The correlation between Gold and the stock markets is inversely proportional. In other words, Gold, Silver(metals) and the Equity/stock market move in the opposite directions. As gold and silver rises, the equity/stock Markets falls. The opposite is also true. let’s take a look at an example on the chart below.

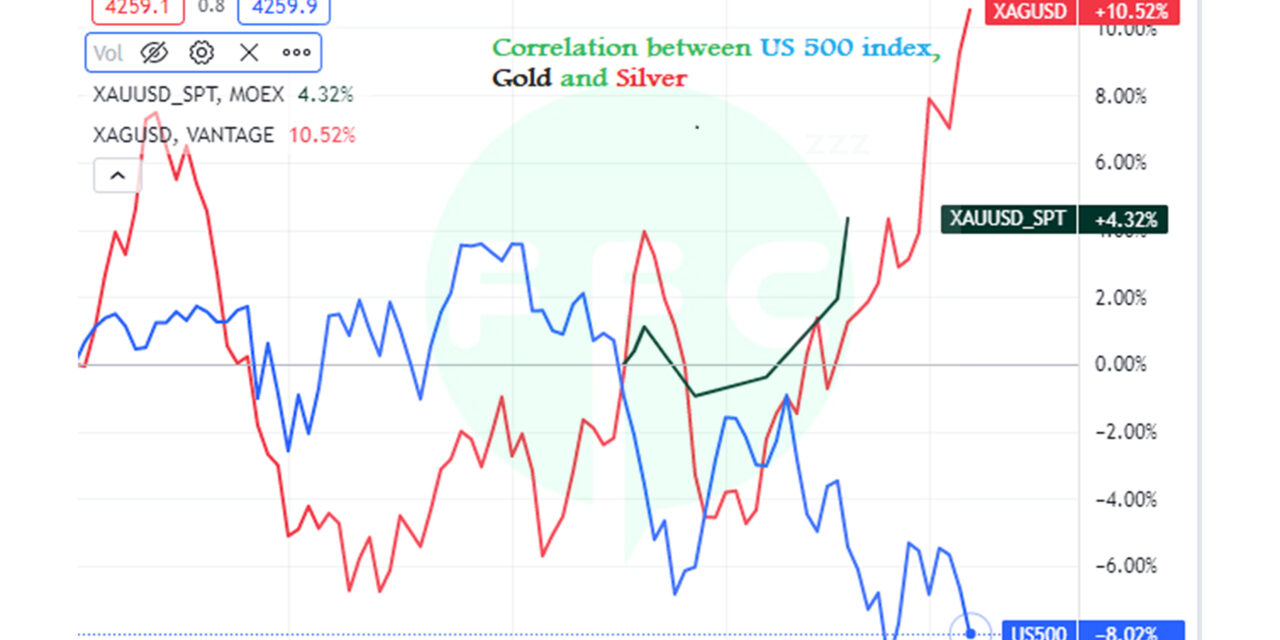

On the chart below we are trying to compare, gold, silver and US500 index

The Blue line, represents, US500, red is Silver and Black is gold. If you take a good look on the chart, you can clearly see that, silver(Red)and gold(black) are rising as US500(blue) is falling.

The word correlation can mean a connection or relationship between two or more things. Therefore, we shall mainly look at how gold or silver is connected to the stock market in regard to their movements in the market.

Under intermarket correlation, in the field study lesson, you will find a wide scope on how to use different correlations to trade.

For example;

- How the stock markets affect the forex market?

- How oil prices affect the Canadian Dollar?

- Why the Us. Dollar strengthens whether in good or bad conditions?

- And how bond yields affect the currency market?

In this article, we shall mainly focus on the correlation between gold or silver and the equity/stock markets and how to use it to trade.

Let’s first have a quick look at gold and silver and then the stock markets

Gold and Silver

Gold and silver are the major metals on the forex market. Gold is commonly traded against the Us. dollar (XAUUSD)and the Australian dollar (XAUAUD). While silver against the dollar (XAGUSD).

The metals have a good pip value therefore best to trade when you have the right prediction.

Most traders run to gold in times of uncertainty and this makes it more volatile. Aside from its intrinsic value, Gold is a safe haven. This is because it is less affected by uncertain conditions.

Silver comes second-best metal traded after gold.

Silver and gold have a positive correlation and tend to move in the same direction almost all the time. This is shown on the chart below.

As gold prices increase, silver prices follow too. The reverse is true.

You can trade gold and silver the same way you do for currencies on your trading platform. Or you can buy and sell gold or silver directly.

The Equity/stock Markets

Stock markets/ equity markets is where investors and traders buy and sell shares of the public listed companies. Stocks work through a network of exchanges.

The major exchanges include, New York stock exchange, (NYSE), Nasdaq, the Australian securities exchange (ASX, Japan, Hongkong and Shanghai.

Aside from using exchanges to buy and sell stocks/indexes, you can use a broker on the forex market.

The major indices include, S&P 500(US500 index), Dow 30(US30), FTSE 100(UK100 index), Nasdaq (US100 index), Hong Kong (HK50).

Like we saw earlier, the correlation between Gold and the Equity/stock markets is negative. The two move in opposite direction most of the time.

This is how. As gold price rise, the index prices fall. In the same way, when silver prices rise, the index prices fall as well.

Conversely as prices of gold and silver fall, the index prices rise.

Now that you know that, how do you use this information to trade on the forex market.

How you can use the correlation between Gold, Silver and the Equity/stock markets to trade?

First, we need to know what really moves gold prices.

Major currency Inflation;

When currencies experience high inflation, most traders will opt to invest in gold or silver since the metal is more stable and hold more value. Major currencies on the market include; USD, GBP, EUR, AUD, CAD, NZD, CNH, JPY, ZAR and HKD.

If the countries currency is affected by inflation, it affects the respective stock in that country as well. Currencies act as the face of the companies on the stock market in that country. High Inflation reduces money value overtime.

Remember, to invest in a particular stock, you must change your currency to that country’s currency to buy stock.

If investors turn their money away and invest in gold or silver, then the stock/index value will fall as well. However, the reverse is also true

Fore example, if the EUR loses value, pairs like EUR/USD, EUR/JPY, EUR/NZD, EURCHF will fall on the market. Certainly, the UK100, France 40 index, DE30 will fall as well. In this case, you will look for sell opportunities on these pairs and buy gold or silver and pairs where the EUR is a quote.

Demand and supply

High demand for gold or silver will automatically increase its prices. As a rule of demand and supply, the higher the demand the higher the price and vice versa.

Increase in demand for metals for example gold and silver may come as a result of demand for the metals in industries, high speculation by the traders in the market, bad economy.

In the same way, if supply of gold falls, prices will go up. The same goes for silver.

On the other hand, in case of low demand and high supply, gold prices will fall.

Since gold, silver and index/stock market are negatively connected, when there is high demand for the metals their prices will rise and the stock prices will fall. Read the chart below.

When this happens, then you know, its time to buy gold or silver and sell the index.

Gold Vs the US. Dollar.

When gold prices go up, the USD value falls and when USD appreciates, gold prices fall.

The reason is;

Gold is priced in the dollar;

This means every time you make a transaction on gold; you spend or receive a dollar. The more dollar spent to buy gold, the more it is supplied into the economy the less the value.

When there is higher the demand for gold, its price will increase on the market. This will also lead to an increase in demand for sliver hence increase in its prices.

As the currency value falls, so does the value of the US. Indices.

For instance, if the value of the US. Dollar falls, the US100, US30, US500 prices are likely to fall too. When it rises, the indexes price will rise as well.

In this case, you should consider selling the US indices and pairs where USD is the major pair. They are; USD/JPY, USD/CHF, USD/ZAR. Or buy pairs where the USD is a quote currency. For example EUR/USD, GBP/USDNZD/USD, AUD/USD.

On the other hand, if the US economy is strong, the stock market value rises as well. This attracts more investors to the US economy and the USD will appreciate in value. It also leads to low demand for gold and so is silver after all the dollar feels safe now for investment.

When this happens, consider to sell gold and silver and to buy the US indices as well as pairs where USD is the base currency.

Geopolitical impact

Political instabilities such as wars, change in government highly affect the stock market as well as the forex market. You are likely to see a sharp change in the market after a political crisis in the major economies in the world.

For example,

After the world war I, stocks opened with about 20% fall on the NYSE after 4months close.

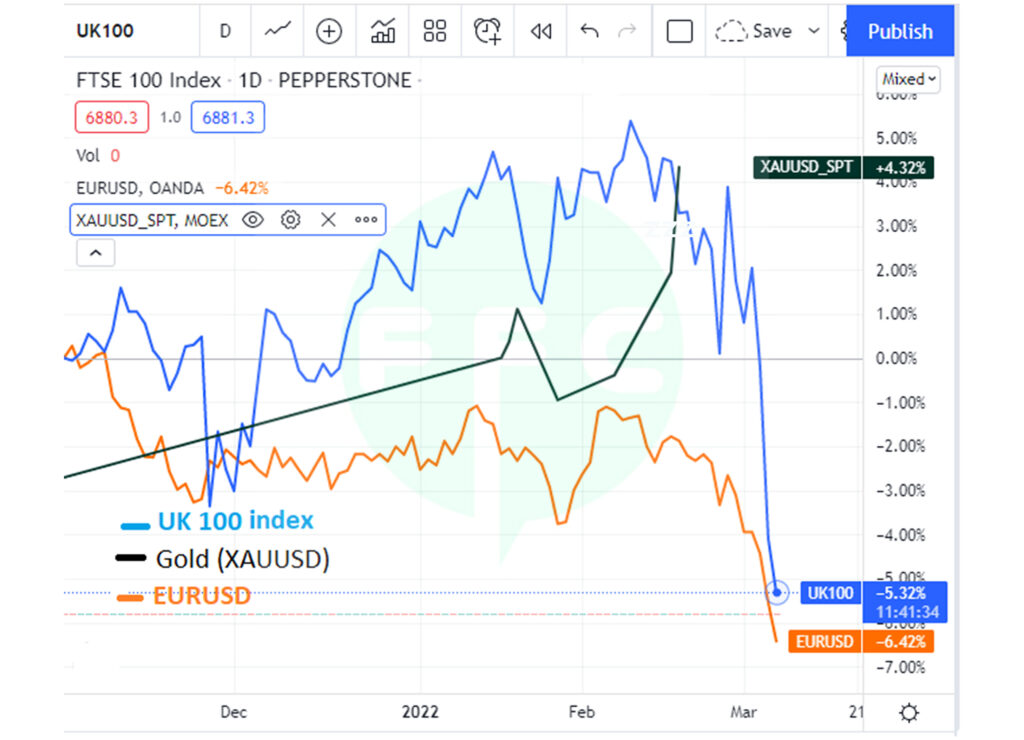

Also following the current crisis in Ukraine you will realise that most of the European currencies have fallen in value as well as their respective indexes. I can give an example of the UK100 index and all pairs quoted with the EUR. e.g EURUSD

In case, you were holding your money in these pairs, it would be the best time to sell off buy pairs where these currencies are the quote.

This would also give you an opportunity to buy gold or silver since gold is not affected by uncertain conditions.

Final words

Currency correlation helps you to know the behaviour or direction of currency pairs in question

Like we said, it can either be positive correlation or negative correlation.

Currency pairs with a positive correlation tend to move in the same direction almost most of the time.

For pairs with negative correlation, they move opposite each other.

However, you should also not that, this does not hold all the time. There are times in the market where you will find positive correlated currency pairs moving in the opposite direction. or pairs with a negative correlation moving in the same direction.

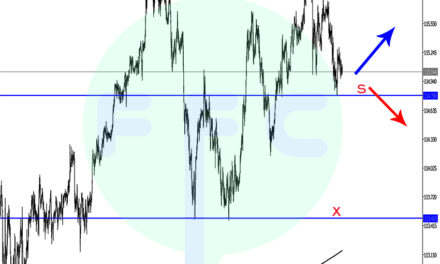

What do you do then, use other technical indicators such as moving Averages, support and resistance, Fibonacci retracement to get extra confirmation.

Certainly, you can use the currency pair correlation to determine the direction of different pairs. Then to take trade positions, always follow your trading strategy and rules.

Good luck trading..