U.S. Dollar index trade in Forex is commonly used by traders to measure the value of the U.S. dollar in relation to the other trade partners’ currencies.

Same as Like the Dow Jones industrial average is used in stock markets to measure the value of U.S. stock market.

US Dollar Index was developed in March 1973 by federal reserve, soon after the fail of the Bretton Woods system with a value of 100,000.

Since then, it has been altered only once when the European currencies combined in 1999 and the EUR was born.

The index is published by the Intercontinental Exchange (ICE)

To know the value of the dollar index, calculate the average weight of exchange rates between the dollar and the six major currencies.

The US Dollar Index Currency Basket

The U.S. Dollar Index consists of 6 foreign currencies. They are the:

- Euro (EUR)

- Japanese Yen (JPY)

- British Pound (GBP)

- Canadian dollar (CAD)

- Swedish Krona (SEK)

- Swiss Franc (CHF)

However, the weighting of each currency within the dollar index is different.

According to the ICE FX Index, the currency weight is as follows:

Among the 6 currencies, the EUR has the biggest weight.

This is because it’s a combination of 19 member countries that use it as their sole currency.

The next is Japanese Yen (Japan) and is one of the biggest economies in the world.

Then United Kingdom, Canada, Sweden and lastly Switzerland.

The dollar is the main currency driver in the market since USA has the largest economic market and is the center of foreign exchange.

All in all, 24 countries make up the dollar index.

How do we get the 24 countries?

First of all,

The Euro represents the 19 countries in the European Union.

Then add the other 5 countries. Namely; Japan, Great Britain, Canada, Sweden, and Switzerland. In total you get six currencies.

They are the major countries that influence the forex market due to their strong specialties in their economies.

With the Euro making up the largest percentage of the US dollar index, a significant change in the price brings a big effect on the index.

How to trade the US dollar index

To trade US Dollar Index in Forex, focus on the US economy and the Euro zone (largest portion).

US Dollar Index on a Daily Chart

The weighted index reflects the strength of the USD in relation to currencies in the basket of the US dollar index.

In fact, it measures the value of the US dollar against U.S. biggest trading partners.

With its 19 countries, euros make up a biggest percentage of the U.S. Dollar Index.

The next highest is the Japanese yen, which would make sense since Japan has one of the biggest economies in the world.

The other four make up less than 30 percent of the USDX.

This should now make sense to you.

The dollar index is as equal to the difference between U.S. economy and the other economies in the basket.

For instance,

If you see the dollar index in forex falling, it is so clear that the U.S. economy is not doing well.

On the other hand, its a boom in the euro economy. The euro contributes the largest percentage to the index.

However, if the USDX is rising, then so probably is the U.S. Dollar.

How to use USDX Index Movements to Trade Forex

Now suppose, you want to trade the EUR/USD pair.

One thing you should always keep in mind is that; if the USDX is rising, then so probably is the U.S. Dollar in the forex market.

Conversely, if the USDX is falling, then the U.S.dollar is also declining in value in the forex market.

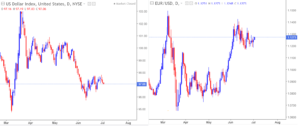

Take a look at the Chart below

In this case, with the EUR/USD, Buy the pair when the dollar index is falling

In regard to that, do the same for all pairs where the U.S. dollar is the quote currency in the pair.

For instance; GBP/USD, NZD/USD, AUD/USD.

Sell the pair when the dollar index is rising and buy the pair when the dollar index is falling.

Alternatively, for pairs where U.S. dollar is the base currency, buy the pair as the index rises and sell the pair when the index falls.

For example, USD/JPY, USD/CHF, USD/CAD.

Take a look at the Chart below;

From the Chart above,you sell the pair when the index falls.

But of course the EUR/USD, is the best pair to trade with the U.S.dollar index because it takes a big portion of the index, 57.6%

ATTRIBUTES OF A SUCCESSFUL TRADER

As i had promised to discuss the attributes of a successful forex trader. These are the most important of all. It's as simple as understanding the mechanisms of a predator. What hurts new traders is that they can not distinguish between facts and opinions and they end...

- Oh, bother! No topics were found here.