CHF moves are heavily affected by Gold Prices and Swiss National Bank Monetary and Fiscal Policy.

CHF remains a safe haven for most investors due to Switzerland’s peaceful modern economy and it’s strong bank secrecy laws.

There are other factors that move the CHF but we shall discuss the major ones.

ECONOMIC data that moves the CHF

Major economic data that moves the CHF include;

1. Gross domestic product GDP

The gross domestic product measures the countries current performance both domestic and foreign value.

In case of a negative data results, it indicates contraction in the economic performance as well as fall in value for CHF.

However, a positive results is an indication for economic growth and expansion as well as increase in value of CHF.

2.Prices of gold

Like we said earlier, Gold acts as a shield for CHF currency. This greatly moves the CHF

The fact that 25% of Switzerland’s money is backed/kept as gold in the bank as reserves.

A change in gold prices brings great impact on the currency.

As gold prices move up, the CHF value appreciates.

Similarly, as the prices fall, CHF also follows.

There is a Positive relationship between gold and CHF.

3. Retail sales.

This gives the total value of goods and services consumed monthly at a retail level.

A basket of consumable goods is used to measure the changes in the level of consumption of goods and services .

4. Consumer price index (CPI)

This measures changes in prices of Switzerland goods and services at a general price level.

Low CPI indicates weak CHF

The SNB uses CPI to track price changes of different goods and services and to measure consumer expenditure as away of monitoring inflation levels.

5. Balance of trade.

This measures the country’s expenditure on imports and income on exports.

The gap between imports and exports helps investors and the country to analyse the country’s balance of payment.

Switzerland is well-known for its export industry.

Therefore, balance of trade has become a good tool for investors to gauge the country’s economic status.

A surplus trade balance indicates strong CHF

6. The Euro economy

Like any other export dependent economy,

Switzerland’s economy is highly affected by changes in the economy of the Euro zone.

Most of the Switzerland’s exports go to its trading partners in the Euro zone, the likes of Germany, France, Italy and Australia.

A decline in the economy of these countries causes a great impact on the Switzerland’s economy.

It reduces demand of its products hence a slow down production.

On the other hand,

A boom or expansion of the economy of any of these countries is a blast to Switzerland’s economy.

This necessarily means more demand for CHF to buy more of Switzerland’s goods and services.

This results to a boom in its economy and increase in GDP of the country.

More so, Most traders buy more of the CHF when there is sort of political crisis in the euro zone. CHF is a safe haven currency.

Investors seek safety by purchasing more of the swissy to avoid financial uncertainties.

Trading the USD/CHF and EUR/CHF

These 2 pairs are usually active during the European session.

The USD/CHF can be affected by cross exchange rates of the EUR/CHF.

This is because the EUR’s valuation due to a hike in the ECB’s interest rate can weaken the swissy currency and can also have an impact on the USD/CHF.

You can also monitor the economic news fundamentals of its major trading partners like the USA, euro zone.

Any change in the economy or important news from any of these countries, is a great deal to the Switzerland’s economy.

Last but not least,

The dollar valuations. This is because most of the commodities are priced in dollars.

So when the Dollar rises,

The commodity prices fall. To buy more of the commodities, you will require more of CHF to buy few dollars. The CHF falls as the dollar rises.

Getting to know the CHF

The Swiss franc is abbreviated as CHF, the official legal tender of Switzerland.

CHF stands for “confoederatio Helvetica franc” a latin name for the swiss confederation.

Its nickname is swissy by most traders.

The swissy is the 6th most traded currency on the forex exchange market in the world.

It remains a safe haven currency for investors during financial uncertain times due to its high degree of stability and reliability.

Also, it has the lowest interest rate.

Switzerland’s neutrality

As mentioned earlier,

CHF remains a safe haven for most investors due to Switzerland’s peaceful modern economy and it’s strong bank secrecy laws.

Investors find it safe purchasing lots of CHF during periods of financial uncertainty because it is more reliable and stable.

This is a good attribute towards the swissy currency because as demand for CHF increases, so does its value.

Switzerland facts and figures

- Country Name: Swiss Confederation

- Short Form: Switzerland

- Government Type: Federal Republic

- Capital: Bern

- Independence: 1st August 1291

- Neighbors: Australia, France,Germany, Italy, Liechtenstein, Switzerland.

- Spoken languages: Swiss-German, German, French, Italian, Lombard, Romanish

- Head Of Government: Alain Berset

- Currency: Swiss Franc (CHF)

- Imports: $243.4 billion

- Exports: 301.1billion

- Website: https://www.myswitzerland.com/en/home.html

- Major Cities : Zürich, Geneva, Basel, Lausanne, Bern, Winterthur, Lucerne And St. Gallen.

Monetary and fiscal policy

The Swiss national bank( SNB) conducts the nation’s monetary policy by monitoring the country’s expenditure and consumer behavior.

It is the governing board that is responsible for monetary policy. It consists of three members and their deputies.

Its 3 main objectives are:

- To ensure price stability and economic development.

- Implement monetary policy decisions on a medium term inflation.

- To achieve its operational target range for interest rate, the three-month libor.

The SNB establishes a 3-month Swiss Franc libor as a reference for interest rate.

i.e it sets a 3 months target to monitor the performance of interest rate before making any decisions.

Also influences money markets through open markets operation and adjusting the interest rates on deposits held by the banks .

It is also able to intervene into the foreign exchange market, if necessary.

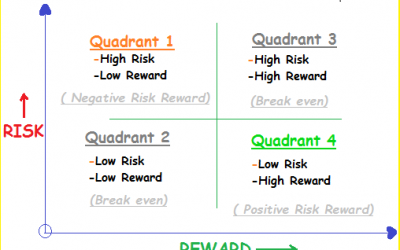

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.