Corrective Wave Patterns in Elliot Theory are a 3-wave pattern that move in the opposite direction to an impulsive wave.

After the formation of the 5 impulsive waves, the corrective waves pattern begins.

Corrective Wave Pattern in elliot theory

The first wave moves in the opposite direction of the previous trend but never moves beyond the origin of the previous impulsive wave.

Unlike the impulsive wave where we use numbers 1 – 5, with the corrective waves we use,the letters a,b,c respectively

The corrective wave patterns in elliot theory comprise of 3 waves and b moves in the opposite of a and c. The pattern forms both in the uptrend and the downtrend.

Below is the Elliot Waves

The corrective wave patterns in Elliot theory can appear inform of; Zigzag, Flat triangles or a combination.

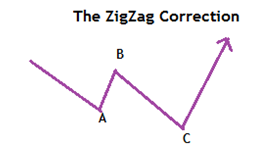

A zigzag correction wave.

This is a 3 wave correction labelled A-B-C and is divided into a sequence of 5-3-5.

A and C are motive waves with 5 sub-waves while B is a corrective wave with 3 sub-waves.

Wave A and C have the same length and the zigzag is the simplest of the corrective waves.

It may form in a single, double or sometimes a triple form where 2 or 3 zigzag waves are connected.

This wave normally shows up in the second wave of an impulse wave.

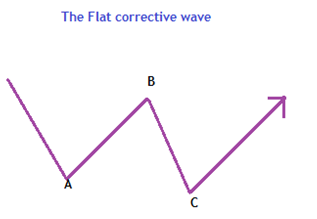

Flat correction wave

A 3-wave correction where the sub-waves appear inform of 3-3-5.

A and B are corrective with 3 sub-waves and C is a motive wave with 5 sub-waves.

This wave is flat because it moves in the sideways direction.

Normally, it shows up in the fourth wave of an impulse wave. The flat correction can appear as a regular flat, expanded flat or running flat.

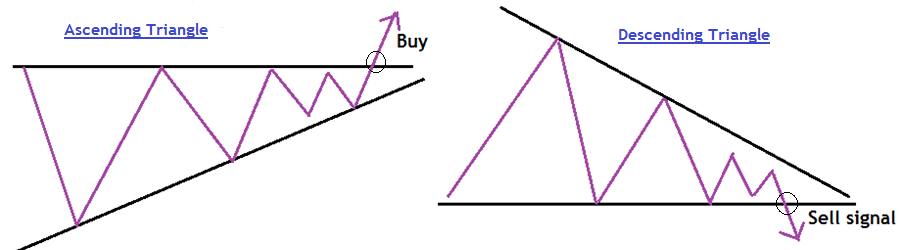

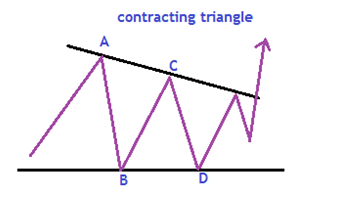

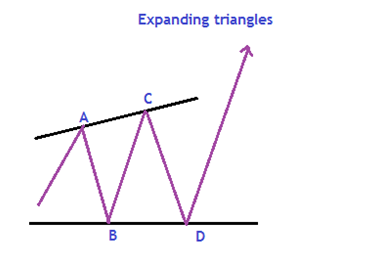

Triangle corrections

Triangle Corrections are overlapping five wave patterns labeled A-B-C-D-E subdivided into 3-3-3-3-3.

The triangle corrections move in a side ways movement with decreasing volumes and volatility. The correction has five waves and each subdivide into 3 waves.

This may appear in 4 different ways.

- Ascending triangles

- Descending triangles

- Contracting

- Expanding triangles.

It usually happens in wave B or 4, subdivided into three 3-3-3-3-3. Subdivisions can either be abc, wxy or flat.

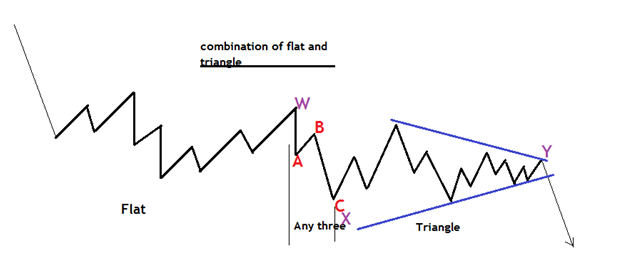

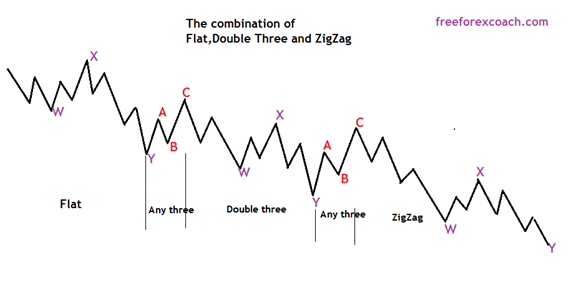

Combinations (Double and Triple)

This is the side ways combinations of the corrective pattern; Double threes and Triple threes.

It is combination of the zigzag, flat and triangles making a flat correction extending side ways.

The Double threes and triple threes are horizontal in character

Double three

Double three is a 3 sideways combination of two corrective patterns labeled WXY.

Wave W & Y subdivisions are either zigzag, flat or smaller degree double three or triple three. X can be any wave  Triple three

Triple three

The triple three is a side ways combination of 3 corrective waves. It is labeled WXYZ.

Wave W, Y & Z subdivisions can appear as zigzag, flat, double three of smaller degree or triple three of smaller degree. Wave X can be any corrective wave.

Elliot Wave Fractals

The Elliot wave is sub divided into small waves known as the fractals. Elliot acknowledged 9 degree of the waves, categorizing them in order of their sizes and time length.

The cycle starts from the grad super cycle usually forms in the weekly and monthly time frame to sub-minuette degree. This forms in the hourly time frame.

This is as below

- Grand super-cycle (many years)

- Supercycle (a few years)

- Cycle ( a year)

- Primary (a few months)

- Intermediate ( months)

- Minor ( weeks)

- Minute ( days )

- Minuette ( hours)

- Sub-minuette ( minutes)

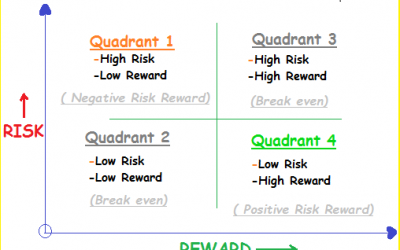

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.