To Follow your Trading Rules is not as easy as it seems. But there are techniques to help you grow the nerve to follow Forex trading Rules.

To Follow your Trading Rules is not as easy as it seems. But there are techniques to help you grow the nerve to follow Forex trading Rules.

If you want to see consistent profits on your trading account, you must follow your trading rules.

Your rules should be written some where either in a book, notice board or saved on a desktop of your computer.

Your rules should protect you from chasing the market ie early or late entries, protect you from over trading and over risking and keep you calm.

In a nutshell, Only your rules put odds on your side..

Our overall main objective is to become better traders every single week and make money monthly.

One of the sure gauging ways is in our discipline and patience i.e the ability to follow our trading rules. Only and only then can we get a growing positive equity curve

You should have simple rules and as precise as possible. No room for second guessing yourself or your system.

How do you follow your trading rules

We shall take you through simple steps you can follow to make it easy to follow forex trading rules.

These include;

1. Start by writing your rules down

Make a list of your rules, pin them some where on the board in your house/office.

Make sure they are always put on a display so that you don’t forget about them.

You should be able to access them easily and also easy to read.

In other wards, your trading rules should clearly tell what to do, when to do it, how to do it and why you should do it. The list should also include the don’ts and why.

2. Make your trading rules part ot your trading routine

Read your rules every day before you start trading.

Make it part of your pre- trading routine and always remind yourself why these rules are important.

Access and evaluate yourself at the end of the day.

Then find out if you followed your rules. If not, give a reason why and promise yourself to always put your rules first.

Specifically, identify any consequences of not playing by your rules and take record. This will motivate you to follow your rules.

3. Review your trading journal and assess your trading performance

Last but not least, always assess yourself after a week and grade yourself regarding to self-discipline.

You can add remarks.

Review your trading journal every week, months and point out areas of good performance, compare with times of bad performance.

Assess and try to find out if you followed your trading rules.

Identify areas where you need to change and make a follow up

Of course, the competition in the market arena is fierce, your only competitive edge are your rules.

Trading is about following your rules, everything else is amateur behavior.

If you have not set your trading rules yet, here is a guideline to aid you to your consistent profitable trading!

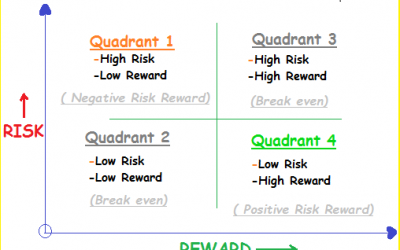

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.