To use position size calculator in forex is so easy. You just need to know what you need

You don’t have to worry carrying a calculator everywhere you go because you don’t want to mess up on your position size.

Simply search online, you will access the position size calculator any time with ease.

Also, you can access the position size calculator here at freeforexcoach.com any time.

Just go to tools and select position size calculator.

To use position size calculator in forex, On the calculator enter;

- The currency pair you want to trade

- Your account size

- Stop loss in pips

- And finally the percentage of your account you wish to risk.

Then hit the calculate button.

Below is an example of the position size calculator.

The position sizing calculator will suggest position sizes basing on the information you provide.

But to properly use this calculator you will need to understand risk reward and position sizing

Alternatively, you can calculate the position size using a formula below.

How do you calculate position size using a formula

Position size = (Account size ×% risk per trade)/ (stop loss in pips × pip value)

For any trade, you need to first determine how much you want to risk per trade and the stop loss in pips.

Also, the pip value of the currency pair.

Then substitute in the above formula to get the position size for your trade.

Assume you have a $10,000 account and risk 1% of your account on each trade. Your risk is $100.

If you take a trade on the EUR/USD, buying at 1.22375 and place a stop loss at 1.22066.

This results in 30 pips of risk.

Position size = (Account size ×% risk per trade)/ (stop loss in pips × pip value)

Standard account

For a standard size pip value = $10

= ($10,000 x 1%)/ (30 x 10), 100/300

= 0.33

Mini Account

For mini size, pip value =$1

Position size = (Account size ×% risk per trade)/ (stop loss in pips × pip value)

= ($10,000 x 1%)/ (30 x $1),= 100/30

= 3.33

Micro Account

For a Micro size, pip value =$0.1

Position size = (Account size ×% risk per trade)/ (stop loss in pips × pip value)

= ($10,000 x 1%)/ (30 x $0.1), =100/3

= 33.33

If you trade a standard lot, then each pip movement is worth $10. Therefore, lot of 0.33 will result in risk of $100 if it moves 30 pips

But if you risk $100 on a position of 3.33 mini lots (equal to one standard lot, $1). In case you lose 30 pips on a 3.33 mini lot position, you’ll have lost $100.

When you trade on a micro size ($0.1 standard lot) and risk the same amount on a trade ($100). If you use the same stop loss in pips, it will require you to use 33.33 as your position size.

The number of lots the formula produces is linked to the pip value used into the formula.

If you use the pip value of a micro lot, the formula will produce your position size in micro lots.

Similarly, when you use a standard lot pip value, then you’ll get a position size in standard lots.

The same goes when you put a mini lot pip value. Read more.

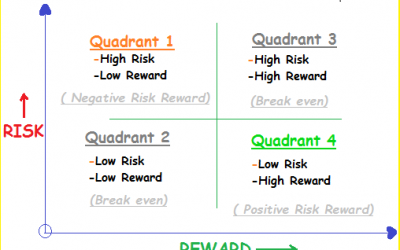

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.