There are three types of forex charts, they include:

- Line chart

- Bar chart

- Candlestick chart

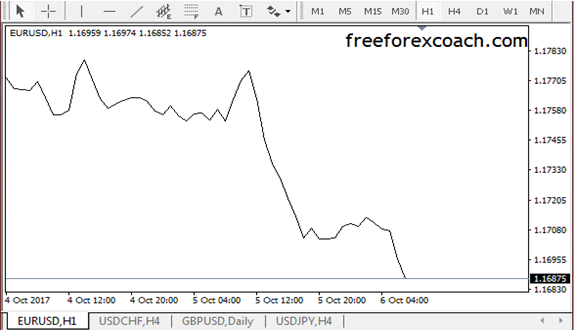

Line Chart – types of forex charts

With a line graph, points are connected with a line from one closing price to the next closing price.

The line curve represents the general price movements of currency pair over a period of time when drawn.

The line chart is simple to interpret but does not convey all the information to the user.For instance, It does not indicate the opening prices.

Since you it is very difficult to tell when price is opening and closing it is less preferred by traders.

Bar Graph

The bar graph is more of a candlestick but it lacks a real body. It discloses both the open and close of prices as well as lows and highs.

The lower part of the line shows the lowest level price fell and upper part shows the highest level price reached.

The vertical line represents currency while the small horizontal line down on the right vertical line is the opening price and left side up is the closing price. The bar chart is much easier to follow compared to the line graph.

Candlestick Chart – types of forex charts

A candlestick has two body parts and is almost similar to bar charts; the difference is that a candlestick has a real body .

The body gives a conviction of the movement by making it easier for traders to see where the candlestick opens and closes. The shadows show the real emotions the lows and highs.

The top and the bottom of the candle show the closing and opening of prices while the top and down shadows show the high and low prices.

This is the most popular type of forex chart used by traders

When the opening price is on the lower part of the candle then the closing will be on the higher part of the candle and vice versa. In addition to that,when the closing or opening is the low or high then there is no shadow.

Common mistakes most traders make and how to avoid them?

Fear and greed are the number one causes for the common mistakes most traders make when trading. Fear and greed normally come before trading, during and after trading. When you are under fear or greed, you are likely to commit these mistakes most traders make; Get...

- Oh, bother! No topics were found here.