Inflation to a trader

Inflation to a Trader is Key indicator for currency Value strength.

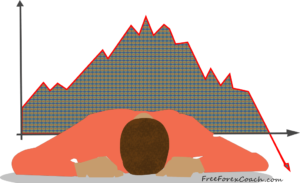

Traders always sell currencies when they suspect a future fall in the value for currency they hold as investment and opt for higher yielding currencies.

The persistent increase in prices in an economy leads to loss of value in the domestic currency(inflation). This makes it expensive to buy other foreign currencies.

Inflation is the persistent rise in the price of goods and services.

When there is inflation,

- The price of goods and services rise

- Purchasing power each unit a currency can buy falls.

- Consumers can just purchase a handful of goods with a lot of money

- Revenues, and profits decline

- Last but not least the economy slows for a time until a measure of economic equilibrium is reached.

When currency‘s value is below its normal value,

it’s a loss to traders holding that currency.

Why? Because its current value becomes less than the value at which you bought it.

Indicators of Inflation

Consumer Price Index (CPI);

It measure the average price of a basket of goods and services that households can purchase.

The CPI measures the rate of price changes in the economy on the side of the consumer/buyer.

The producer Price Index(PPI);

PPI measures the average change over time in selling prices received by domestic producers of goods and services.

PPI measure price change from the perspective of the seller.

When the CPI or PPI comes out higher than expected, the currency increases in value relative to other currencies. Meanwhile the forex market becomes more bullish.

Effect of inflation on interest rate decisions

The Central banks use (CPI) and (PPI) of the current period and the previous period to track inflation.

During inflation,

The central bank is likely to raise interest rate. In the periods of deflation, the central bank cuts interest rates to encourage borrowing and spending.

When inflation is above the expectations, the currency is likely to strengthen.

How? The central bank comes in and raises the interest rate to curb down inflation which may strengthen the currency.

So, what does inflation to a trader mean??

When you expect a future rise in prices that may lead to inflation, Sell the currency/asset you hold.

Otherwise you will stand losses or wait to sell until that currency appreciates again.

Future inflation simply means future loss in currency value.

As the saying goes, “a bird in hand is worth two in the bush”

Traders always sell currencies when they suspect a future fall in the value for currency they hold as investment and opt for higher yielding currencies.

Lower inflation is a sign of bad economy. It is normally followed by cut of interest rates to encourage borrowing for capital expenditure.

This weakens the currency in along run.

This is as a result of increase in demand over supply due to excessive money in circulation.

In the end, prices increase hence future inflation.

Common mistakes most traders make and how to avoid them?

Fear and greed are the number one causes for the common mistakes most traders make when trading. Fear and greed normally come before trading, during and after trading. When you are under fear or greed, you are likely to commit these mistakes most traders make; Get...

- Oh, bother! No topics were found here.