Bollinger bands are one of the commonest indicators traders use to trade ranging markets.

Bollinger bands in the ranging market

In ranging markets, as price moves between the upper line and the lower line of the bands, it tends to respect these levels finding support and resistance.

The Bollinger bands contract on the reduction of volatility in the market and expand at the presence of high volatility in the market.

When the market is successfully trending, you will clearly see the bands expand as a result of increased volatility in the market.

If the market is ranging, the bands contract indicating price consolidation due to fall in volatility.

Take a Look at the chart below

Price movements between the bands is likely to bounce either on the upper line giving a sell signal or on the lower band giving a buy signal.

A candle stick pattern on the upper or lower band would be an added strength to the signal.

The take profit levels are on the upper and lower band for sell and buy respectively.

However, price may also break on the lower band or upper band. What’s important it to always wait for the signal confirmation.

How to trade bollinger bands in ranging markets

When price bounces off the upper band, it gives you a sell signal.

Similarly on the lower band, buy signal.

Having a reversal candlestick pattern on the band, is an added advantage for trade confirmation.

Follow the chart below.

Take a look at the USDCAD, Hourly chart below;

From the chart above,

The sell and buy signals are confirmed by candlestick reversal patterns on the upper and lower bands.

The take profit levels are on the upper and lower band for sell and buy respectively.

Trading breakouts on the band

When price breaks the upper band, it gives a buy signal.

Buy after confirmation

Place your stop loss slightly below the lower band.

Here is an example;

On the other hand,

When price breaks the lower band, it gives a sell signal.

Sell once you get confirmation.

Place your stop slightly above the upper band.

Check an example below;

You can learn more on Bollinger bands trading here in our previous session!

Using lagging indicators like Bollinger bands in ranging markets does not always give clear signals.

This is because they tend to flatten in the sideways direction.

The indicators tend to give a lot of signals of which most of the signals are fake outs.

How to trade Bollinger bands with other indicators

Bollinger bands work better when you combine them with other technical tools like support and resistance, Fibonacci retracements, channels, and trend lines.

Technical indicators help to identify the reversal points in the range.

You can also combine them with oscillators such as stochastic and RSI that show the overbought and sold points.

Learn more on how to trade with multiple indicators from previous lessons

Trading either in trending or ranging market environment makes profits.

What matters is how you do it.

As a forex trader you have to come up with a strategy that will increase more odds to your side and use that to trade in either of the situation.

It’s very important to know if the current market is trending markets or ranging.

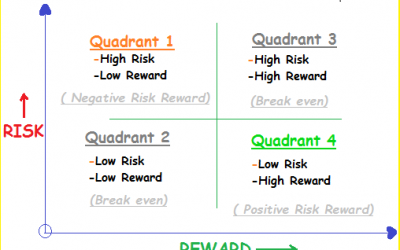

This helps you to gauge the level of volatility at a current situation so as to adjust your risk-reward ratio accordingly.

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.