You can read forex Market sentiment as the actual feeling/mood in the market.

If the majority traders believe that a certain currency will appreciate, they buy more and the market is in an uptrend direction.

On the other hand, if they believe that currency value will fall, they sell off that particular currency and the market shows a downtrend direction.

3 ways to read forex market sentiment .

1. Trend

A trend is the most important indicator in the Forex market.

Daily traders can use trends on a bigger time frames to define the market sentiment.

If you are a short term trader or a scalper, mainly you trade lower time frames.

For instance, scalpers trade on 5 – 30 min chart. Small time frames most times give fake signals when it comes to market trend direction. This is mainly shows market retracements or trend pullbacks.

To be on a safer side, after spotting a trading set-up on a lower time frame, compare the trend direction with that on a higher time frame.

Make sure the two correspond.

If they all point in the same direction, then go ahead and take your trade. If not the case, wait for another opportunity.

Looking at the trend on a bigger time frame gives a clear feel of the market.

Compare the direction for the trend using both the small time frame and the large time frame. Trade only when the two are in agreement.

2. Price action

You can also use price action to compare the traders response towards a certain pair of currency in both directions.

If the market moves up very fast and slows while falling it shows that the base currency is stronger than the quote currency.

Therefore the market is more bullish. The reverse is true for a bearish market.

This commonly happens at the time when there is news release.

When the news is positive, we expect the market to move up very swiftly.

Also, when the news is negative, it falls down as many investors sell off that currency.

However, if the news is positive and the market continues to fall instead of rising, it shows a strong bearish sentiment in the market. The opposite is true.

In addition, when news is positive but the market continues to move side ways, expect a possible bearish sentiment. This shows that the buyers are still undecided.

3. Momentum

As price moves up and down on the market chart, the buyers and sellers are expressing their feelings and perception about the current status of a currency pair.

Momentum measures price movement with time.

With price momentum, you can tell who is in control of the market as price makes lower highs or higher lows.

The highs and lows in a trend indicate a fall in the strength of currency.

For instance,

If a currency pair starts making lower highs in an uptrend, it shows that the bulls are losing momentum.

When price makes equal swings up and down, it shows equal strength between the bulls and bears.

If it makes higher lows when price is ranging, the bears are losing it and a sign for a possible bullish reversal a head.

You can also read Forex Market sentiment using the Commitments of Traders’ Report.

It is released by the commodity future traders commission CFTC every Friday at 2:30 pm EST.

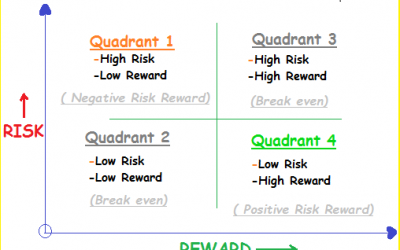

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.