So, how does leverage work in forex trading?

Leverage means controlling a big account by only contributing little and borrowing the rest from your broker.

If your broker allows you to leverage let’s say $50,000.

Your broker would require you to put 2% of the position you want to hold from your account as the margin. Out of $50,000, it would be $1000.

Your leverage ratio would be 50:1.

This means you are only contributing $1000 towards the amount you are using to hold your position and $49000 is contributed by your broker i.e. Borrowed amount.

How does leverage work in Forex trading

Suppose you want to hold a position worth $50,000.

Trading with no leverage

If you want to hold a position of $50000 with no leverage, you have to come up with the whole amount by yourself.

After taking position, if trade moves 1% against you, you lose $500. However if the trade moves to your direction you make $500.

When you trade with leverage

If you use leverage, you will need only $1000 to make $500 which is half of your account.

Your broker would require you to put 2% of the position as margin to hold a $50,000 position.

This means you will raise less on your account to hold a position of $50,000. Of course this is cheaper. What is important is to have a margin of $1000.

However if the trade goes against you, your account suffers a draw down of 50% loss where by only one trade will be enough to kick you off the market.

Let’s see, $(50*1000 * 1%), $500. Your account balance is $(1000 – 500), $500. For a single trade.

How about if you had decided to trade your $1000 account on a micro basis

Trading this account on a micro gives you more chances to test your experience.

You are likely to explore the market more often than someone who is trading the same account using leverage.

If you still use a 1% risk; $(1% * 1000), $10. This is still insignificant to a trader.

So even if you lose 20 trades you still have enough capital to sustain you in the market.

What you should consider when trading with leverage

Most successful traders use leverage while trading so that they are able to hold big positions and get a higher profit.

1. Risk Management

It takes a higher risk to get a higher yield.

The higher the leverage used on your capital, the higher the amount of risk your account is exposed to.

For every trade you take, use risk management. Mind the size you use to trade and always trade with a stop loss

2. Leverage also varies with different time frames time.

The longer you expect to keep your position open the smaller the leverage you should use. A swing trader cannot use the same leverage as the scalper.

If you are a scalper or a day trader you can use a higher leverage because your hold positions for a very short time.

Unlike for swing traders using a big size may wipe out your account within a shortest time possible. Therefore, choose a size that is enough to sustain you in a trade for a long time.

And finally your account size. Small account, no leverage. Medium account small leverage. Large account leverage enough.

Avoid using very large leverage.

What is the best leverage to use in forex trading

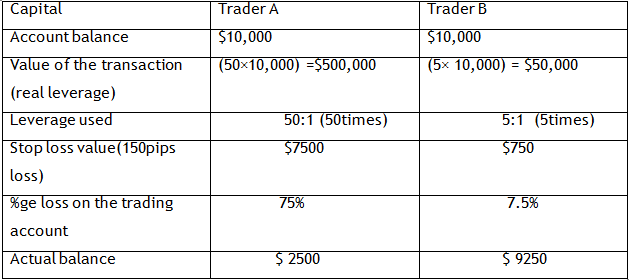

Suppose two traders having the same capital accounts accept to hold positions from their broker using different sizes.

Trader A with a $10,000 trading account, takes a position of $500,000, leverage 50:1.

This means that he wants his position to make 50 times or $50 every time his trade moves one pip instead of one dollar.

And Trader B having the same account $10,000 takes on $50,000, leverage 5:1

In this case, his position makes $5 dollar each move a pip makes.

If they were all wrong about the market and their trades hit stop loss targets of 150 pips.

How much loss would each trader suffer from their choice of leverage?

The table above sheds light on how dangerous leverage can be.

You may think am pessimistic and you are now imagining, what if the trades hit the profit target?!

Never the less, in trading any trade can be a winner or a loser, so its very important to protect your money from large risks.

Don’t be greedy! Use appropriate leverage! Also stick to your risk management rules to trade.

How Does Greed Impact your Forex Trading Success?

There are several ways greed can impact your Forex trading success. Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or...

-

- Topic

- Voices

- Last Post