Successful forex trading mostly depends on how you think and react to the market.

- How you react when you are losing or winning or when you have missed a good trading setup?

- What effects will it have on your decision making?

- What are your trading emotions and personal feelings?

In forex trading, traders take positions with an intention of maximizing gains and minimizing losses.

But they later get more irrational and rely on their emotions which influence their decision making.

Successful trading is about following your time tested rules, everything else is armature behavior!

When you lose on a trade,

Sometimes you feel like taking more trades so that you can cover up for the previous loss.

Other wise, you may fear taking more trades because you fear to make a bigger loss again.

On the contrary,

When you win a trade, you get more confident.You feel may be its high time you took more trade and increase on your profit.

You now feel you have the market right into your hands.

All that are emotions playing you!

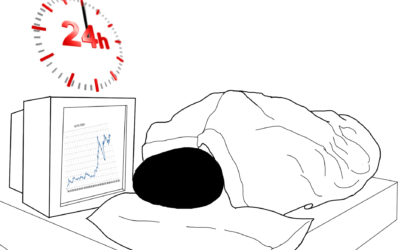

As a matter of fact, most traders in the market always experience similar thinking and experience the same emotions as they trade.

It’s these same emotions that corrupt your mind and take over you from the beginning to the end of a trading period.

What are the common trading emotions

These emotions are fear, greed, hope, regret and over confidence.

When a trader is under any of these emotions, he/she feels like they have had enough of losses.

They start to think, forex trading is not their calling and so end up quitting.

Some traders fill their mind with hope and a lot of expectations as they start trading. Because they think they can have it all with in a short time.

They end up taking trades anyhow and when it doesn’t work as expected they get disappointed.

Others quit following their trading rules hoping that trying out any other set-ups borrowed from other traders would do better.

When that fails they get frustrated and sometimes stop trading for a while.

Failing to stick to your plan is likely to cause big draw downs to your account because you don’t know how to react when a trade goes against you.

On the other hand when you are taken up by greed, you ends up staying in a trade for long. To some extent, you sometimes extend your profit target in a hope of getting more.

At some point you find it hard to accept when you miss out on a trade setup.

So you end up chasing the market.

Staying in a trade for long and taking trades late can lead to unexpected big losses.

The market is never wrong. Finding out what triggers your impulsive trading is the best way to curb the emotions!

In our next lessons we will discuss in detail, what exactly these emotions are and how to control them to have a successful forex trading career.

How long should you hold an Open Position ?

How long you can hold an open position in forex, is a personal thing for all traders. The decision is all yours. You know what your goals are as a trader, the kind of strategy you use to trade. All this starts from what you are? and What you want? If I am to answer,...

- Oh, bother! No topics were found here.