to reacting to price movements.

The shorter the Moving Average the rougher/choppier it gets and the quicker it reacts to price movements.

Moving Average is calculated by taking the average of closing prices of currency for the last X number of periods.

There are three types of Moving Average include,

- Simple Moving Average (SMA); Simple Moving Average is more lagging compared to the other two. It is calculated by adding up the last X period’s closing prices and then divide it by X periods.

- Exponential Moving Average (EMA); It reduces lag by applying more weight to the most recent prices.

- Weighted Moving Average (WMA); This has more weight on the most current prices and less on the old price data.

Why should you use moving averages summary

- Moving average smooths out price action and helps to forecast future prices.

- Can help you identify the current market trend since they follow price

- It represents the average closing price of the market over a specified period of time.

- Therefore you can make use of it to determine the current market momentum.

determine trend direction – Moving AVERAGEs SuMMARY

When you see a moving average is rising and price is moving above the moving average, this is considered an uptrend.

On the other hand,when the moving average is falling and price is moving below the moving average, it is a downtrend.

However,when the moving average crosses price from one side to another side, it signals possible change in price direction..

To avoid fake signals, use moving averages with other indicator. e.g. support and resistance or trendlines.

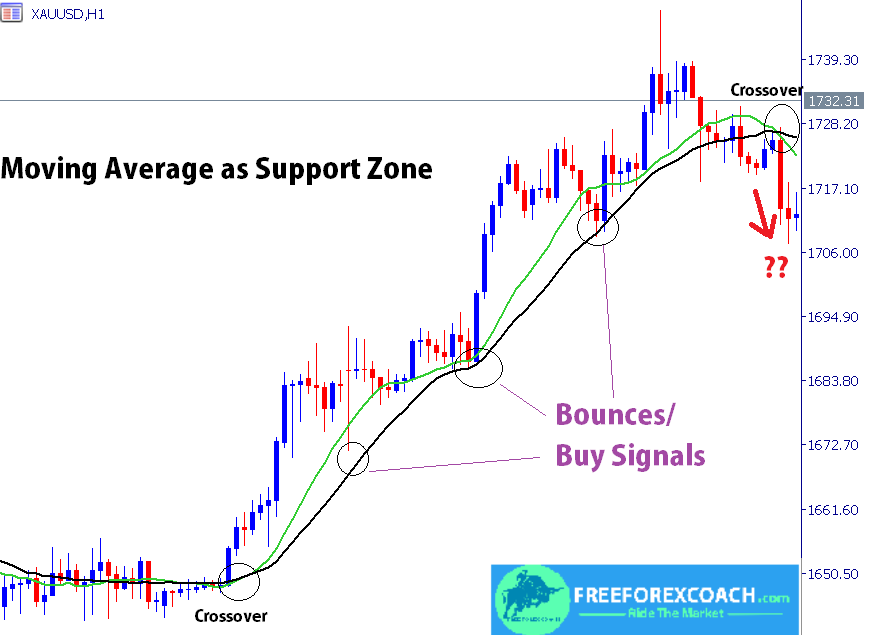

crossovers – Trade with moving averages summary

Here we shall look at moving averages summary on crossover strategy.

You have to use the fast moving averages and the slow moving averages.

A crossover happens when the slow moving averages catches up with the fast moving average.

When the faster Moving Average crosses the slower Moving Average from above, it gives a sell signal.

You can sell. Or else, you can buy, when the faster Moving Average crosses the slower Moving Average from below.

A cross over of Moving Averages can also signal a change in trend direction.

Although, Moving average crossovers are a reliable trading strategy, they only work better in trending markets other than ranging markets

Last but not least, Moving Averages can be used to identify support and resistance levels .

Using moving average as dynamic support and resistance

Why dynamic? because it tends to change as price changes.

The Moving Average above the price becomes a resistance.

Price is likely to bounce back on moving average resistance hence giving a sell signal.

When this happens, you can trigger out your sell position at the pull back.

In addition, when price holds above the moving average several times, it becomes a support and there fore price is likely to bounce back giving a buy signal

None of these strategies is a holy grail, therefore you must always bear that in mind every time you trade. To minimize losses, risk management is the key.

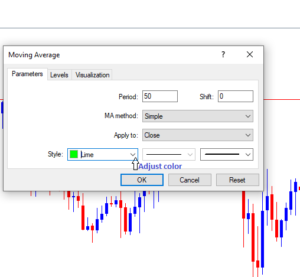

What is the best moving average to use to trade?

What you should know is that all the moving averages work well and perform in the same way.

But the most commonly used simple moving average(SMA) and exponential moving average(EMA). However, when you use more than one moving average, you increase on its viability.

For this strategy to be more effective, you should use moving averages with different time periods. That is; the shorter moving average(it averages out less prices) and the longer moving average( it averages out more prices ).

The shorter moving average moves faster with current price close as the longer moving average lags behind.

When the two moving average cross, it gives a strong signal that trend is likely to change course.

Why is it hard for most traders to maintain consistent profits in trading?

You would be suprised at reasons why most Forex Traders fail to Make Money from Trading. They are simple reasons mostly emotional. Out of 100, only 5% of the traders have managed to make CONSISTENT profits and the 95% have failed. Out of 95%, 99% are the new traders....

- Oh, bother! No topics were found here.