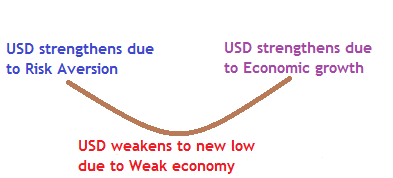

US Dollar Smile Theory in Forex indicates that US Dollar can strengthen both in good & bad market conditions.

There are times when you get to the market expecting to see the US dollar falling but to your surprise its making higher highs, showing no signs of getting down.

Then you wonder, Why?

This was explained using a Dollar Smile Theory in Forex.

Dollar Smile Theory in Forex.

According to the theory, the dollar does best when the real financial world looks either very good or bad.

It was explained by the former great currency economist, Stephen Jen at Morgan Stanley.

He came up with the Dollar Smile theory with an intention to explain why the dollar behaves in such a manner.

He explains it using the 3 economic stages as illustrated below

Stage 1: The USD rises due to risk Aversion

During the periods of economic instability, investors run to the USD seeking a safe haven regardless of the US economic status.

When the global economic conditions are bad, most of the investors prefer keeping their wealth in USD and the Yen rather than the more risky currencies.

This is because regardless of the economic conditions, the USD is believed to be a stable and strong currency.

From the illustration, the left side of the smile shows that the U.S. dollar benefits from risk aversion.

Stage 2: The USD falls to new lows, (Economic slowdown and recession)

As the US economy struggles the Dollar starts bottoming in the market giving signs of poor performance of the greenback and weak economy.

There is a possibility of a potential interest rate cut by the Fed push the dollar further down.

Meanwhile, investors withdraw from buying it to selling it off and now opt for higher yielding currencies

Stage 3: US economy is very strong – dollar smile complete

To the right,

The strong economic growth attracts more foreign investors in the US leading to a lot of capital flow into the economy.

This may lead to raising of the interest rate by FED, low unemployment, strong consumer confidence and a strong GDP.

As a result, the greenback appreciates hence strengthening the dollar and completing the smile.

This theory applied in 2007 financial crisis.

During the global financial crisis the Dollar still appreciated.

However, when the market started bottoming in march 2009 the investors started to withdraw.

In this case, they chose to invest in higher yielding currencies and so the US Dollar fell.

How long should you hold an Open Position ?

How long you can hold an open position in forex, is a personal thing for all traders. The decision is all yours. You know what your goals are as a trader, the kind of strategy you use to trade. All this starts from what you are? and What you want? If I am to answer,...

- Oh, bother! No topics were found here.