Summary on Leverage in Forex Trading is an overview of what we covered in previous lessons. Leverage! Margin! Margin Call! Stop Out levels! etc

Summary on Leverage in Forex Trading

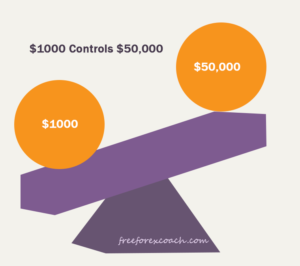

Leverage means trading a big account by only contributing little and borrowing the rest from your broker.

For example you can open an account as low as $100 dollars and trade it using 10,000 units; the $9900 is lent to you by your broker.

However, the same way you make big profits using leverage is the same way you stand to make big losses.

But In case you choose to trade using leverage;

- Of course do not use very high leverage.

- Choose to trade currencies with low spreads.

- Avoid holding trades for long with a very big leverage

- Stick to your trading plan and risk management rules

- Know when to cut your losses when a trade fails

- Finally be a disciplined trader and risk only that you can afford to lose.

While using a leverage to control a big position, your broker will require you to deposit a minimum amount on your account to allow you to hold the trade.

This acts as your collateral security. That amount of money is the margin

WHAT IS A MARGIN IN FOREX TRADING

A Margin is the amount of money your broker locks as collateral to allow you to hold a position.

This is to ensure that you have sufficient balance on your account relative to the size of your position.

Margin is always expressed as a percentage of full amounts of the position you intend to hold. Some of the Forex margins brokers use include 2%, 1%, 0.5% or 0.25% .

Common Forex terms related to margin

Account Balance.

Total amount of money on your trading account.

Margin Used:

Amount of money your broker locks to maintain your open position. It is released at the close of your current position.

Free Margin;

The amount of money available for you to open more positions.

![]()

Equity

It is the account balance plus the floating profit or loss for a running trade.

Equity = account balance +profit/loss

When there is no current trade running, your equity is equal to the account balance and equal to free margin. Also your equity changes as the profit or loss changes.

Marginal call.

This is a call you receive from your broker when the equity amount on your account is equal or below the margin level (margin) and the market is still going against you.

At this point you cannot take any additional positions. Or else, you must deposit more money into the account.

Margin level

This is the level where a broker can determine whether you can take any more new trades or not.

Most brokers use 100%. This means, at this level your equity is equal to margin.

In other wards, you will not be allowed to open any new position unless any of your running trades goes back to profits and your equity increases.

Habits that may lead to marginal calls

- First is holding on to a losing trade for long, depletes usable/free margin

- Secondary, over leveraging your account

- Last but bot least, using small capital accounts which forces you to over trade with too little usable/free margin.

Stop-out level

When your equity falls below the margin level and reaches as low as 5%, the system starts to close your losing open trades automatically starting with the biggest losing position

Final word

Using leverage is one of the best ways to multiply your profits when trading Forex especially if you have a small account.

Leverage gives you great opportunities to trade any size you want although you must stand warned. Anything can happen in the market. You may make a big lose or lose all your money.

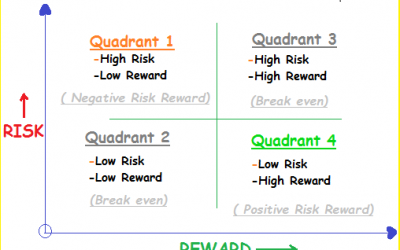

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.