You can Scale in Trades in Forex basing on certain elements after analyzing the market. These are usually pullbacks or pattern breakouts.

In Scaling in, you open a position with a fraction of the amount you intend to risk using a small size.

Then keep adding more positions as price continues to advance in your favor.

By doing so, you are able to hit two birds with one stone, How?

- You reduce on the loss in case the trade goes back immediately after taking position.

- Also, you have more chances to exploit all the profits to your exposure as price moves further to your direction.

We shall take you through an example and show you how you can scale in trades in forex while trading

How do you scale in trades in forex

The way we take positions while scaling in is not any different from our normal process of taking positions.

Most traders who use scaling in and out normally base their trading decision on certain elements after analyzing the market.

These could include;

- After a pull back on levels of support and resistance.

- After a breakout on a potential support and resistance levels

- Or the formation of continuation chart patterns such as triangles,rectangles pennants and flags ( price consolidation)

Examples on how to Scale in Trades in Forex

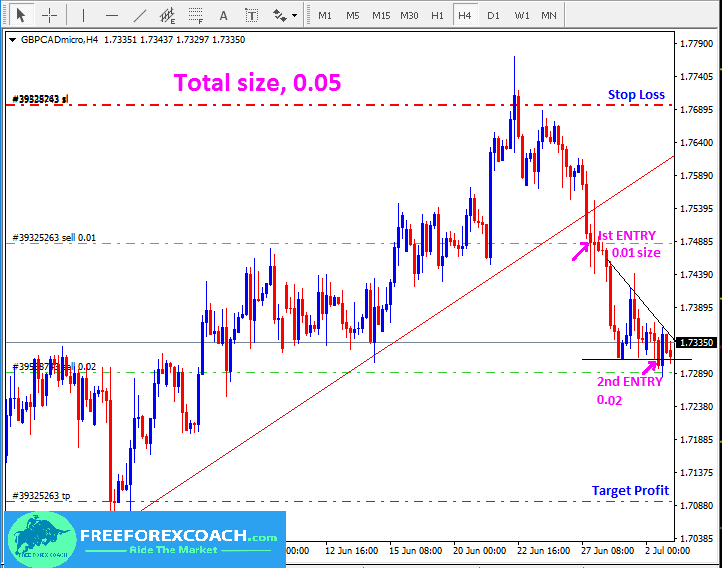

We are trading a breakout on a trend line. If the maximum size to use on every trade you take is 0.05.

Here’s an example on GBP/CAD, H4.

From the above chart, we have our first position on the breakout and the second at the break of consolidation triangle.

When scaling in, you take a trade with a small position size and add more trades as the market goes in your favor.

1st Entry

After taking our 1st position with a small size of 0.01, on the trend line breakout, price continued to move down to our favor.

Later price got in a consolidation triangle as identified on the chat above.

This gave us a signal that price is likely to continue after the pause.

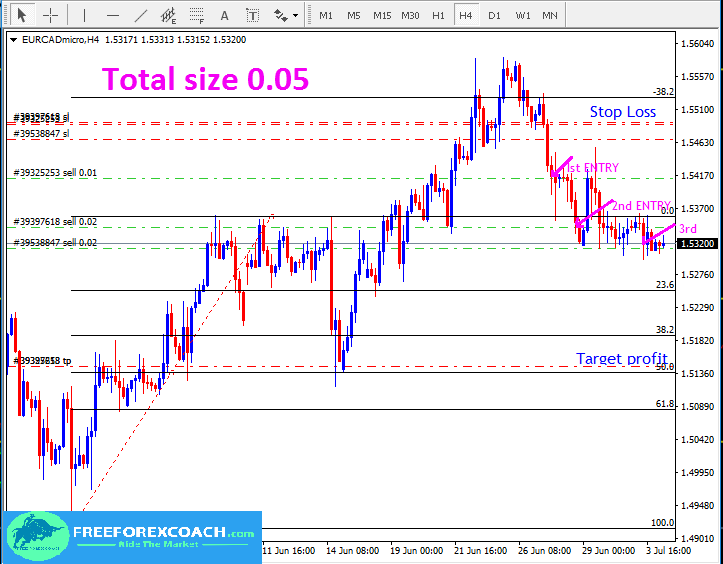

2nd & 3rd Entry

After the break on the triangle, we added another position and increased the size to 0.02 from the the initial size which was 0.01.

Since the market still shows a strong bias to the downside , though still in consolidation.

We can add on another position of 0.02 if the trade gives a stronger confirmation after the end of the consolidation.

How and where to set your stop loss and target profit?

Your can set stops and target levels in two different ways depending on what suits you or your trading strategy.

1. You can have one stop-loss for all your positions and one target profit.

This means if price hits your stop loss, all your trades will close out automatically. If the market goes as predicted and reaches you target profit, your profits will be larger.

Alternatively;

2. You can choose to have separate stop-loss on each new scale-in point.

If one position is stopped out then you will still have your other positions running.

With different target profit, the trades close out separately one by one with small profits till the last trade.

Look at the example on EUR/CAD,H4 Chart.

But all in all, make sure the total risk on open positions is not higher than your risk threshold on your trading plan.

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.