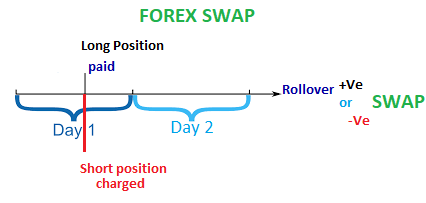

In Forex Swap, when you keep a position open through the end of the trading day, you will either be paid or charged interest on that position.

And this depends on the underlying interest rates of the two Currencies in the pair.

We previously looked at what forex swap is.

Now time for us to get into the details of it and see how one can gain from these swaps.

What is Forex Swap?

Swap is an interest fee that you either pay or receive on your account at the end of each trading day, for holding an overnight position with your broker.

it is either negative or positive depending on what you’re selling or buying.

When negative, you will lose some money for holding overnight positions. When positive, your broker will add some money to your account.

How does Forex Swap work?

Example,

If you hold a short position overnight on a currency with higher interest rate against a low-interest currency, you pay some fee.

But if you have a long position on a currency with higher interest rate against a low-interest currency, then you receive some fee for each day that you hold that trade.

Some brokers may not charge swaps on overnight positions.

This is common especially on currency pairs whose interest rate differentials is equivalent to zero or when very low.

However, sometimes, you will realize that the swap on your trades is larger than usual.

This happens especially when you open a trade position on Wednesdays and hold it over the weekend.

In such a scenario, you will have a triple swap charge.

Why Positive Swap?

To hold a position overnight, you pay interest on the currency you sell and receive interest for the currency you buy.

If the interest on the currency bought is greater than the interest paid for the sold currency, you receive a positive swap for holding a position overnight.

Your trading account gains.

For example,

if you sell EUR/USD, then you are selling Euros and buying Dollars.

When you hold the position overnight, you will pay interest for selling Euros, and receive interest for buying Dollars.

The fact that the U.S. dollar has a higher interest than the Euro, you stand a chance to have a positive swap.

Note:The longer you stay in a winning position, the greater the possible interest income accumulation on your account.

Why Negative Swap?

If the interest on the currency bought is less than the interest you pay for the currency you sold.

You receive a negative swap for holding a position overnight.

Your trading account is debited with a swap fee.

On the other hand, if we use the same pair as in the above example.

If you buy EUR/USD, it means, you buy the Euro, as you sell the Dollars.

If you hold the position overnight, you will receive interest for buying the Euros, and pay interest for selling the Dollars.

The U.S. dollar has a higher interest than the Euro.

In this case we shall have a negative swap. The swap value will be deducted from your account when you close out the trade.

In case your trade goes against your prediction, you will see a bigger loss than normal after closing out the trade.

This is due to a negative swap accruing on your trade.

How do I avoid Negative Swap?

You earn a negative Swap when you hold a short position for currencies with higher interest rate as you buy currencies with low interest rates.

Namely; NZD/JPY, AUD/JPY,USD/JPY, AUD/CHF, NZD/CHF,USD/CHF, GBP/CHF, GBP/JPY

How to avoid negative swap is very simple, mind the currency pair positions you hold overnight.

We said that,

When you sell currencies with higher interest rates as you buy currencies with lower rates, It results to a negative swap on overnight trades.

What do i mean?

When you choose a pair to trade, you must know the interest rate for both currencies in a pair. If you sell a currency with higher interest rate overnight, expect a negative swap.

The opposite is true.

However,

You can also avoid swap fees completely.

Close your open trade positions before the end of the trading day. That is 5pm EST, (9pm GMT) as simple as that.

Can I make money from Swap in Forex Trading?

The answer is, Yes.

You can make money from Swap fees on trades but only if you do it the right way.

How? Carry trading!!

Carry Trading.

Carry trading in Forex is a type of strategy where traders sell currencies of countries with relatively low-interest rates and use the proceeds to buy currencies of countries with higher interest rates.

Here,

The Forex trader borrows money in one country with a lower interest rate, and invests it in another country with a higher interest rate.

Their aim is to benefit/profit from interest differences.

In order to successfully benefit from carry trading, the first step is to find a Forex currency pair with high interest differential.

Currency pairs you should consider for carry trade

USD/JPY, USD/CHF, AUD/JPY, AUD/CHF, GBP/CHF, GBP/JPY, NZD/CHF, NZD/JPY, CAD/JPY, CAD/CHF.

Currencies with higher interest rates;

U.S dollar(USD), New Zealand dollar(NZD), Australian dollar(AUD), British pound(GBP) and Canadian dollar(CAD)

Some examples of low yielding rates are;

The Japanese Yen (JPY),

The Swiss Franc (CHF)

And the Euro (EUR).

The most popular high yielding currencies to look at are, the U.S. dollar (USD), the Australian Dollar (AUD) and New Zealand Dollar (NZD).

For instance,

if we consider the U.S. dollar and Japanese Yen (USD/JPY) as the yielding pair.

Current rates for the dollar is 2% and the Yen rate is -0.1.

If you hold a buy position overnight on USD/JPY, you earn a positive carry/swap.

However, this is more meaningful when a trade is moving to your favour.

There is no point earning a pip a day in swap if the pair is moving against you 100 pips a week. In addition, carry trade is applicable when you hold a trade for a long time.

If you plan to earn from carry trading/swap,

- Find a pair with the highest interest rate differential.

- The pair should be stable or in favor of an uptrend for the currency with a high interest rate.

- Identity your risk before entering a trade.

- Also, Study the current economic conditions for the countries in a pair and relate to fundamental and technical analysis.

How swap is added or deducted from your trading account?

Forex Swap is calculated automatically at the end of every trading day.

For Wednesday to Thursday rollover, swap is deducted/added in a triple size.

In the Forex market,

When you hold a position open overnight from Wednesday to Thursday, swap triples.

This is because the value date is moved forward 3 days, to Monday (skipping over the weekend). Remember, the banks close on weekends.

Swap triples because you are paid or charged interest for 3 days instead of just one.

You can see the size of the swaps in the trading terminal on the MT4/5 platform next to the position you have.

Swap is deducted from/added to our account automatically when you close your position.

If you see a swap fee on your position in the trading terminal on the platform,

Try to compare the closing value of your trade and the real profit/loss after closing out the trade.

You will notice either an increase or decrease on the profit added to your account.