There are several different ways to trade forex.

There are several different ways to trade forex.

Many people think that investing in forex is only for banks and the very rich. That is not true. You can also invest in the forex market.

The forex market is composed of large traders specifically the banks and institutional investors. The medium investors; the brokerage firms and the small individual investors; the speculators.

Forex trading is very accessible to everyone online through brokers.

If you are still wondering on how to go over the forex investment, do not worry we will show you the how!

You can invest/trade forex in different ways. This depends on what is convenient for you or what interests you for your investment. The most popular ways to trade forex include: forex spot, futures, options and exchange traded funds(ETFs) .

Spot market – ways to trade forex

This is the commonest of ways to trade forex for individual traders. To trade forex under spot markets, here you trade currencies immediately or on spot using the current market price.

Spot forex trading is an agreement between two parties to buy one currency against selling the other currency at an agreed price for settlement on the spot date.

Under the spot market, transactions are settled after 24-hours on spot. This is where small individual traders take chances to invest.

Speculating traders make exchange rate predictions to take advantage of price movements in the market. In the spot forex market, currencies are listed, quoted and traded in pairs.

For example, you will find currency pairs like; GBP/USD,EUR/USD,USD/JPY,CAD/CHF and so many others.

Because you trade currencies in pairs, investors and traders have to bet that one currency will go up and the other will go down. And they buy or sell the currency pair depending on the current price or exchange rate.

Traders in the spot forex market participate in trading through forex brokers, online on over the counter basis. No physical contact.

In conclusion;

The spot trading is simple, highly liquid and has very low spreads. It is around the clock operations. It’s a short term trade. Spot trading is very easy to invest in since accounts can be opened with as little as $30. Another advantage is that brokers usually provide news charts and research for free.

Futures

Futures are contracts to buy or sell at a specified amount of a given currency at a predetermined settlement price on a set date in future.

Currency futures are futures contracts for currencies that specify the price at which currency can be bought or sold for another at a future date.

Futures were created by the Chicago Mercantile Exchange (CME) in 1972. They are standardized and traded through a centralized exchange.

The market is very transparent and well regulated, therefore, transaction and price information is readily available.

In spot forex, traders can hold trades on leverage from their brokers. This is not the same for futures. In future contracts traders are responsible for having enough capital in their account to cover margins and losses that may arise taking the position.

However,future traders can exit their obligation to buy or sell the currency prior to the contract’s delivery date when they close out the position.

trade forex using Options

An option is a financial instrument that gives the buyer the right or the option, but not the obligation to buy or sell an asset at a specified price on the options expiration date.

In option trading, a seller offers the buyer options to buy/sell or not to. It is not an obligation that you must like in futures. The transaction is done at a specific price on the expiration date.

When the option involves a currency purchase it becomes a Put Option. But when the option holder wants to sell a currency, that is, a Call Option.

We shall explore more on options when we get to trading options lesson.

Most trading is over the counter(OTC) and is lightly regulated but a fraction is traded on exchanges like; International Securities Exchange, Philadelphia Stock Exchange, Or The Chicago Mercantile Exchange For Options On Futures.

EXCHANGE TRADED FUNDS(ETFs)

An exchange-traded fund (ETF) is an investment fund traded on stock exchanges, much like stocks.

It is a basket of securities such as stocks, bonds, commodities or combination of these that you can buy and sell through a broker.

Exchange-traded funds (ETFs) are investment securities that are similar to mutual funds but trade like stocks. Investors typically buy ETFs to passively track an index, such as the S&P 500, and to invest at a lower cost than many index funds.

Some of the examples include Schwab U.S. Large-Cap ETF (SCHX), the Vanguard Total Stock Market ETF (VTI), iShares Global Clean Energy ETF (ICLN) and Global X Robotics & Artificial Intelligence ETF (BOTZ).

You can buy and sell ETFs through brokerages such as Fidelity, Charles Schwab or Robinhood at any time during normal trading hours.

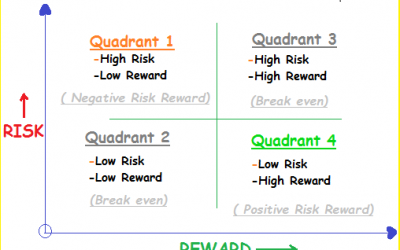

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.