To confirm a Trend using Momentum Indicators is lagging but saves you from so many false signals.

The MACD, is one of the commonly used momentum indicators traders use to confirm trends. They are good at spotting trends once they are formed.

Momentum indicators lag behind the price, and give signals with a delay

Though they always save traders from most fake out, these indicators give signals when the trend has already started. As a result you are likely to miss out on good entry opportunities. So you make late entries.

This may save you from many fake out signals but at an expense of late entries or missing out trades with high volatile movements.

What would you prefer? A late entry on a well established trend or making early entries which turn out to be fake outs? It all depends on you.

Let now see how to confirm a trend using momentum indicators.

Example : Use, MACD and the Moving averages

You can use any of the moving averages; Simple moving average, Exponential moving average and Weighted moving average indicator.

The MACD and the Moving average crossovers.

From the above chart,

We can clearly see the MACD histogram and signal line crossovers with the zero line corresponding with the moving averages crossovers.

That is a confirmation of a trend direction.

The two indicators are agreeing with each other pointing in the same direction.

We have a strong buy signal as the MACD histogram shifts above the zero line and the faster moving average crosses the slower moving average from below.

It is also true that a trend may reverse when the MACD histogram crosses the zero line to the lower side, and the faster moving averages crosses the slower moving average from above.

End of an uptrend and beginning of a downtrend

confirm a Trend using Momentum Indicators Check – list

When

The MACD crosses the signal line and the histogram crosses the zero line, this gives a signal that a trend is likely to change.

Also, when the moving average line gets closer or crosses through the price trend, it indicates a possible change in trend direction.

When you use two moving averages;

As the slower moving average approaches the faster moving average and price moves closer to the two moving averages, its a strong signal for change in trend.

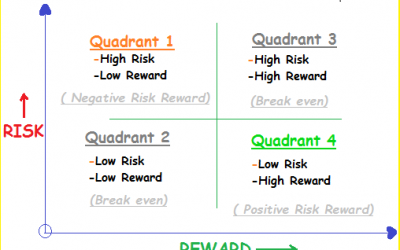

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.

- Registered Users

- 5,712

- Forums

- 7

- Topics

- 18

- Replies

- 42

- Topic Tags

- 1