Bitcoin vs Ethereum?

Bitcoin and other crypto currencies were designed exclusively to operate as peer-to-peer digital currencies except for ethereum.

Below are some the comparisons of bitcoin vs ethereum. This will give you a summarized package about bitcoin and ethereum.

But before we do that, let’s first take a small recap on Bitcoin and Ethereum.

What is Bitcoin

Bitcoin is a cryptocurrency/ digital currency. It was primarily built as a store of value and a medium of exchange.

In other wards it works more of fiat currencies. So, you can use it to pay for goods and services online and in the real world as well.

In 2008, a mysterious person named Nakamoto introduced bitcoin however its real identity is still unknown up to date.

The first bitcoin was mined in 2009 and launched in the same year. Back then, it literally had no value in that you could buy bitcoins for less than $0.01.

In 2010, the first time bitcoin was traded on the real market. 10,000 bitcoins were exchanged for 2 pizzas.

Since then, Bitcoin gained more exposure to the market and its value kept on growing steadily till today, year 2020. Bitcoin now has the highest market capitalization on the digital market equivalent to $214.29 billion.

To cut the long story short, Bitcoin is just a decentralized currency.

It is made up of codes that run on a block chain network on the computer and no government or central bank controls it.

Like any other fiat currency, it appreciates and depreciates in value and is also used as a medium of exchange.

What is Ethereum

Ethereum is the second most popular cryptocurrency after Bitcoin by market capitalization of about $43.72 billion, year 2020. Its token is Ether.

So, every time you mine Ethereum you get a reward as Ether.

Ethereum block chain is quite similar to that of bitcoin however, its programming language allows developers to create more apps and smart contracts.

It also enables peer to peer transactions.

Back in 2013, Buterin a co-founder of the online news website Bitcoin magazine saw a need to develop decentralized applications on top of bitcoin.

So he gave in his proposal but all in vain. He never gave up.

A few months later, he published and shared a detailed ethereum white paper.

In 2014, Buterin with other founders launched Ethereum and created a non- profit company Ethereum foundation to support the development of the blockchain platform and its ecosystem.

Since then Ethereum became investors favorite platform and most people believe it is likely to take over Bitcoin in future.

When you looks at the cryptocurrency market, Bitcoin and Ethereum are the major rivals with the highest market capitalization.

Most traders tend to confuse the two but the fact is, they are completely different although they share some things in common.

Now let’s look at the difference between Bitcoin and Ethereum.

Bitcoin Vs Ethereum

1. Like we discussed, Bitcoin is the most popular cryptocurrency in the world with the highest market capitalization. It was created in 2008 by a mysterious person named Nakamoto.

On the other hand, Ethereum is the second most popular cryptocurrency with market capitalization. Therefore it comes after Bitcoin. Unlike Bitcoin, Ethereum was developed by a 19 year old Buterin Vitalik in 2013.

2. In the ethereum blockchain instead of mining for bitcoin, miners work to earn ether, a type of crypto token that fuels the network.

Beyond a tradable cryptocurrency, ether is also used by application developers to pay transaction fees and services on the ethereum network.

3. Bitcoin blockchain is mainly used to track ownership of digital currency (bitcoins). In addition, Bitcoin stores value and is a medium of exchange.

On the other hand Ethereum blockchain focuses on running the programming code of any decentralized application.

4. Also, transactions are much faster on Ethereum network than Bitcoin network.

Ethereum takes only 12 seconds average blocktime while bitcoin’s average blocktime is about 10 -15 minutes. This makes ethereum quicker in confirming transactions.

5. More than 2/3 of all available bitcoin have been mined, with the majority going to early miners. Ethereum raised its launch capital with a pre-sale and only about ½ of its coins will be mined by its fifth year of existence.

6. The reward for mining bitcoin halves about every 4 years and is currently valued at 12.5 bitcoins, (2020 is 6.25 bitcoins).

Conversely, Ethereum miners receive 3Ether every time a block is added to the blockchain.

7. In ethereum the costing of transactions depends on their storage needs, complexity and band width usage. In bitcoin the transactions depend on the block size and they compete equally.

8. Last but not least, Bitcoin uses SHA – 256 cryptocurrency algorithms while Ethereum uses Ethash algorithms.

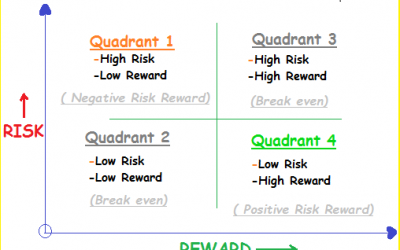

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.