Impulse Wave Rules in Elliot wave Theory are mainly three. If one of these impulse rules is violated, then the pattern is not an impulse wave.

The 3 rules are:

- Wave 2 cannot retrace more than 100% of wave 1.

- Wave 3 can never be the shortest of waves 1,3 and 5 .

- Lastly wave 4 can never go beyond wave 3.

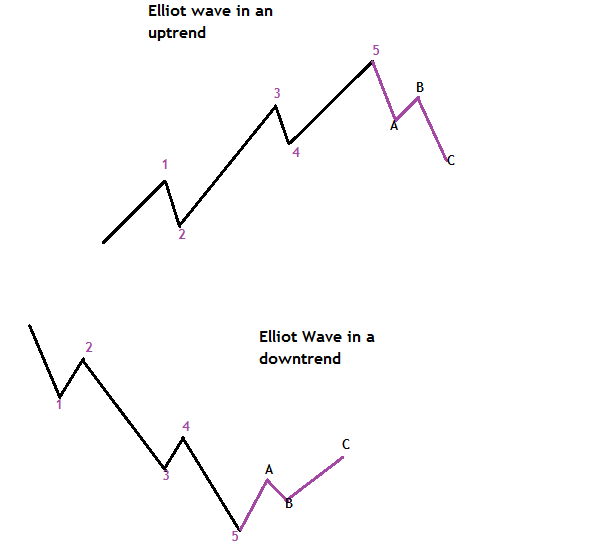

The impulse is the motive wave pattern that consists of 5 waves. Among the 5 waves, 3 waves move in the direction of the main trend while the 2 waves move opposite of the main trend.

According to Mr Elliot, the impulsive waves can form both in an up trend or down trend taking a form of 5-3 wave patterns. These drive the market trend in the direction of a large trend.

The first five wave pattern labelled 1,2,3,4,5 forms the impulse wave and are further divided into 5s and 3s.

On the Elliot wave,the last 3 wave pattern a,b,c form the corrective waves. This forms after the completion of the impulse wave and moves against the trend.

Let’s take a look at the structure of the Elliot wave.

From the illustrations above,

The numbers 1,2,3,4,5 mark the 5 waves of the impulsive wave.

Letters a,b,c make the 3 waves of the corrective wave of the Elliot wave.

When trading the Elliot wave, you must keep count of the waves. 5 for the impulse and 3 for the corrective move.

impulse wave rules in Elliot Wave

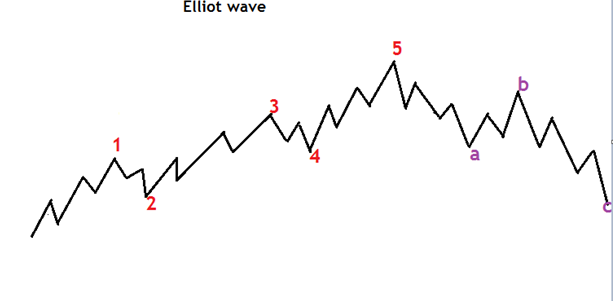

The first 5 wave patterns 1,2,3,4 and 5 forms the impulse wave and these are further divided into 5s and 3s.

In addition,

The impulse wave has the three waves 1,3,5 which move in the direction of the trend, the Motive waves.

Whereas the two waves, 2 and 4 which move against the trend, are the Corrective waves.

Impulse wave Rules in Elliot Theory on Forex Chart

Impulse wave Rules in Elliot Theory on Forex Chart

From the chart above,

There are the 5 waves of the impulse. According to our chart, the fifth wave is still forming to complete the 5 waves of the impulsive move.

You can also see that all the 5 waves have different length and the third wave is the longest.

Waves 1,3,5 can further be divided into five smaller waves each while 2 and 4 into 3s. let’s take a look at an illustration below.

The Impulsive wave with smaller waves

In this case,

1,2,3,4,5 in blue show the 5 small waves in the 3 motive waves of the impulse wave.

While a,b,c represent the smaller waves of the corrective waves of the impulsive wave. That is wave 2 and 4

Further more, the impulsive wave has 3 rules that define its formation. These rules are unbreakable.

If one of these rules is violated, then the pattern is not an impulse wave. You should therefore wait for the next setup.

I will mention them once again as a reminder

The 3 rules are:

- Wave 2 cannot retrace more than 100 % of wave 1.

- Wave 3 can never be the shortest of waves 1,3 and 5 .

- Lastly wave 4 can never go beyond wave 3.

Next we will look at the typical characteristics of the Impulsive and Correctives waves.

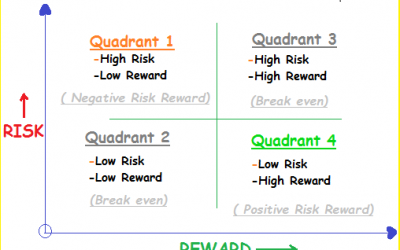

Risk Reward ratio Quadrants: The Difference between Amateur and Professional Traders!

Risk reward ratio (RR) is the “holy grail” of trading. Risk reward ratio Quadrants identify where you actually belong in your trading business. RR is the most important metric in trading and a trader who understands it can greatly improve his/her chances of becoming...

- Oh, bother! No topics were found here.