Intermarket correlations in forex requires you to analyze different global economic markets in relation to their currencies.

This lesson will see overview of what we covered about intermarket correlations in forex from previous lessons.

The global market economy is comprises of securities such as bonds, and other government financial securities.

It also comprises of, stock indices, commodities such as gold, oil, natural resources and agricultural products and currencies.

The commodities, bonds and stocks are often affected by fluctuations of the prices of currencies.

Therefore, this has established a strong inter-market correlation between the global economic market and their respective currencies.

Intermarket correlations in Forex

How Commodity Prices Affect Currency Movement

The table below shows a summary on how major commodities affect forex market. These major commodities include; Gold and Oil. We discussed with examples and details in our previous lessons.

Just as we mentioned in previous lessons, commodity price fluctuations greatly affect certain currencies much greater than others.

Take a look below;

| CASE | REASON |

| If Gold moves up, USD falls |

Investors tend to purchase more of gold during economic unrest. This is because apart from gold being a safe haven, it maintains its intrinsic value for long. |

| When Gold moves up, AUD/USD also goes up | Australia is one of the major exporters of Gold in the world contributing about 80% of gold to the market. Therefore, its economy is highly boosted by gold. |

| Contrarly, when Gold moves up, USD/CHF also moves down | Over 25% of switzerlands reserves is backed up with gold. Consequently, increase in the gold prices boosts the CHF |

| When Oil appreciates, USD/CAD falls | Canada is one of the major oil exporters in the world. About 85% of its oil to the US economy is from Canada. When oil prices increase the CAD appreciates . |

| When Dow falls the Nikkie falls too | It is equal to the Dow Jones industrial average in America. |

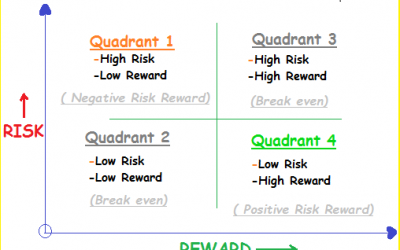

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.