There are several ways greed can impact your Forex trading success.

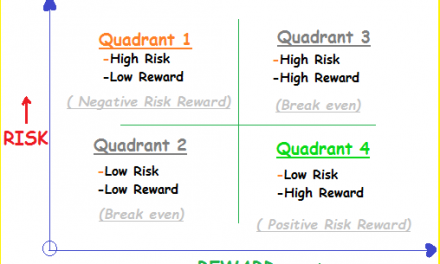

Firstly, greed can make you abandon your well crafted trading strategy in favor of impulsive and speculative actions. Instead of adhering to predetermined entry and exit points based on technical or fundamental analysis, you chase after potentially lucrative opportunities without proper assessment of risk. This increases the likelihood of losses.

Secondly, greed can impact your forex trading success by tempting you to use excessive risk beyond your risk tolerance levels. In the pursuit of maximizing profits, you may leverage your positions excessively or trade with disproportionately large lot sizes. While this approach can amplify gains in favorable market conditions, it also magnifies losses when trades turn against you

. Thus, greed heightens your vulnerability to significant financial setbacks.

The worse part is that greed fosters a mindset of attachment to outcomes. You become fixated on achieving unrealistic profit targets within short time frames. This fixation leads to frustration and disappointment when expectations are not met.

As a result, you start engaging in revenge trading, attempting to recoup losses quickly and easily lose much much more

In conclusion,

Greed Impact on your Forex Trading Success is highly underrated. The consequences of yielding to greed in Forex trading can be deadly. Excessive risk-taking can result into wiping out your accounts and causing emotional distress.

Moreover, the psychological toll of greed-induced trading can be significant, leading to stress, anxiety, and even depression.

At its core, greed in Forex trading manifests in various forms.

It may manifest as an overwhelming desire for greater profits, prompting traders to take excessive risks beyond their risk tolerance. It may also manifest as an inability to accept losses, fueling a dangerous cycle of revenge trading in pursuit of recouping losses quickly.

Furthermore, greed often leads traders to disregard sound risk management principles and succumb to impulsive decision-making.

In the next article, we shall look at the best approach to deal with greed while trading