You Read the US Dollar Index in Forex (USDX) value relative to a base of 100.000.

If the dollar index for the period is below 100, it means it has fallen by that difference and when it’s above 100, it has appreciated by that difference.

The value of the U.S. Dollar Index shows how much the U.S. Dollar has risen or fallen relative to the starting point of the index back in 1973.

For instance, if the dollar is at 80%, it means it has fallen by 20% since March 1973.

On the other hand, if the dollar reading is 120, this means that the dollar has increased by 20%.

How to read us dollar index in forex on a chart

US Dollar Index Formula

Usdx = 50.14348112 x ((EUR ^ 0,576) x (JPY ^ 0.136) x (GBP ^ 0.119) x (CAD ^ 0.091) x (SEK ^ 0.042) x (CHF ^ 0.036))

Below is the Daily Chart for year 2020 showing how to read U.S Dollar Index in Forex

From the above chart,

You can clearly see the blue line indicating the price level of the dollar index (97.53).

The US Dollar Index (USDX) measures the dollar’s general value relative to a base of 100.000.

In this case,

The dollar has fallen 2.47% since the start of the index.

(97.53 – 100.00) compared to the basket of six currencies.

WHY IS THE US DOLLAR INDEX IMPORTANT

Trade-weighted dollar index TWDI 1998

The TWDI was created by Fed Reserve Bank in 1998.

It measures the average value of the U.S. Dollar against the currencies of broad group of major U.S. trading partners composed of 26 currencies.

Also, it helps the policy makers to asses the competitiveness of US goods to its trading partners.

The FED also uses it to adjust the US monetary policy depending on the strength of the USD currency.

To the forex traders,

USDX acts as a trend signal indicator with pairs quotes with the U.S. dollar.

Since the index measures the strength of the U.S. dollar, you can easily tell where the USD is likely to go after seeing the dollar index movement.

AS a rule of thumb, if the USDX is rising, so does the U.S. Dollar.

Conversely, if the USDX is falling, probably the dollar will also follow.

However, not 100% all the time.

The major U.S. Trading Partners

USA trading partners that make up the index are 26.

The table below lists the basket of the 26 component currencies that make up the Fed’s Dollar index.

Country or Region 2017

The trade weighted index is different from the USDX by the currencies used in the basket and their weights.

The trade weighted index includes countries from all over the world that carryout trade with the USA.

It helps to asses the performance of the USA economy by comparing its exports and imports.

Weights for broad index can be found on the Fed webpage;

Http://www.federalreserve.gov/release/H10/Weights.

To find the historical data, visit;http://www.federalreserve.gov/release/h10/summarr/.

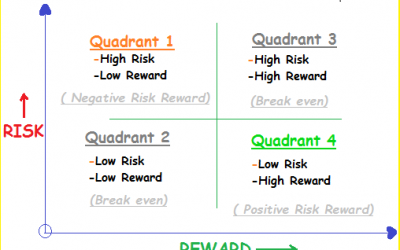

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.