The Euro moves are influenced by 6 Major factors. There are other factors that move the Euro but we shall discuss the major 6.

Major economic data that moves the Euro

1. Monetary Decisions by the ECB

The decisions the European central bank makes, moves the Euro.

When the central bank chooses to raise interest rates the Euro gains value but when it chooses to cut interest rates , the Euro value falls.

Any decisions the central bank takes, for the purposes of restricting money circulation will favor the Euro.

Conversely,

If ECB decides to increase money in circulation, it will weaken the value of Euro.

As a forex trader, buy the Euro when strong and sell the Euro when weak.

2. Germany Industrial Production

This measures the change in the output from Germany’s manufacturing, mining and quarrying industries.

Germany is the European largest economy with the largest manufacturing economy.

This moves the EURO greatly

It is the 3rd largest exporter in the world therefore contributes much to the Europa’s GDP.

When Germany’s manufacturing industry is doing well, much of the Euro is demanded due to increase in production and exports.

This leads to further economic growth of the Euro zone hence strengthening the Euro.

The opposite is also true

3. The U.S. dollar index USDX

The US dollar index is used to measure the value of USD relative to a basket of foreign currencies (US trading (partners’ currencies)

U.S. has the largest world’s economy and the USD is the world’s most traded currency, it is worth comparable.

From the basket of countries that make up the dollar index,

Euro carries the largest percentage compared to other countries.

Euro 57.6%, JPY 13.6%, GBP 11.9%, CAD 9.1%, SEK 4.2%, CHF 3.6%.

Therefore, when you compare the EUR/USD with the US dollar index, you can easily know how the Index moves the Euro

Let’s see how?

When the dollar index is rising,

it signifies a strengthening dollar and so the EUR/USD will fall. This Indicates that the dollar is stronger than the Euro.

In other wards sell EUR/USD

On the other hand,

When the dollar index falls, the dollar is likely to fall and the EUR/USD will rise. In this case, buy EUR/USD.

4. Gross Domestic Product.

The GDP measures the countries current performance for a given period compared to the past years performance.

A high GDP indicates growth in the economy hence a rise in the value of the Euro.

A healthy economy is mostly followed by inflation and increase in the interest rates by the central bank.

Also, High capital inflow due to more foreign investors into the healthy economy. This may lead to further increase in the strength of the Euro.

On the contrary,

A fall in GDP shows that the Euro economy is not doing well.

This discourages investment hence a fall in the value of the Euro.

5. Trade Balance

This is the difference between the value of exports and imports that moves the Euro

When the trade balance is positive it indicates that exports are greater than imports hence a surplus.

This shows that the demand for Euro is high leading to its value appreciation.

However,

if trade balance is negative it becomes a deficit hence more imports than exports.

This shows an increase in the supply of the Euro to foreign countries. It may lead to much money into circulation and a fall in the value of the euro.

6. Consumer Price Idex (CPI)

CPI measures the change in the price of consumable goods and services. This includes food and energy prices, housing , transportation,clothing, housing and entertainment.

The CPI measures inflation in an economy comparing the cost of goods and services consumed per household.

If the value of CPI is high, it is a sign of persistent rise of prices which may result to inflation.

This calls for the European central bank to raise interest rates as a measure to regulate inflation for a stable economy.

On the contrary,

If the CPI is low, it shows less value in the EURO. It also indicates slow development in the European economy.

This may require the ECB to intervene in the matter.

The ECB may cut the interest rates to encourage borrowing to boost domestic expenditure.

Trading the EUR/USD

The EUR/USD is the most traded pair in the Forex market.

It is less volatile and represents the largest economies in the world.

You can trade EUR/USD relating it with the dollar index.

The EUR has the biggest percentage on the US dollar index.

This makes it easy to correlate with the dollar to establish the relationship between the two.

As the index move up, it is a sign that the dollar is increasing in strength therefore time to short EUR/USD. The opposite is true.

Trading news that moves the euro

Again,

You can also trade the EUR/USD; looking at the news release from strong economies.

Mostly the news release from the Euro Zone and US economy is a big deal.

Some of the news you shouldn’t miss include, GDP,CPI, ECB interest decisions,Germany Industrial Production and employment changes, to mention but a few.

More so, since the EUR has a high negative correlation with the dollar, any news release from the U.S. economy matters a lot.

To trade other currencies paired with EUR, you need to pay attention to strong economic news release from those economies.

Some of these pairs are; EUR/JPY,EUR/CHF,EUR/NZD,EUR/GBP,

get to know the Euro

The euro is the second traded currency in the forex market after the USD.

It is the official currency of the Euro zone and 19 member states use the Euro in the zone .

The countries include; Australia, Belgium, Cyprus, Estonia, Lativia, Lithuania, Malta,Slovakia, Slovenia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands,Portugal and Spain.

Most traders commonly call it fiber and the Euro is known as an anti-dollar among currencies traded in the financial market.

The major economies in the Euro Zone are France, Italy, Germany and Spain.

Consequently,the EUR/USD has become the most traded pair because it’s the most liquid currency.

Also it’s from the most active financial economies in the whole world; USA and the Euro zone.

EUROPEAN UNION FACTS & FIGURES

- Country Name: European union

- Short Form: Europe

- Abbreviation: EU

- Government Type: Modern Democratic Constitutional and Parliamentary Monarchy

- Capital: Brussels (Belgium)

- Independence: 7th February 1992

- National Symbol: A circle of 12, five pointed golden yellow stars on a blue field; union colors blue and yellow.

- Member nations: 28 countries;

- Location: between North Atlantic Ocean in the west and Russia, Belarus and Ukraine to the East

- Area : 4,479,968 sqkm

- Population: 511.81 million

- Parliament president: Antonio Tajan

- Commission president: Jean-Claude Juncker

- Council president: Donald Tusk

- Currency: Euro (EUR)

- Imports: 1.727 billion

- Exports: 1. 9 billion

- Time Zones: GTM+0 (western), GTM+1 (central), GTM+2 (eastern)

- Website:

- http://europa.eu/Major Cities : Paris, Berlin, Madrid, Rome, Bucharest, Hamburg, Budapest, Vienna, Warsaw.

Monetary and fiscal policy

The European Central Bank manages the monetary policy for the euro member states.

Its policy applies to all members despite the varying economic conditions that may occur across the region.

Like any other central bank, the ECB aims at achieving its objectives. Its objective is to maintain price stability in the whole region and the Maastricht treaty goals.

The ECB’s decision making body consists of the the executive board council.

It comprises of the president, the vice president and the four other members

Today, Christine Lagarde former Managing Director of the International Monetary Fund(IMF) is the president of the ECB.

She was appointed by the European Council on 18th October, 2019 for an 8 years term of office.

She succeeded Mario Draghi, former president of ECB

Its basic tasks include;

- To define and implement Monetary policy for the Euro zone

- Conduct foreign exchange operations

- Take care of the foreign reserves of the European system of the Central Banks

- Promote smooth operation of the financial market infrastructure

- Authorize the insurance of the Euro banknotes and coins

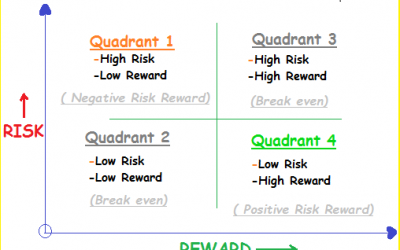

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.