Trade Balance in Forex Market affects the supply and demand of currencies in the economy

Trade balance refers to the difference between countries imports and exports for a period of time.

But before we continue on trade balance in forex, I find it necessary to first discuss how this fundamental analysis is relevant to the countries’ economy.

For starters let’s first look at balance of payment.

What is balance of payment (B.O.P)/ Trade balance

Balance of payment measures all the transactions made between the residents or entities of a country with other countries.

It is done over a defined period of time such as quarterly or yearly.

B.O.P comprises of the 3 elements, that is :

- The country’s current accounts,

- Capital account

- Financial accounts.

The current account

It reflects international payments and the trade balances ( trade of goods and services between countries).

This involves exports and imports.

Exports are goods produced domestically and sold abroad on the international market.

Imports are foreign produced goods bought from other countries and to the country for domestic consumption).

The capital account:

The capital accounts measures the monetary flow between countries used to purchase financial assets like stocks, bonds and others.

For instance

If you buy stocks on the New York stock exchange market and you are not a citizen, you put money into the US economy hence increasing their capital account.

The financial accounts:

This measures change in domestic ownership of foreign assets and foreign ownership of domestic assets.

For example

if a country sells off its assets like corporate stocks, commodities or gold, those assets will be owned by foreigners.

if it buys assets from other countries, then it increases on the assets owned outside the country.

Of the 3 elements, the current account is the most important because it measures the country’s trade balances.

Trade balance /balance of trade has a direct effect on the country’s economy compared to others.

Let’s see how

The effect of Trade balance in forex/ balance of trade to a country’s economy

Trade Balance in forex comprises of the country’s exports and imports.

This shows the income a country generates from abroad on exports in relation to money it spends a broad on imports.

The trade balance between countries affects the supply and demand of currencies in the economy.

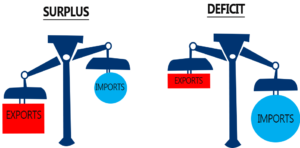

If the country’s exports are greater than its imports, it reflects a trade surplus.

This means there is high demand for the country’s domestic products a broad.

In turn, it leads to rise in prices of those goods hence currency appreciation in value as well.

This is a good sign for the country’s economic growth.

On the other hand, if the imports become greater than exports, it indicates a trade deficit.

A trade deficit is a sign of less demand for the country’s products on the foreign market.

As a result, prices of those goods fall hence fall in value of the currency.

An increase in the country’s trade deficit i.e. when imports exceed exports, is bad for the local currency.

Similarly, an increase in the trade surplus, when exports exceed imports, is good for the local currency.

Most economist and traders rely on Trade balance figures to gauge the strength of the country’s economy in relation to other countries.

If exports are higher than imports (a trade surplus), the trade balance is positive. If imports are higher than exports (a trade deficit), the trade balance is negative.

As a Forex trader,

You will sell the currency when the balance value falls (deficit) and buy when it appreciates(surplus).

How procrastination can affect your trading success?

Procrastination to trade is when your trading set up confirms and you hesitate to take trade. Or your trade show all failing signals and you hesitate to close trade to cut losses. Also, in cases, where you sometimes hesitate to take profit because you want to...

- Oh, bother! No topics were found here.