There are various ways to Protect Yourself from Forex Scams. Forex scams can come as robot scams, signal scams, managed account scams or broker scams

So you must Be alert and aware of scams out there especially online.

Forex scams always target people that like get rich-quick schemes.

They come in many ways to attract your attention and robe your money.

Don’t be tempted by the online robots, brokers, signals, etc for most of them are scams.

Let’s now discuss how you can protect yourself from Forex scams;

How do you protect yourself from Forex Scams

They are so many and are everywhere especially online. Here are some of the ways you can protect yourself from Forex scams.

For EAs/Robot scams

- Check maximum draw down reported in the back-test report of the automated trading system. If they have large draw downs, run away!

- Clearly check if EA uses stop loss. Robots which do not use stop loss cannot protect traders from losses and are therefore not worth checking out.

- Check if trades are held open for a long time. EAs that hold strategies for a long time or those that close trade in seconds (scalping strategies) often produce great equity curves, but have no real applicability in real trading. Keep away from them

- See if the lot sizes are increasing. Most likely the provider is using martingale trading style to recover from losses. This is very dangerous for your account.

- Check if the Robot uses the grid style of trading. Here there is a lot of buying and selling at the same time. Such a strategy exposes the account into a lot of risks and should be avoided.

- Check if Forex EA closes the trades in a few seconds. Such trading robots are scalping and they mostly do not work on any other trading account because they are very sensitive to Spread changes.

For Broker scams

- Check the broker’s license and regulatory information. They must be regulated by at least one of the financial bodies we listed here

- Compare price feeds both on the demo and real accounts. Also you can subscribe to other price feeds to compare

- Check out the reviews about a broker. Pay close attention to the information about funds withdrawal

- Do not trust a broker, who changed the name of the firm several times.

- Check the records of the broker’s company and performance history. Before investing in Forex trading with a new broker, investigate about the firm’s performance record. Even if you receive good customer testimonials, you should not trust it blindly and information they contain might be false.

- Always record and keep your trading details in a journal. You can use it as evidence, in case you feel being cheated by your broker.

- In case of any disputes with your broker, you can take legal action. Record every single transaction, take snapshots etc, this will be your EVIDENCE.

You can use the services of the National Futures Association (NFA) or the CFTC (Commodity Futures Trading Commission). Both have programs that can help you in this sort of instance.

For Managed accounts and signal scams

Don’t trust any opportunity which sounds too good to be true. If someone offers you a strategy promising to get 100% through Forex trading, that is a scam.

Forex is not a get rich scam and no strategy is holly grail.

No one can be a millionaire overnight and it obviously takes time make money from Forex trading.

Stay away from companies which do not inform about the risks

Forex is the most risk venture of all. What you can make. You can also lose it at the same time.

If they do not explain or tell you about the risk involved in the investment offered and convince you to invest a big amount. It is likely to be a scam.

Invest more on education than relying on buying trade signals

You can avoid Forex scams when you get more knowledge on how to trade yourself.

It may take time to master that however, it’s worth it. Start by trading on a demo.

Practice until you feel comfortable trading on a live account. Forex trading needs patience and trading discipline for you to profit and good risk management.

Last but not least, it is very important to know who you deal with to trade. Do a good due diligence before you deal with anyone.

The good news is that there are legit companies in the Forex niche.

Like we mentioned before do good research on the internet. Ask other traders on forums and get to really know the kind of companies you are dealing with.

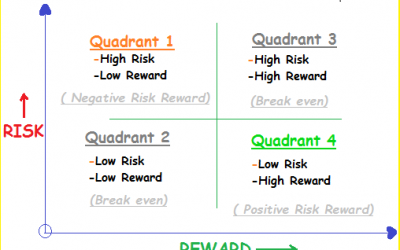

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.