Margin and Free Margin in Forex confuse some traders.

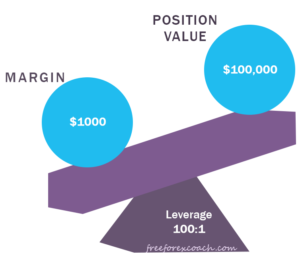

When you use leverage to control a big position, your broker requires you to deposit a minimum amount of money on your account to allow you to hold that position.

That amount of money is the margin.

Free Margin is the amount of money that is not involved in any trade. You can use it to open more positions

Let’s look at margin and free margin in forex in details;

What is a margin in forex trading

A margin is good faith deposit collateral your broker locks to allow you to hold position.

This is to ensure that you have sufficient balance on your account relative to the size of your position.

Example

For you to hold a position of $100,000, $500,000, $10000, $5000, your broker would require you to set aside $1000 from your account.

This acts as margin for a leverage ratios of 100:1, 500:1, 10:1 and 5:1 respectively.

So, Margin is the amount of money your broker locks as collateral to allow you to hold a position.

It is therefore a good faith deposit a trader sets aside to hold an open position.

Your broker pools your margin to someone else’s margin deposit to maintain your position within the inter-bank network.

Margin is always expressed as a percentage of the full amounts of the position you want to hold.

Margin and leverage required

Some of the Forex margins include, 2%, 1%, 0.5% or 0.25%. This helps traders to calculate the maximum leverage to fit for their trading accounts.

Here are some of the maximum leverages brokers provide with the available margins.

The amount of margin required does not only depend on leverage but also on your position size

In fact, as the trade size increases your margin requirement increases as well.

The forex Margin terms you must know

Account balance:

Total amount of money on your trading account.

After the close of every position, your account balance increases or reduces. It increases with a profit and reduces when your trade closes with a loss.

In addition your account balance does not change when you have trades running unlike equity, profit and loss and free margin. It automatically changes every time you close an open trade.

Margin used:

Amount of money your broker locks to maintain your open position. It is only released at the close of your current position.

The amount of money you use to open a position and is calculated basing on leverage.

Free margin:

As we mentioned before, it is the amount of money that is not involved in any trade. You can use it to open more positions.

This is the difference between equity and the margin used to open a trade.

As your equity increases, the free margin also increases. The opposite is also true

![]()

When there is no open trade running, your free margin is the same as your account balance.

Equity

This is the account balance plus the floating profit or loss of a running trade.

Equity = Account balance + Profit/Loss

When there is no current trade running, your equity is equal to the account balance and equal to free margin.

In fact, your equity increases with increase in profit and falls with an increase in a loss. Also, it falls with a fall in profits and rises with a fall in a loss.

Margin call.

This is a call you receive from your broker when the equity amount on your account is equal or below the margin level (margin) and the market is still going against you.

At this point you cannot take any additional positions.

You must deposit more money into the account or else some of the open positions will automatically close to limit the risk.

Your broker will close some of your positions starting with ones with a large loss.

Margin level

This is the level where a broker can determine whether you can take any more new trades or not.

Most brokers use 100%. This means, at this level your equity is equal to margin.

In other wards, you don’t have any free margin to open any new position. You can open new positions only when any of your running trades goes back to profits and your equity increases.

Alternatively, you can add more capital to your account to increase your equity balance and free margin.

Why is it hard for most traders to maintain consistent profits in trading?

You would be suprised at reasons why most Forex Traders fail to Make Money from Trading. They are simple reasons mostly emotional. Out of 100, only 5% of the traders have managed to make CONSISTENT profits and the 95% have failed. Out of 95%, 99% are the new traders....

- Oh, bother! No topics were found here.