Choose a forex broker with the following qualities that we shall discuss here-under. Forex trading is known as the most risky business since it involves exchange of just money.

Remember, here there is no physical contact between the buyer and the seller. All transactions are done over the counter through a broker.

There fore it is of great importance to choose a forex broker you can trust in this risky business.

There are lots of forex brokers online, but not all have the good intentions as they claim.

Before you make your final decision on choosing an online forex broker , there are several factors that you need to consider in order to get a broker who will meet your trading needs.

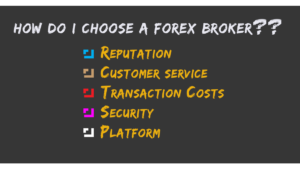

so, how do i choose a forex broker?

Below are some of the factors to consider when you are to choose a forex broker.

1.Reputation of the forex broker.

Before you register with a broker, you should first check in which country the brokerage company is registered.

You must choose a forex broker with a good reputable past, reliable platform and quote tight spreads and without any slippages before you deposit your money into your account.

Do some research and find out the kind of image other people have about the broker you intend to use. What they say about the brokerage firm!

2.Customer service and payouts.

A good broker should be able to balance his payouts and should have good customer services.

Consider a broker who offers great customer services and an excellent trading platform.

For instance,

if they can offer services in your natives language, email support and live chart support to ensure good communication with their clients.

Some brokers assign personnel managers to ensure continuity in the support clients get.

3.Forex broker Trading platforms.

The trading platform is the most important.

You need to find a good trading platform that is user friendly but also with features that are good and powerful enough to meet all your trading needs.

Choose a forex broker that offers a demo account on his platform for the purpose of back and forward testing your trading strategy and training practices.

For example,

for Meta-trader 4 (MT4). It is a window based platform that provides a wide range of charting, back testing tools and expert advisors.

The expert advisors offer algorithmic trading, auto-chartist, 3rd party technical analysis software and multiple trading accounts.

Choose a forex broker that offers browser based platforms/ web based platforms that allow you to trade using the browser. You can use this in times when you are unable to access personal computers during trading hours.

Some brokers also offer social trading, mobile trading to traders who would wish to use their phones to trade.

They offer mobile app versions of their trading soft ware. They include iphone OS (ios), androids and windows phones.

This helps you to have a wide range of options on where to carry out your trades from and does not limit you from trading.

You don’t have to cling to your computer all the time or carry big laptop every time you want to trade.

You can trade using a mobile phone or in a café as long as you can access internet. therefore it makes trading easy even when you go for vacations, you can still trade with convenience.

4.Trade execution.

You should choose a forex broker with good execution practices. Choose a forex broker who is able to have your trades filled in time and at the best affordable rates.

Some brokers like the Dealing Desk act as the direct counter-party and take the other side of your trade.

Your gain is their loss, however, this may not be the case because their role is to set the bid and ask spread as they match your trade executions with other clients.

They offer fixed spreads to their clients and offset the market risks of your trades with those of other clients and their liquidity providers.

The STP/ECN Brokers take orders straight through to the inter-bank market .This comprises of financial institutions like hedge funds, banks and mutual funds.

The STP brokers take quotes from the inter-bank markets add a few pips as spread and then take your order to the liquidity providers with the best quotes.

Some will also allow your orders to interact with other orders in the ECN and this allows you to see the best prices offered.

Their orders tend to be quick with no delays compared to other brokers because it’s lined up straight to the inter-bank market.

It is available for big traders who take high volume trades and has big spreads.

Other brokers like the XM.COM have a strict no-requote policy under their regulations which would protect you from making losses in case the markets go very volatile.

A re-qouting is when you cannot fill your order at a rate on your screen but you are given a new price at which to execute your trade.

You should also consider choosing a broker that offer guaranteed stop losses and take profit points and negative balance protection to avoid losses in case of strong gappings in the market.

5.Associated transaction costs.

The transaction costs in forex trading include spreads, commissions and fees.

Aim at choosing a broker that will offer you good services at affordable prices.

An additional cost on each transaction is significant to your account when aggregated. Therefore you should be keen when choosing a broker to be able to minimize your costs and protect your profits.

Spreads vary with different currency pairs due to different volumes and can either be fixed or floating basing on market conditions.

Big spreads can easily blow your account in case you are trading on a small account.

As we said earlier,

Spread is a compensation for brokers, therefore you should decide which kind of spread works for you before choosing a broker.

Some brokers do not charge commissions while others do.

There is also an attachment of fees charged by some brokers especially those in less competitive markets.

It’s necessary to always be aware of all costs and fees involved whether listed or not to clearly understand your position.

6.Security – choose a forex broker

Choose a forex broker with the most secure server and position.

You will have to look at the broker’s credentials and verify his legitimacy and associations. whether he is registered with the government regulatory authority or not.

This is easy to do because information is always provided by a number of agencies. This will help you to separate the fake brokers from good ones.

These are some of the countries and their regulatory bodies:

- United States: National Futures Association(NFA) and Commodity Futures trading Commission(CFTC)

- United Kingdom: Financial Conduct Authority(FCA) and Prudential Regulation Authority(PRA)

- Australia: Australian Securities and Investment Commission(ASIC)

- Switzerland: Swiss Federal Banking Commission(SFBC)

- Germany: Bundesanstalt fur Finanzdienstleistungsaufsicht(bafin)

- France: autorite`des Marche`s Financiers(AMF)

- Canada: Autorite`des Marche`s Financiers(AMF)

7.Deposit and withdrawal.

A good broker is the one that allows you to deposit your money and withdraw your earnings without a hustle.

So! whichever broker you choose, you should be able to deposit and withdraw cash without any difficulty.

A lot of scams and fraud are everywhere online offering very exciting payoffs that seem to be very eye catching. If you don’t take caution you will end up falling a victim.

Right now you already know what you need in to consider for a good broker.

Take your time to read through several times and make sure you don’t make mistakes and end up with a wrong broker.

This contributes a lot to your trading journey.

Good luck choosing a good broker.

Here we go! Free Forex Coach is here to remind you that not all that glitters is gold.

So before you deposit your money with just anyone, think more about it twice or even thrice.

Develop a habit of skepticism and do more due diligence.

Gather enough information (facts) about the broker you intend to work with to avoid fraudulent brokers and forex scams.

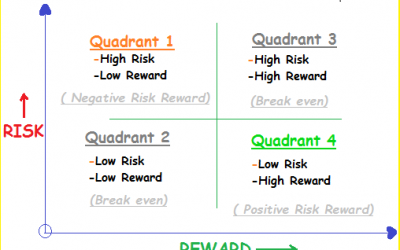

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.