Yes, Forex Trading is Risky just like any other high return Investment.

But there are Risk management techniques to use and make good profit trading Forex

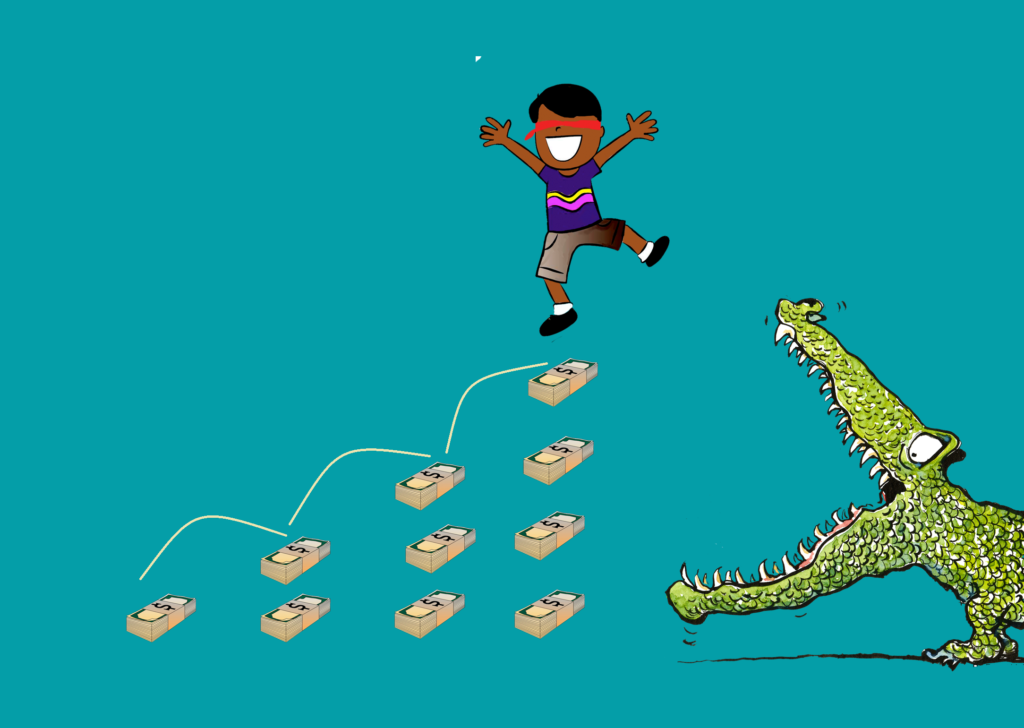

Doing Forex trading without following risk management rules, is as dangerous as sailing on water without wearing a life jacket, knowing you can’t swim.

How terrific that is to know that the moment your ship drowns, you wouldn’t last even for a second in the sea.

Therefore, you must not forget that when you take a risk, you will always expect one of the 2 outcomes.

That is; a Profit or a loss.

Then Concentrate on how to maximize on profits and limit your losses.

The Forex market is constantly changing every moment and this brings great risks to all traders.

In this article we shall clearly state why risk management is very important to all traders. We shall also highlight the most important forex risk management techniques.

But before we get into that, let’s first see how forex trading is risky and how much you should risk to trade forex.

How risky is forex trading?

Of course every investment is risky but the risk of trading forex is higher. However it can be managed.

This is why we are here to tell you that you should know all risks involved before taking part in forex.

Every trade, no matter how much sure you are about its result is nothing but a well-informed guess.

There’s nothing that is extremely certain in the forex market.

There are too many external factors which can push the movement of a particular currency.

However much we say that fundamentals move the markets, there are other times when we see strong movements in the market just out of the blue.

No news and the technical indicators are not even pointing to that direction. And you wonder why?

The forex market is operated by human beings who are driven by feelings and emotions all the time.

Apart from the central bank intervening with the market directly, by buying or selling their currency. The market participants’ sentiment gives another reason behind the unexpected large movements in the market.

So, this calls us to always prepare for the uncertainties by doing a comprehensive market research on the entire scenario.

Always look into the fundamental analysis, technical analysis and sentimental analysis before disposing your money to a high risk.

Forex trading is risky if you don’t know or practise risk management aggressively.

How much should you risk trading forex?

Knowing how much you should risk to trade forex is very important and this varies with different traders.

The fact that you know how risky forex trading is, it makes it easy for you to decide on how much you want to invest in forex.

Depending on the kind of a trader you plan to be or how much you expect to make from forex trading, you can determine how much you should put to forex.

The truth is,it is never easy to trade with a very small account if you plan to see big profits in a short time.

You will be forced to over-trade to develop your account and at the same time to use very big size which may lead to account blowing.

By clearly stating your goals and the kind of a trader you want to be, it is a step ahead to decide on how much you should invest in forex.

Due to the high competition between brokers in the forex market, some brokers can allow you to open an account with as less as $30.

This means you can even start trading with $30. Like i said before, you should not expect to make much from such a small account.

Just remember this always. Forex Trading is risky and you should risk money you are willing to lose. If it is lost, it will not affect your lifestyle and will not cause you to lose too much sleep.

risk management techniques in forex trading

Risk management is one of the most important concepts to surviving as a forex trader. At the same time, it is the most challenging practice to most traders.

It is an easy concept to grasp for traders, but more difficult to apply especially when trading on a real money account.

This is why most folks think forex trading is risky beyond any other investment

When dealing with real money, emotions come in and things change.

You are likely to feel as if you are not making enough, or you should adjust a bit. Or you are being so hard on yourself, with the rules hence limiting your chances.

This should be the time you think more on risk management. Or else, you may not take in the consequences of trading with no risk management.

Some of the techniques of risk management include; stop loss and target profits, risk to reward ratio, position sizing and the risk per trade.

When you apply these correctly, you are able to avoid large draw downs and have more chances to take positions in the market.

1. Stop loss and target profit.

A stop loss is one of the risk management techniques to control losses.

Previously, we said that forex trading is one of the risky venture investments therefore losses are hard to avoid. Making a loss in forex trading is normal though some losses are unacceptable.

You should know when to cut your losses on a trade when it is not doing well. You can use a hard stop or a mental stop.

A hard stop is when you set your stop loss at a certain level as you initiate your trade.

A mental stop is when you set a limit to how much pressure or draw down you will take for the trade.

When the trade goes against you, it will close out automatically as it hits your stop loss level.

This will help you to avoid making a big loss in case you are away from your trading platform.

It will also protect your account from a big draw down.

When you trade with a stop loss, your emotions are kept intact and you do not trade chasing the market around.

why you need to set a stop loss and target profit.

Setting a stop loss ahead helps you to cut your losses on time .

It should be set in a way that reasonably limits your risk on a trade and give a trade enough room to breathe. It should not be so close or too big but enough to fit your position size.

In addition, you should avoid moving your stop loss further or cancel when a trade starts to go against your favor.

Instead stick to it or close the position once it qualifies to be a failed trade.

Avoid setting a stop loss on support and resistance levels because price is likely to bounce back on these levels. It should be slightly above the resistance or below the support.

Setting a stop loss on the levels of support and resistance is one of the common mistakes most traders make. Their stops end up hit as the trade moves back to their predicted direction.

What you should know is that, price always has higher chances of bouncing back on levels of support and resistance than break through.

It is also important to Set a target profit in order to avoid staying long in an open position.

When you hold on a trade for long, chances are high that you are likely to lose your profits back to the market.

Most traders trade retracements of the main trend.

This becomes hard to predict where the price will pull back after retracement. Therefore, if you don’t set a target profits, you may fall in a trap.

Retracements are short term strategies. In order to profit from trading retracements, you should not set your target profit far from your entry point otherwise it may not be hit.

You will always make money and give it back to the market.

2. Risk to Reward Ratio.

To make money from forex trading, you must have a risk to reward ratio that you use on every trade you take.

After determining your entry level, your stop loss and take profit order, measure the risk: reward ratio. If it doesn’t match your requirements, skip the trade.

Use a risk to reward ratio that is less than one but positive.

For example, if your risk is 1 and the reward is 2, the risk reward ratio is( ½ = 0.5). Your risk to reward should be able to keep you in profit even when the number of losing trades is more than profiting trades.

Don’t try to widen your take profit order or tighten your stop loss to achieve a higher risk: reward ratio.

The risk should match your stop loss and position size and the reward should match your target profit.

Set a target profit that is achievable otherwise you will always give back your profit to the market.

3. Position sizing.

To determine an appropriate position size for your trade, you must first of all know how much you want to risk on that trade and your stop loss.

Most traders make a mistake of fitting their stop loss to their desired position size, instead of fitting their position size to their desired stop loss.

Traders not only try to fit their stop loss to the position size but also usually pick a random number such as 0.1, 0.5,1.

They then apply it to all their trades without ever thinking whether it is the right size to use and why?

You should aim at using a size that matches your account size.

If you are trading on a small account, start trading with a small lot size. Once you do that, you are a step ahead to stay flexible and manage your trades with no emotions attached.

Also, if you trade multiple setups, you will see that each setup has a different win rate and risk: reward ratio.

Therefore, you should reduce your position size on setups with a lower win rate and increase it when your win rate is higher.

Maximize high profits on setups with high winning rate as you minimize losses on setups with low winning rates.

This helps you to stay in profit even when your losing trades are more than our winning trades.

4. Leverage

Using leverage to trade in forex is one of the best ways to increase your profits.

Leverage helps you to take on big positions even when you are trading on a small account. Although it sounds attractive, it is one of the reasons why traders blow their accounts.

Leverage is known as a double edged sword which means it can make for you a big profit or a big loss.

Most brokers talk about the benefits of using leverage and actually encourage their traders to use leverage. It is unfortunate that they don’t tell them the other side in case trades don’t go as expected.

So with high expectations, traders come to the trading platform with a mindset that, taking a large risks makes big profits.

At the end of the day their accounts are no more.

What should come to your mind first before you think of using leverage is that the money you are using to trade does not belong to you.

Therefore using big amount (loan) to hold a large position exposes your account to a very big risk. No broker will accept to loss his money.

As you take that trade, it is your account that gets exposed. In case a trade goes against you, your account is wiped off and the trade will automatically close.

We are not saying you should not use leverage.. But always aim at reducing your account risk exposure, that way you will stay long in the game.

5. Correlation

Studying correlation is another way to protect you from too much risk exposure.

This will enable you to know how different currency pairs behave and the risks associated when trading more than two currency pairs.

Correlation is shown in 3 different ways.

- Positively correlated currency pairs; tend to move in the same direction almost 100%. For example EUR/USD and GBP/USD, USD/JPY and USD/CHF.

- Negatively correlated currency pairs; tend to move in different direction almost 100%. E.g.(USD/CAD and EUR/USD).

- Neutral correlated currency pairs; these move randomly. They have no relationship. For example USD/JPY and GBP/CHF.

It is very important to understand correlations between currency pairs.

This helps you to avoid taking double risks and eliminates unnecessary losses.

For example, if you go short on EUR/USD and short on GBP/USD, you are exposed two times to the USD and in the same direction. It is like you are taking two trades on a single currency pair.

A simple change in the US economy affects the 2 pairs the same way. This exposes your account to double loss in case the trades go against your favor.

Like i said, if you are to stay long and benefit in the game of trading, aim at keeping your risk exposure as low as possible and trade only when it is necessary.

Keep watch of your risk management habits and try always to use risk management.

In conclusion

Forex Trading is risky, actually very risky, if you don’t practise the above risk management techniques.

Risk management is always the safest way to trade and the only way to stay long in the game of trading but it is not easy to keep as it sounds.

Most of the traders have failed to profit consistently from the market not because they don’t have good strategies to trade but because they have failed to use risk management.

The truth is, a good strategy will not make you profits if you don’t use good risk management techniques/strategies.

Risk management is all about keeping your risk under control.

The more controlled your risk is, the higher the chances you will have to take up more good opportunities in the market.

Once you learn to practice risk management, you will be sure of consistency. You will continue to trade when things do not go as planned.

You will always be ready to take up a new opportunity that shows up in the market.