Elliot Wave Theory Rules are Simplified into 3. They give you full guidelines on how to trade the elliot wave theory strategy.

These 3 rules include.

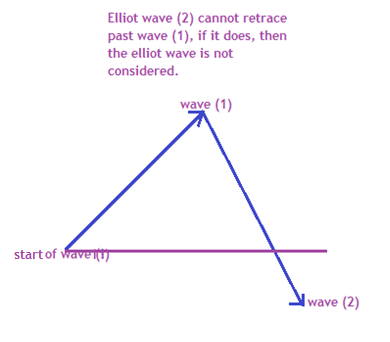

1. Wave 2 never retraces 100% of wave 1

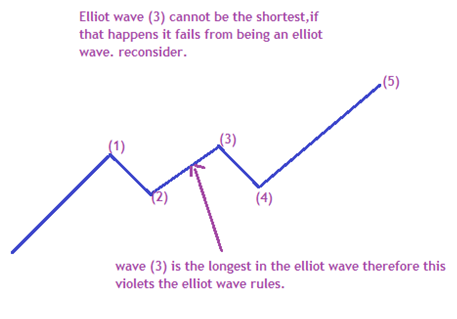

2. Elliot Wave 3 is never the shortest wave in a complete 5 wave sequence.

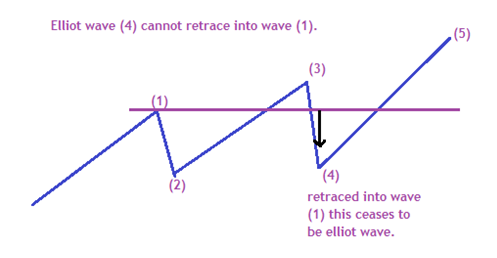

3. Wave 4 cannot retrace into wave 1

Guidelines for trading Elliot wave theory rules

- The impulse wave comprises of 5 waves.

- Wave 3 is usually the strongest wave

- The Elliot Wave 5 and wave 1 are very often equal in price

- Wave 2 usually unfolds as simple a-b-c correction

- Once a 5-wave sequence is complete the whole sequence is corrected.

- The first leg off the move from a complete 5 wave sequence often finds support and resistance at the prior minor wave 4.

- Once a correction completes the main trend resumes

- Wave 4 can’t retrace into the area of Wave 1.

The violation of any of the above rules implies that the Elliot wave count is incorrect.

Next lesson, we shall look at how to trade and identify signals using Elliot Theory

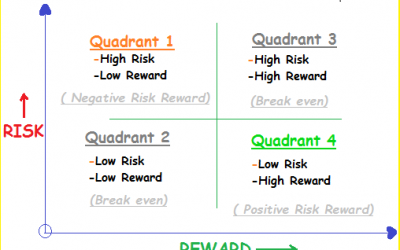

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.