Inflation in forex is the persistent increase in the prices of goods and services in an economy in certain period of time.

The quantity and quality of goods and services a unit of currency can buy is less than what it used to buy before.

Let’s look at the most common types of inflation in forex

Demand pull inflation

In this case, the general increase in prices of goods and services in an economy is as a result of imbalance in demand and supply.

When demand for goods and services becomes more than supply, it simply means there is a shortage in production relative to the available demand.

The higher the demand, the higher the price.

Therefore continuous increase in demand lead to persistent price increase which is inflation.

Cost push inflation.

The cost push inflation is as a result of continuous increase in the costs of production.

This includes wages, production materials, capital and transport.

The high costs of production make production process hard and expensive leading to setting of high prices on products.

Money supply.

As the Central bank continuous to print more money, a lot of it goes into circulation.

This makes spending cheap hence demand exceeds production(limited supply).

Excess demand over supply lead to high prices and loss of value in the currency.

For example;

if last year you would buy a kg of sugar using 6 dollars but now you need 12 dollars to get the same kg of sugar. This a double price.

As prices continue to increase, much of the domestic currency will be required to purchase small quantity items.

This is a sign that money has lost its value.

Inflation is not bad when maintained at a good level because it stimulates growth in the economy.

The recommended level worldwide is 2-3% per year.

The good side of inflation

As people expect inflation increase,they spend more which is a drive for economic growth.

- A moderate amount of inflation is a sign of a healthy economy.

- As demand for goods and services increase, production increases and the economy grows.

- The increase in production creates more jobs for the citizens and wages increase too.

The bad side of inflation

High Inflation reduces the value of money overtime. The money you have today has more value than the money at a future date.

- If you don’t invest it today and decide to keep it in cash it is likely to be less tomorrow due to inflation changes.

- When there is inflation, the prices of goods and services keep increasing.

- In addition, the amount of goods and services you can buy with money become less compared to what it used to buy.

- This is because high inflation reduces the purchasing power of currency( value).

How does inflation affect the forex market

Inflation directly affect the currency values as this is as a result of money supply and demand from other countries.

More money supply less currency value and vice-versa.

Higher inflation rates have negative effects on the value of a currency. The currency becomes weaker compared to other currencies which means it buys less of other currencies.

Therefore the currency becomes more bearish in relation to the quote currencies on the market.

In addition, very low inflation is also bad because its indication for low demand for goods and services and this slows economic growth.

As a trader,

You should not under look the inflation data because it is one of the primary factors central banks consider when determining interest rates.

It is the Central bank that regulates the inflation levels in the economy.

The Central banks usually use consumer price index (CPI) to measure inflation .

Consumer Price Index (CPI) is the average price of a basket of goods and services that households can purchase.

Namely, food, energy, clothing, housing, medical care, education, and communication and recreation.

We shall talk about more on CPI and its effect on FX market in the next sessions. Lets now look at how interest rates affect inflation

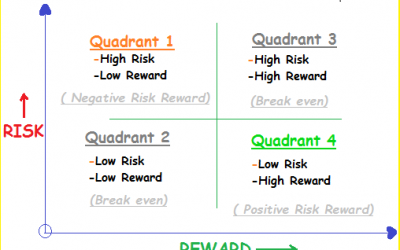

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.